Momentum around XRP has surged to new heights, doubling its market cap in just one week and capturing the attention of the global crypto community.

The token blasted past the critical $1 psychological level over the weekend, reaching an intraday high of $1.23 before settling at $1.15, after climbing as much as 97.21% in a week.

What’s more, the past week has seen XRP’s market cap leap from $33 billion to $66 billion, a remarkable feat that has reignited global interest in the digital asset, as per data retrieved by Finbold from CoinMarketCap.

XRP’s dramatic rise has been fueled by a combination of technical indicators, legal developments, and speculation about future market conditions.

The token’s current performance reflects an 84% increase over the past year, placing it among the strongest movers in the crypto space. With 18 green days out of the last 30 and trading well above the 200-day simple moving average, XRP is defying broader market trends, even outperforming half of the top 100 cryptocurrencies over the past year.

However, Bitcoin remains a formidable competitor, and XRP’s yearly inflation rate of 5.86% coupled with overbought signals suggests that a pullback may be on the horizon.

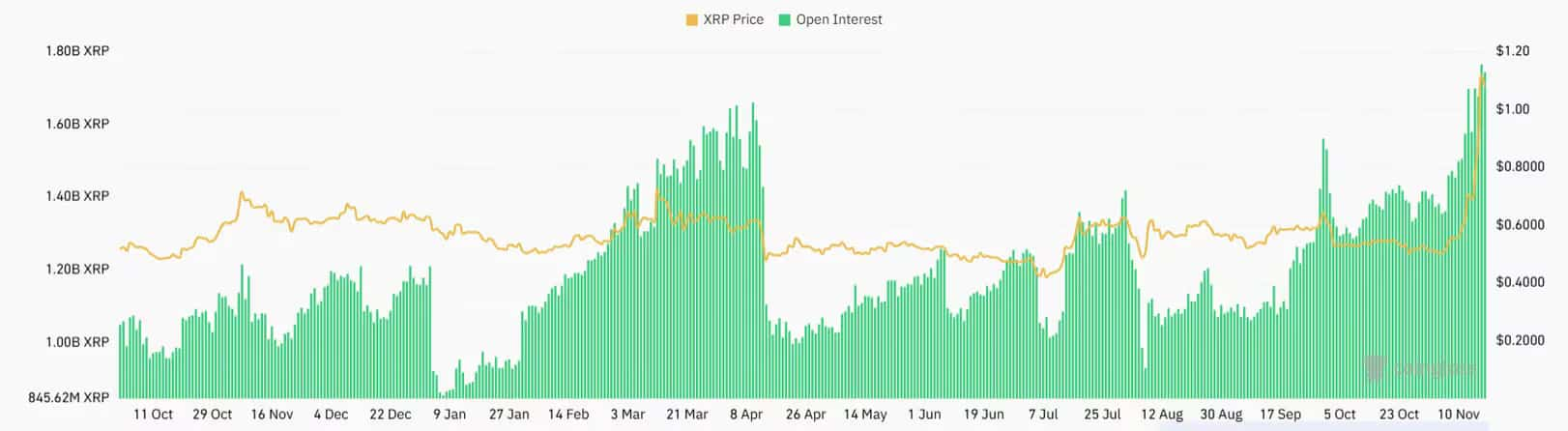

Open interest in XRP/USD futures contracts surpassed 2 billion tokens on Sunday, reaching nearly $2 billion in value at current prices. Despite the strong momentum, trader sentiment appears divided. Data reveals that 51% of participants are taking short positions, anticipating a near-term pullback in the derivatives market.

SEC legal battle sparks renewed XRP interest

XRP’s rally began late last Thursday, coinciding with a significant legal development. Eighteen U.S. states filed a lawsuit against the SEC and its commissioners, including chairman Gary Gensler, accusing the agency of unconstitutional overreach in its regulation of the crypto industry.

Speculation about a potential crypto-friendly Trump administration has further fueled bullish sentiment, particularly for tokens linked to U.S.-based companies like Ripple Labs, which is closely associated with XRP.

Traders are banking on the possibility that Ripple’s domestic ties and strategic focus could position XRP as a key beneficiary of a more favorable regulatory environment.

RLUSD stablecoin

Ripple Labs is also gearing up for the launch of RLUSD, a stablecoin designed to revolutionize liquidity in cross-border payments. This development could add significant long-term value to XRP by strengthening its utility and expanding Ripple’s ecosystem.

The stablecoin will play a crucial role in Ripple’s cross-border payments products, reducing transaction costs and settlement times while enhancing liquidity.

Beyond traditional use cases, RLUSD holds the potential to integrate with decentralized finance (DeFi) protocols, allowing Ripple to tap into a broader network of blockchain ecosystems. Such versatility could solidify XRP’s position as a utility-driven asset, attracting both institutional and retail investors looking for more than speculative gains.

Featured image via Shutterstock

finbold.com

finbold.com