Gensler’s exit + Elliot Wave patterns signal a huge $XRP breakout. Key break points: $1.33 & $1.88. After $1.88, it’s a clear path back to the ATH of $3.84. Targets: $8-$30. Last time we saw this setup, #XRP skyrocketed. Don’t miss it. #XRP#XRPArmy

invezz.com

2 h

invezz.com

2 h

XRP has caught the attention of investors and analysts after it jumped above $1 in a dramatic weekend rally.

The altcoin has demonstrated remarkable resilience amid regulatory challenges.

With the current bullish momentum, analysts are closely monitoring key levels, particularly the $1.33 resistance, as a potential gateway to higher valuations.

With a convergence of bullish technical patterns, institutional interest, and favourable regulatory developments, XRP price appears poised to recapture its previous highs and possibly enter uncharted territory.

At press time, XRP traded at $1.12 after an impressive 82% surge over the past week that culminated with hitting a new multi-year high of $1.27; it last traded at that level in November 2021.

Although the XRP bullish momentum has cooled off most likely since it is in the overbought region as shown by the 14-day RSI indicator, a renowned investor by the name of Armando Pantoja has noted that breaking the $1.33 threshold could trigger a significant price surge.

According to Pantoja, the $1.33 level aligns with broader Elliott Wave patterns that suggest an upward trajectory once $1.33 and $1.88 are breached, paving the way for XRP to revisit its all-time high of $3.84 and potentially target long-term valuations between $8 and $30.

Gensler’s exit + Elliot Wave patterns signal a huge $XRP breakout. Key break points: $1.33 & $1.88. After $1.88, it’s a clear path back to the ATH of $3.84. Targets: $8-$30. Last time we saw this setup, #XRP skyrocketed. Don’t miss it. #XRP#XRPArmy

The bullish outlook is bolstered by the recent technical breakthroughs that saw XRP pierce the Kumo resistance on the monthly Ichimoku cloud—a barrier that remained unbroken since 2021.

This technical achievement, coupled with XRP’s sustained trade above its 50-day and 200-day EMAs, signals a robust long-term bullish reversal.

$XRP currently above kumo resistance on the monthly Ichimoku It was unbreakable resistance back in 2021 Thoughts @drpastet?

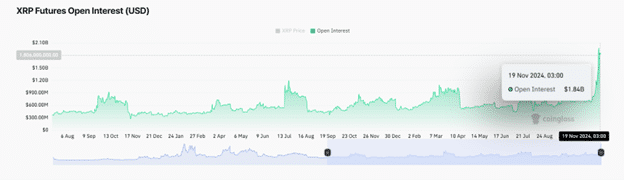

Additionally, record-breaking open interest in XRP futures, exceeding $1.8 billion, underscores growing speculative and institutional interest, further strengthening the bullish case.

A striking feature of XRP’s recent rally has been the quiet yet significant activity of large-scale investors.

According to Armando Pantoja, whales have accumulated 453.3 million tokens, worth over $526 million, in just one week—marking the largest accumulation in almost three years and accounting for 18% of XRP’s circulating supply.

$XRP whales quietly bought 453.3M tokens, $526M in a week—18% of the supply. The most accumulation by whales in almost 3 years. They know what most refuse to accept…something big is coming #XRP

This wave of accumulation signals heightened confidence among major players, who appear to be positioning themselves ahead of anticipated market developments.

Institutional adoption has also gained traction, with XRP-linked financial products drawing significant interest.

The 21Shares Ripple XRP ETP (AXRP) recently surpassed $100 million in assets under management, showcasing growing confidence among institutional investors.

Pending XRP ETF proposals from Bitwise and Canary Capital could further enhance accessibility and drive demand.

As these products gain traction, XRP’s integration into mainstream financial markets is expected to accelerate, reinforcing its price potential.

Amid the renewed crypto market optimism following the reelection of Donald Trump as the 47th US president, the potential resignation of US SEC Chair Gary Gensler has emerged as a critical regulatory catalyst for XRP.

Market participants speculate that new US SEC leadership could usher in a more favourable regulatory environment for cryptocurrencies especially XRP which has faced regulatory pressure from the US SEC.

Ripple Lab’s ongoing lawsuit against the US SEC has been a great impediment, with broader legal actions challenging the agency’s regulatory overreach.

A favourable resolution could eliminate significant barriers for XRP and renew confidence among both institutional and retail investors.

Market sentiment is further buoyed by XRP’s increasing adoption of cross-border payments and the renewed focus on its utility in the global financial system.

As XRP consolidates gains and builds strength, the prospect of breaking $1.33 appears not only plausible but imminent.

In the meantime, investors are keenly watching as the digital asset inches closer to $1.33—a critical milestone that could define its trajectory for years to come.

The post XRP targets $1.33 as a key resistance for a breakout to $3.84 appeared first on Invezz