$NEAR Protocol has retested the $5 mark after breaking through multi-month resistance. Will the $NEAR token rebound to $7.71, or is a drop to $4.50 ahead?

Following the broader market correction, the price of $NEAR’s native token has experienced a bearish reversal from a critical resistance level. The pullback has extended nearly 10% over the past two days, bringing the token back to the psychological $5 support level.

Will this bearish extension lead to a drop to the $4.50 support, or will a post-retest rebound send $NEAR’s price toward $7.71? Let’s dive into the details.

Near Protocol Price Analysis

Taking a bullish reversal from the crucial support of $3.522, the bull run in Near Protocol’s native token extended from $3.50 to $5.75. The bullish recovery accounted for a 64.22% rise and seven consecutive bullish candles.

However, the recovery rally failed to sustain dominance above the $5.50 mark, resulting in a bearish reversal. The bearish reversal started due to the massive supply at the 38.20% Fibonacci level at $5.56. It accounts for a price fall of nearly 10% in two days and forms an evening star pattern.

Additionally, the recent pullback suggests that the Exponential Moving Averages (EMAs) will likely continue the sideways trend. The pullback has led to a declining gap between the MACD and signal lines, resulting in a drop in intensity in bullish histograms.

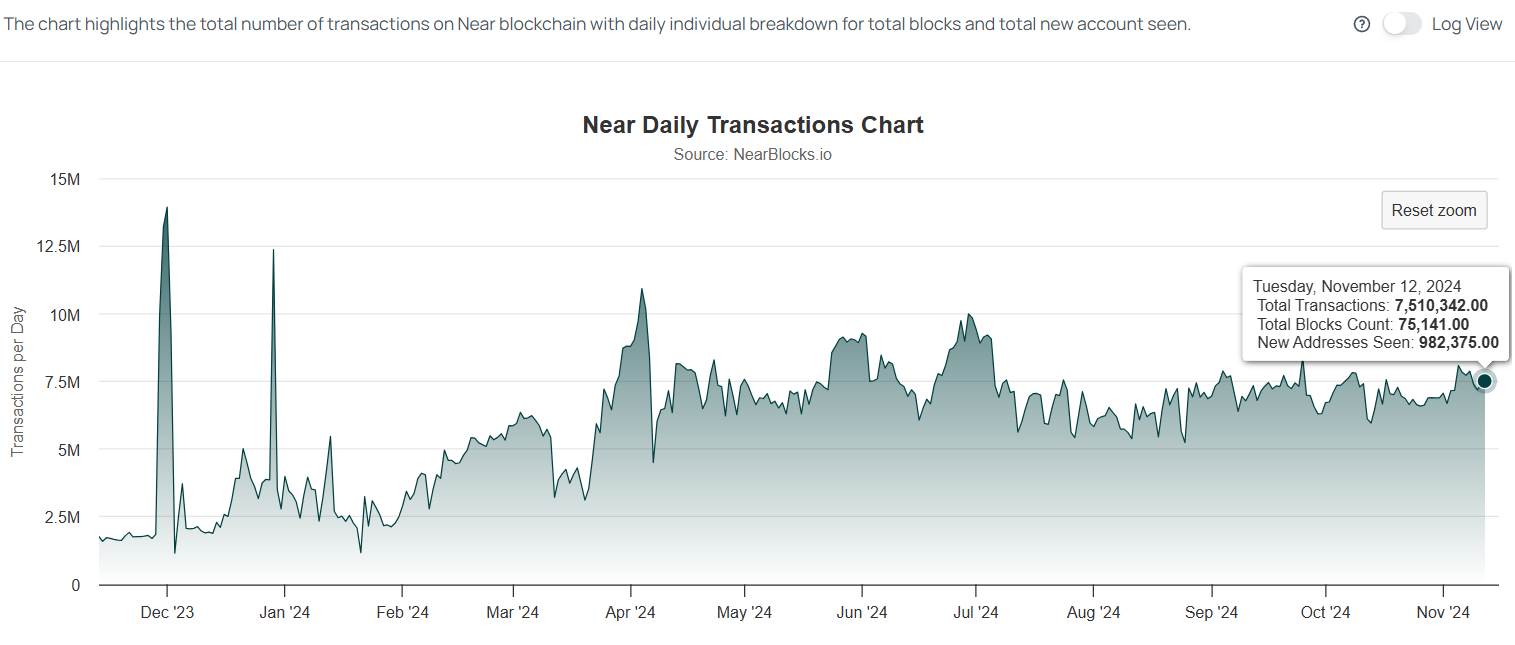

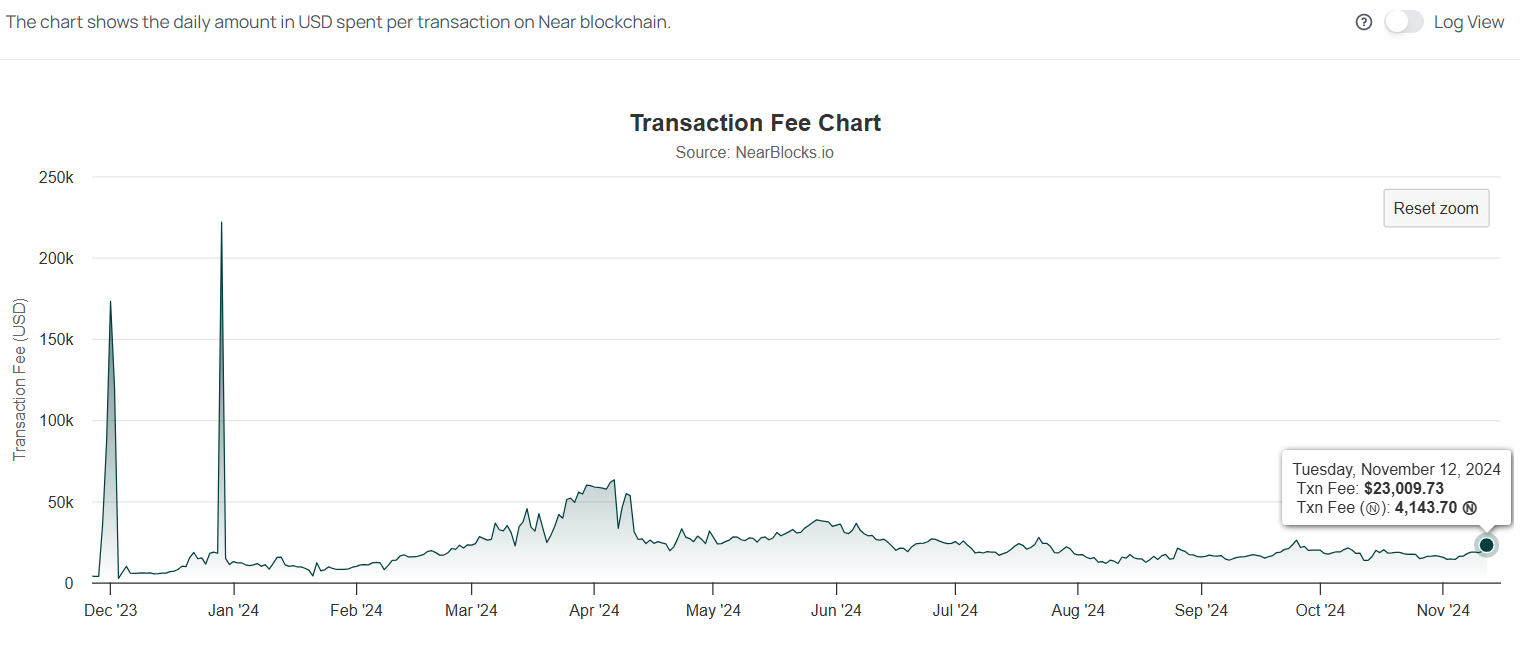

Transactions and Fees Improve over Near Protocol

On-chain metrics for Near Protocol have been showing positive signs, particularly in the ongoing bull market. During the April 2024 rally, transaction fees spiked above $60,000.

Now, the trend is rebounding. A break above the $30,000 transaction fee could accelerate the recent recovery. Furthermore, the daily transaction count continues to form higher lows.

On Tuesday, the total number of transactions reached 7.5 million, with 982,375 new addresses added to the network.

Given these growing metrics and improving market conditions, $NEAR’s price could surge in the near future.

Will the Uptrend Reach $7.71?

In the daily chart, the $NEAR token price has surpassed the long-coming multi-month resistance trendline. Essentially, the ongoing pullback comes as a potential retest.

If the price holds above dynamic support (as indicated by the average line), the uptrend could continue, breaking above the $5.56 level (38.2% Fibonacci retracement). In this scenario, the bull run could target the 78.6% Fibonacci level, which stands at $7.71.

thecryptobasic.com

thecryptobasic.com