The cup and handle pattern observed in the Solana (SOL) chart signals a potential breakout, with analysts eyeing a $400-$500 target.

Solana (SOL) has recently shown impressive market resilience, reaching a local peak of $225 before a slight pullback. At the time of writing, SOL traded at $216, reflecting a 1.23% increase over the past 24 hours.

Over the last seven days, the token has surged by 15.15%, fueling speculation about its potential to surpass its all-time high. Analysts and traders are monitoring the situation closely, offering varying predictions for the token’s next moves.

Solana Potential Bullish Continuation

A technical analyst on TradingView identified a cup and handle formation on Solana’s long-term charts. This pattern, which began forming in late 2021, saw SOL’s price drop below $10 during the bear market. The subsequent recovery in 2023 brought the token to its current levels.

Following the formation of the cup, SOL entered a consolidation phase, characterized by a descending wedge that forms the handle. Historically, this structure indicates bullish continuation, especially on monthly timeframes. The analyst suggests that a breakout could propel Solana’s price to between $400 and $500.

More Conservative Outlook

While long-term charts hint at significant gains, short-term predictions offer a more cautious view. A prominent analyst on X, Satoshi Flipper, highlighted a bullish channel on the hourly chart.

This pattern suggests that SOL could climb to $260, a target associated with a pennant breakout. Beyond that, the token might test new all-time highs.

Meanwhile, another analyst, operating under the pseudonym Bitcoin Buddha, highlighted Solana’s strong performance on the weekly charts and described its current trajectory as highly bullish. He noted that memes coins on the Solana network are now generating over $1 billion in daily trading volume, a bullish sign for Solana. Amid this, he noted that Solana will remain his top pick for this cycle.

Increased Market Confidence

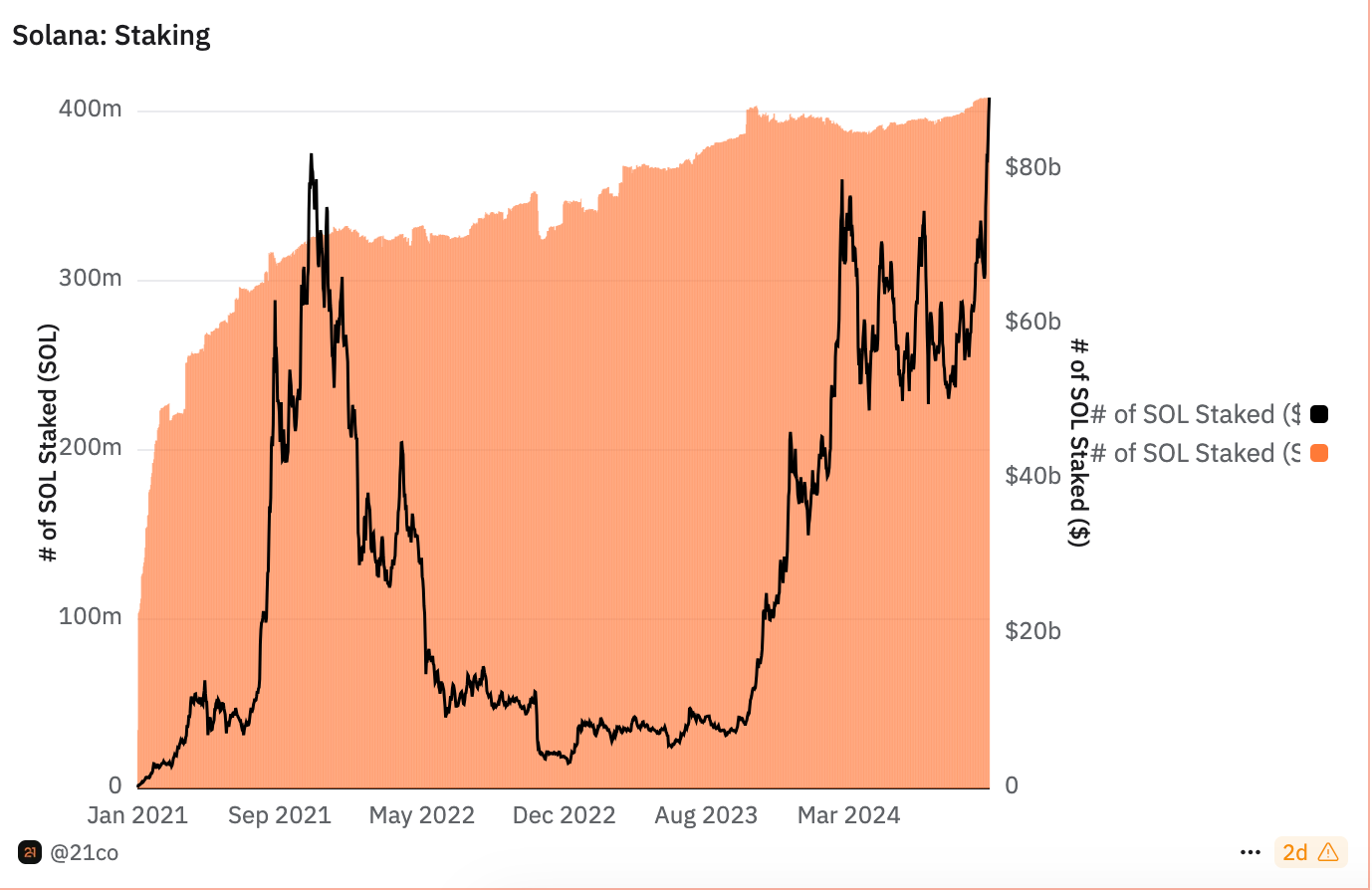

Beyond technical analysis, Solana’s staking metrics indicate strong network confidence. Data from analytic platform Dune shows a consistent recovery in staked SOL. The total value of staked SOL in USD surpassed $81 billion, while the token count stabilized at around 407 million.

Notably, increased staking locks tokens for extended periods, taking them out of circulation. This dynamic could alleviate selling pressure and potentially support price stability or growth.

thecryptobasic.com

thecryptobasic.com