Dogecoin has managed to surpass its record monthly close. It’s likely that a price surge is also on the cards.

In the past, similar breakouts have led to dramatic gains. This includes an 8-month period where there was a 1000% increase.

It also went to as high as 8000% in just 4 months. Is it possible that the past could return?

Dogecoin Breaks Record Monthly Close, 8000% Surge To Follow?

Crypto analyst Alan highlights that Dogecoin has breached its all-time monthly closing price, and this has led to an increased sentiment in the crypto markets.

Historically, whenever Dogecoin’s price has reached this mark, it has seen an explosive increase in numbers.

#Dogecoin today surpassed its previous highest Monthly Close level 🔥

— Trader Tardigrade (@TATrader_Alan) November 12, 2024

Throughout history, when $Doge had performed like this, it gained +1000% in 8 months and +8000% in just 4 months. 🚀

👀 Let's see what happens in the coming 4 to 8 months. pic.twitter.com/dMdQjli1Vx

In relation to the theme, when the previous highest closing price was broken by the monthly average for Dogecoin, the growth was quite pronounced with a boom in prices.

The first surge was up 1000% from $0.0172 to $0.1892 over eight months. And over a period of just 4 months, there was an upsurge of about 8000% from 0.0729 to 5.9135

Simply because a strong bullish trend would happen after the level of the previous highest monthly close has been broken, at this point, there are aspirations that similar growth would emerge over the next 4 to 8 months.

Wiserheads expect the tendency to recur and forecast Dogecoin’s massive surge. This time to even greater $ 24.00 levels by mid-2025. Such past patterns of price surges bring a positive picture for Dogecoin in the short run.

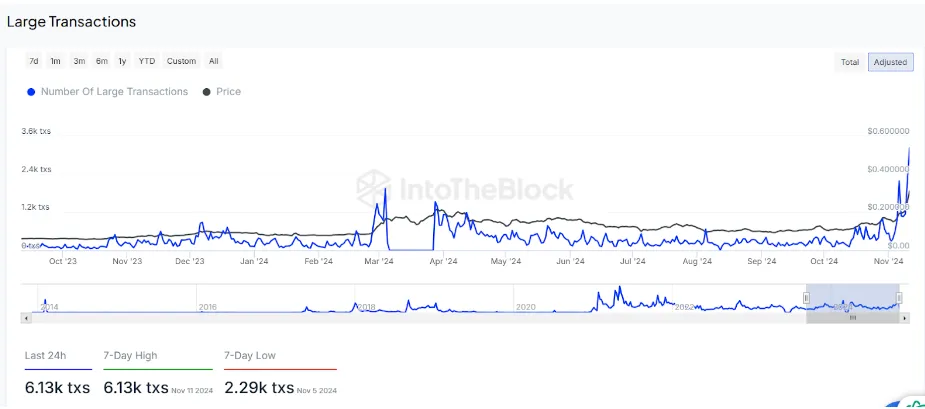

DOGE Large Transactions Hit Yearly High, Signaling Strong Investor Interest

The IntoTheBlock data concerning large transactions for DogeCoin also states that there is a surge in large transactions, which is at the highest point for the year.

In the past 24 hours, 6.13k large transactions were made, which is the same as a week ago, which reflects a notable surge in trading volume.

This increase is an indicator that there is increased activity from bigger players in the market, which could be institutional investors or other large actors.

Considering the temporal structure of this phenomenon, high values of large contracts were registered in April 2024. Now their highest levels are demonstrated in October and November.

This peak increase in transaction volume on the market also correlates to the price dynamics of Dogecoin, which recently breached the $0.40 mark.

Such a trend indicates a strong accumulation and enhances most investors’ trust in such investments.

In light of the past significant increase in large transactions, coupled with the significant price movement, such data provides clear indications of major deep pocket players accumulating DOGE.

This scenario is suggestive of a build-up phase in anticipation of a major price shift within the coming weeks.

This marks the highest extent of large transaction volume activity in 2024. It indicates high levels of institutional or whale interest in Dogecoin.

Sell Signals Across Multiple Timeframes Suggest DOGE May Face a Correction

As per TD Sequential Indicator, two larger sell-off sequences are active for DOGE on the 4 and 12-hour charts.

Another signal is developing on the daily chart. It increases the chances for a potential market correction before any upward movement.

The first signal mark shows 2-sell on the 4-hour chart, followed by a 13 count-down, giving a suggestion that the pressure to sell may be building up submissively.

Likewise, the 12-hour chart has a 9-sell signal that suggests a pullback. The daily chart with an 8 signal recorded also indicates future pricing is likely to head in a correction direction with a 13 count-down sequence.

The TD Sequential indicator is showing sell signals for #Dogecoin $DOGE on the 4-hour and 12-hour charts, with another signal forming on the daily chart. This points to a high likelihood of a price correction before going higher! pic.twitter.com/wnO3yeWlc5

— Ali (@ali_charts) November 12, 2024

There is valid reasoning and correlation as to why the price may retrace on each of the three respective timeframes.

However, this kind of price action wouldn’t be detrimental in the long-term perspective for DOGE, as upward momentum likely to continue.

thecoinrepublic.com

thecoinrepublic.com