MicroStrategy Inc. (NASDAQ: MSTR) has been riding the crypto wave, with its stock price surging alongside Bitcoin’s (BTC) recent all-time highs.

Following the acquisition of an additional 27,200 BTC between October 31 and November 10 at an average price of $74,463 per coin, MicroStrategy now holds a substantial 279,420 BTC, valued at approximately $23 billion according to Bitcoin Treasuries.

With Bitcoin currently trading around $87,000, this holding has positioned MicroStrategy as the top corporate Bitcoin owner, making its stock a highly leveraged bet on Bitcoin’s trajectory.

As MSTR’s stock price hits new highs, currently trading at $338.91, investors are left wondering where MSTR will land by the end of the year.

Key factors influencing MSTR’s stock price

Bitcoin price volatility and momentum

MSTR’s stock price is closely linked to Bitcoin’s value, given the company’s extensive BTC holdings, which represent approximately 1.3% of Bitcoin’s total supply. This signals further upside potential for MSTR stock, which directly benefits from Bitcoin’s upward momentum.

However, this strong correlation also introduces significant volatility, as any downturn in BTC prices could have a direct impact on MSTR’s valuation.

MicroStrategy’s bold decision to integrate Bitcoin into its balance sheet has proven highly profitable, sparking growing interest in corporate Bitcoin adoption.

For instance, Microsoft (NASDAQ: MSFT) shareholders are set to vote in December on implementing a Bitcoin strategy, positioning MicroStrategy’s success as a compelling case study for other corporations, as reported by Finbold.

Regulatory outlook and pro-crypto political influence

Trump’s pro-crypto stance, combined with the Republican Party regaining control of the Senate, has sparked renewed optimism within the digital asset space.

Plans for establishing a U.S. national Bitcoin reserve, along with clearer regulatory frameworks, are creating a supportive environment for crypto assets.

These developments are bolstering investor confidence in Bitcoin-focused companies like MicroStrategy. With this favorable political backdrop, MSTR could attract increased institutional interest as a strategic, indirect investment in cryptocurrency.

The ambitious “21/21 Plan”

MicroStrategy’s strategic “21/21 Plan” seeks to raise $42 billion, split evenly between $21 billion in equity and $21 billion in fixed-income securities, over the next three years.

This ambitious initiative aims to fuel further Bitcoin acquisitions and strengthen the company’s position as a BTC proxy, potentially boosting returns from its substantial Bitcoin holdings.

AI prediction: MSTR stock price outlook

To provide insight into MSTR’s future, Finbold consulted OpenAI’s advanced AI tool, ChatGPT-4o.

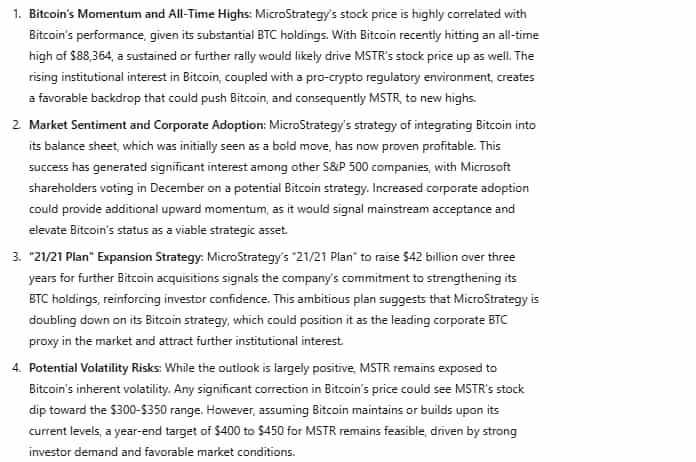

According to the AI model, MicroStrategy’s stock appears poised for significant growth as the company continues expanding its Bitcoin holdings.

Factoring in Bitcoin’s price trends, recent political developments, and MicroStrategy’s strategic positioning, the AI forecast suggests that MSTR could reach a range of $400 to $450 by year-end.

However, any significant downturn in Bitcoin’s price or emerging regulatory challenges could see MSTR settle between $300 and $350, underscoring its vulnerability to Bitcoin’s volatility.

Ultimately, MicroStrategy’s future will closely mirror Bitcoin’s trajectory, making it a high-potential yet high-risk investment for those bullish on Bitcoin’s long-term growth.

Featured image via Shutterstock

finbold.com

finbold.com