Render’s (RNDR) price has shown notable gains, up 28% in the last month. This positions it as the third-largest artificial intelligence coin by market cap, behind $FET and $TAO.

Recent indicators point to a continuation of strong bullish sentiment, with increasing social activity and favorable technical patterns. This surge in both social dominance and price performance suggests growing investor interest in RNDR.

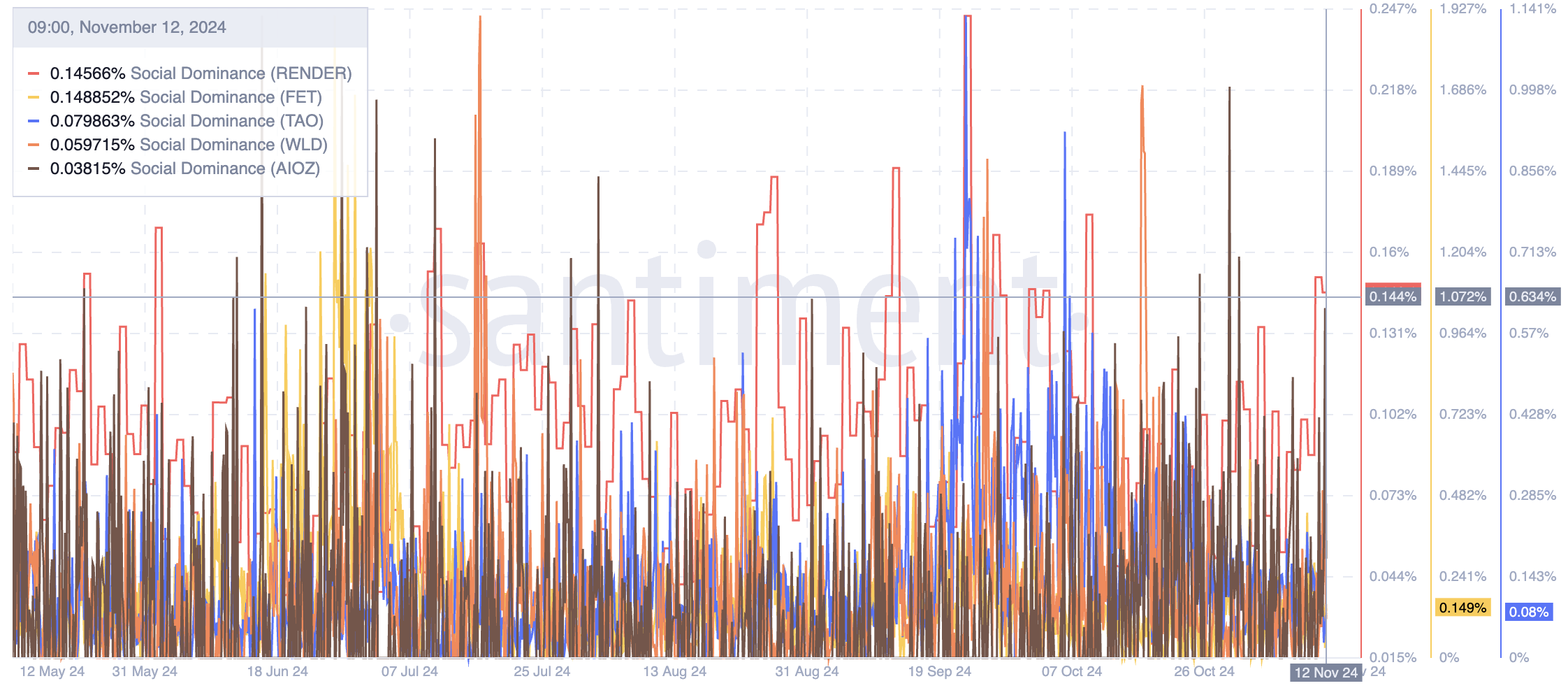

RNDR Is Just Behind $FET On Social Dominance

Render (RNDR) has climbed to the second position in terms of social dominance among the top 5 AI coins, with its social presence almost doubling over the past seven days.

This surge in social activity reflects growing interest and discussions around RNDR, which have likely contributed to its recent price performance.

During the same period, RNDR’s price has risen nearly 40%, positioning it as the second-biggest winner among the top AI coins, just behind AIOZ Network, which saw a 73% increase.

RNDR has outperformed other prominent AI projects like $TAO, $FET, and WLD, highlighting its strong market momentum.

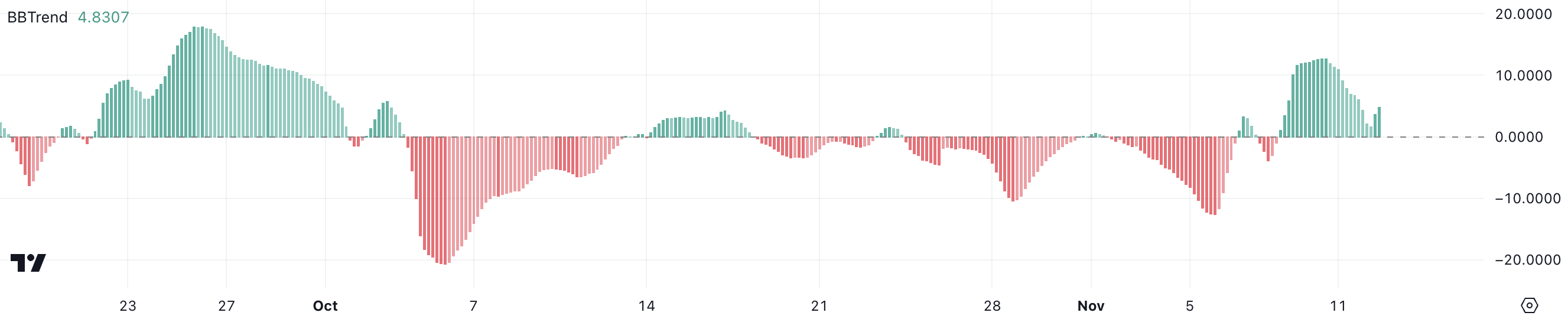

RNDR BBTrend Is Almost Reaching 5

Render BBTrend has remained positive since November 8, reaching a monthly high of 12.7 on November 10. BBTrend, or Bollinger Band Trend, is an indicator that measures momentum in relation to Bollinger Bands.

A positive BBTrend suggests that bullish momentum is driving the asset’s price, while negative values indicate a bearish trend.

After peaking at 12.7, RNDR BBTrend dropped to 1.17, showing that the bullish momentum had faded significantly. However, it has since begun recovering and is now at 4.83, suggesting a renewed but moderate increase in positive momentum.

This recovery could indicate that buying interest is getting even stronger, and if the current positive sentiment persists, the trend may continue to build strength.

RNDR Price Prediction: Can RNDR Surpass $9 Soon?

RNDR’s EMA lines are indicating a strong bullish sentiment, with the price positioned above all of the exponential moving averages.

Additionally, the short-term EMAs are stacked above the long-term ones, which confirms that the current momentum is positive and buyers are in control. This setup suggests that the uptrend could continue if market conditions remain supportive.

If the current bullish trend persists, RNDR price could soon test the next resistance level at $7.94. Breaking above that resistance might push the price even higher, targeting $9.46, which would represent a 34% increase. That would consolidate Render as a top 3 artificial intelligence coin.

However, if the uptrend loses momentum and reverses, RNDR could fall back to the support at $5.83. Should that level fail to hold, the price could drop further to $5.03, signaling a deeper correction.

beincrypto.com

beincrypto.com