XRP, one of the leading cryptocurrencies, recently faced a significant drop in its price, pulling back over 20% from its three-year high. This unexpected decline has sparked concerns among investors and the crypto community, leading to a larger market correction. In this XRP Price Prediction article, we’ll break down what’s behind this sharp pullback, the factors influencing XRP’s price, and what it could mean for the future of the token. Let’s dive into the details!

How has the XRP Price Moved Recently?

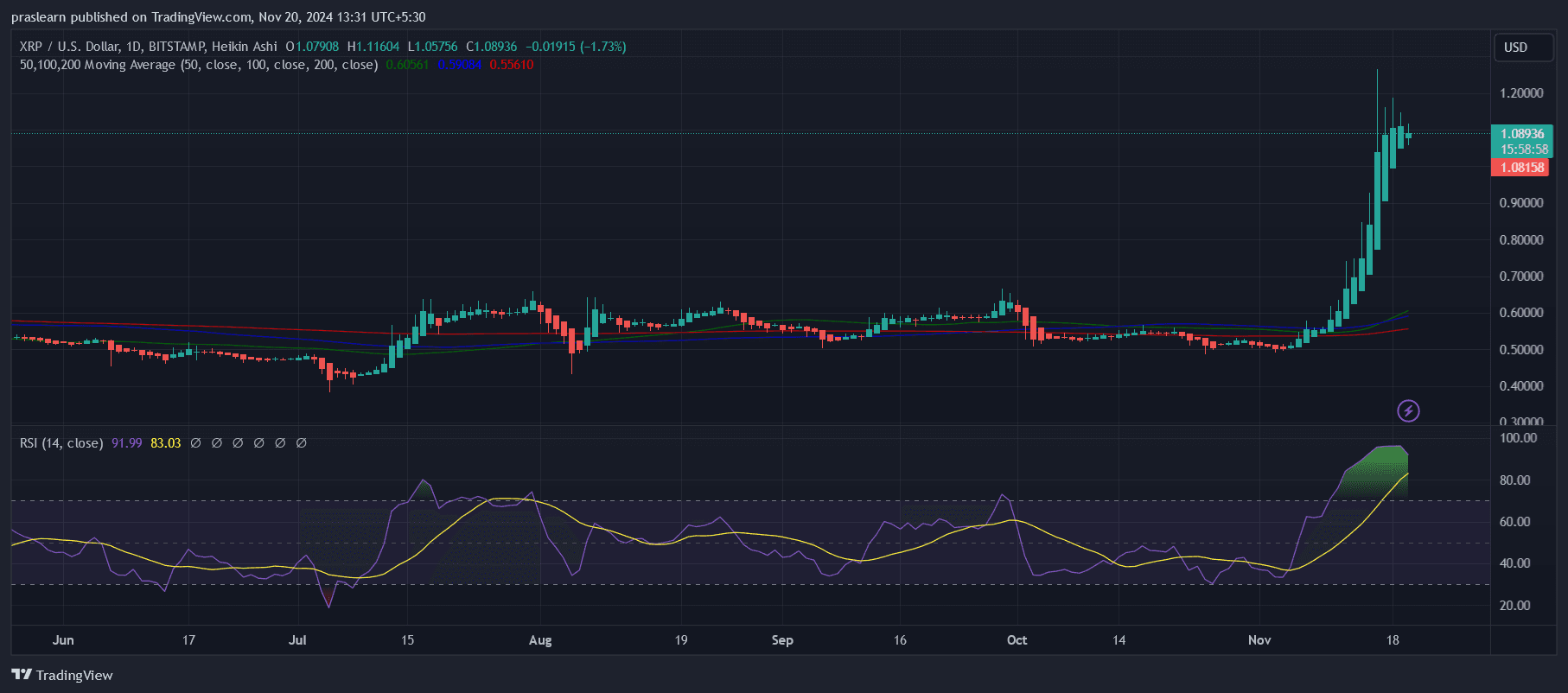

The current price of XRP is $1.084599, with a 24-hour trading volume of $8.98 billion. Its market cap stands at $61.75 billion, giving it a market dominance of 1.98%. Over the past 24 hours, XRP's price has dipped by 1.66%.

XRP hit its all-time high of $3.92 on January 4, 2018, while its lowest recorded price was $0.002802 on July 7, 2014. Since its peak, XRP's lowest price was $0.113268, and its highest recovery since then reached $1.97793. Currently, market sentiment around XRP is bullish, with the Fear & Greed Index reflecting a score of 83, indicating extreme greed.

The circulating supply of XRP is 56.93 billion tokens, out of a maximum supply of 100 billion. XRP's yearly supply inflation rate is 5.98%, which means 3.21 billion new tokens were created over the past year.

Why is XRP Price Down?

XRP's price decline can be partially attributed to large-scale withdrawals from major exchanges like Upbit and Binance. Over the past week, nearly 250 million XRP tokens were withdrawn from Upbit, bringing its reserves to a four-month low of 6.3 billion XRP. Binance experienced a similar trend, with XRP reserves decreasing steadily after peaking on November 12.

These withdrawals, often seen as a sign of rising buying pressure, might typically suggest a bullish trend. However, when combined with other market factors, this reduction in liquidity can amplify volatility, contributing to price swings.

The recent uptick in XRP's estimated leverage ratio (ELR) signals heightened speculative activity in the derivatives market. The ELR reached 0.17, its highest level since January, reflecting increased confidence in a continued price rally.

While this optimism can drive short-term price gains, it also raises the risk of a sharp correction as overleveraged positions get liquidated during market downturns. This pattern often plays a significant role in exacerbating price declines, as witnessed in XRP's recent pullback.

Another factor contributing to the price dip is the record-high futures open interest, which surged to $1.98 billion on Sunday before easing to $1.84 billion by Wednesday. Elevated open interest levels, combined with bullish sentiment, suggest aggressive speculation in the market. Such scenarios often lead to heightened price volatility, with any sudden shifts in market sentiment triggering corrections as traders exit their positions.

XRP Price prediction: What’s Next for XRP?

Despite the current decline, XRP’s overall market activity reflects underlying bullish momentum. The drop in exchange reserves and high open interest levels indicate strong investor interest, which could support a price recovery if the broader market stabilizes. However, the high ELR suggests that caution is warranted, as over-leveraging can lead to abrupt and severe corrections.

If exchange reserves continue to decrease and buying pressure persists, XRP may find support at lower price levels, potentially setting the stage for a rebound. However, sustained recovery will depend on broader market conditions and whether speculative leverage balances out in the derivatives market. Investors should watch for changes in ELR and open interest to gauge the likelihood of further corrections or a return to bullish trends.

In the short term, XRP's price may remain volatile, but its strong market interest could pave the way for long-term growth once speculative excesses are corrected.

cryptoticker.io

cryptoticker.io