Pepe, a popular memecoin, has recently broken out of its consolidation zone, reaching an all-time high and currently trading at $0.00002.

While this impressive surge draws attention, it’s important not to rush in without a clear strategy. Jumping into trades based on emotion or FOMO—fear of missing out—can lead to risky decisions and potential losses. Instead, let’s explore a structured trading approach that can be applied to situations like this.

Pepe (PEPE) Market Update

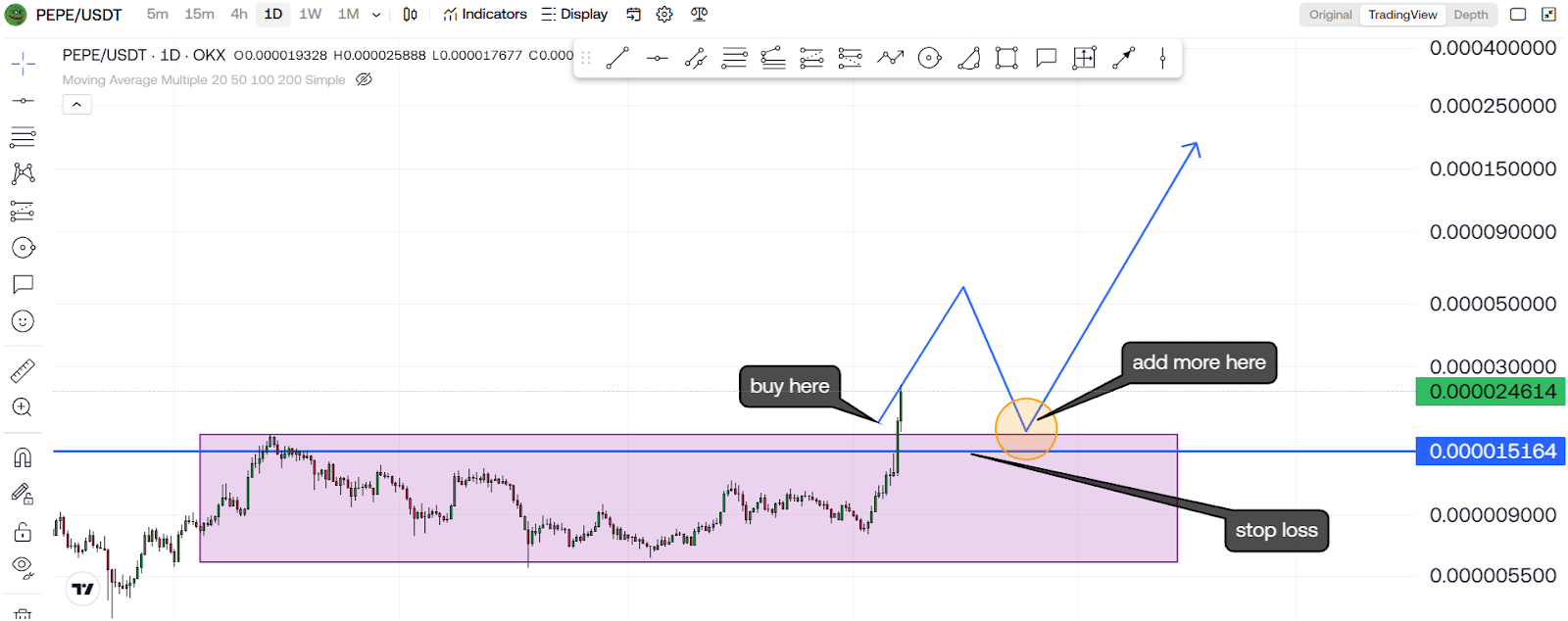

We can look at Pepe’s previous price history and similar breakouts to understand the best strategy. Pepe entered a consolidation period in a prior market phase where price movement remained within a specific range before eventually breaking out. When the memecoin finally broke out of that box, it initially saw a price surge. However, shortly after this breakout, Pepe’s price retraced to its previous consolidation zone, which turned out to be an ideal buying opportunity. This pullback, or retest, allowed for a stronger support level, setting up a more sustainable price increase built on a solid foundation.

This retrace and support-building phase is precisely what we want to see as traders. Waiting for a retest after a breakout can confirm the strength of the support level, reducing the risk of jumping into a high that might not hold. While buying right after a breakout is tempting, history shows that waiting for this pullback can often provide a more reliable entry point. By exercising patience, traders can avoid buying into temporary highs and instead enter with a stronger setup that can withstand price fluctuations.

Now, if we examine Pepe’s current price movement, we see a familiar pattern: it recently broke out of a consolidation box. However, it has not yet returned to this zone to establish a stronger support level. For cautious or conservative traders, this is a signal to wait. The ideal buying opportunity often comes when an asset retraces to its previous support level, providing a solid foundation before continuing its upward trend. Without this retracement, there’s a risk of buying in at a peak, only to see the price correct itself downward shortly afterward.

However, it’s essential to remember that not all breakouts follow this pattern. Cryptocurrency, particularly, has cases where assets experience “parabolic” moves—sharp, continuous upward trends without any significant retracement. Pepe’s price might not revisit its previous consolidation level in such scenarios. Instead, it could consolidate at a new, higher range, leaving behind those waiting for a retrace.

A balanced approach might be the best strategy for both scenarios. Consider entering with a small position in Pepe while placing a stop-loss nearby. This allows you to participate if Pepe goes parabolic while managing risk through the stop-loss.

Then, if the price does return to its previous consolidation zone, you’re positioned to increase your stake at a stronger support level, ultimately averaging your position at a more favorable price. If the breakout turns out to be a false move, your stop-loss will protect against larger losses.

This breakout strategy combines patience and flexibility, helping traders avoid emotional, FOMO-driven decisions. Moreover, by waiting for the market to provide a clearer signal through retests and support-building, we can reduce risk and increase the likelihood of long-term gains.

Final Thoughts

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

usethebitcoin.com

usethebitcoin.com