- XRP price is rising alongside its exchange reserve, defying the norm.

- XRP investors are holding onto their profit despite a 23% price rise in the past week.

- XRP could extend its rally to $0.7400 after breaking above a key descending channel.

Ripple's XRP is up nearly 8% on Monday, as the remittance-based token stretched its weekly gains to 23%. If investors continue holding onto their profits, XRP may likely extend the rally toward $0.7400.

XRP on-chain metrics reveal expectations for higher upside

XRP's Binance exchange reserve has been trending upward since November 6, rising from 3.105 billion XRP to 3.177 billion XRP on Monday, per CryptoQuant's data. A similar upward move is also visible in the XRP Upbit exchange reserve, rising from 6.611 billion to 6.634 billion XRP.

While an increase in an asset's exchange reserve indicates potential for price decline, XRP's price has defied the trend, rising alongside its exchange reserve balance.

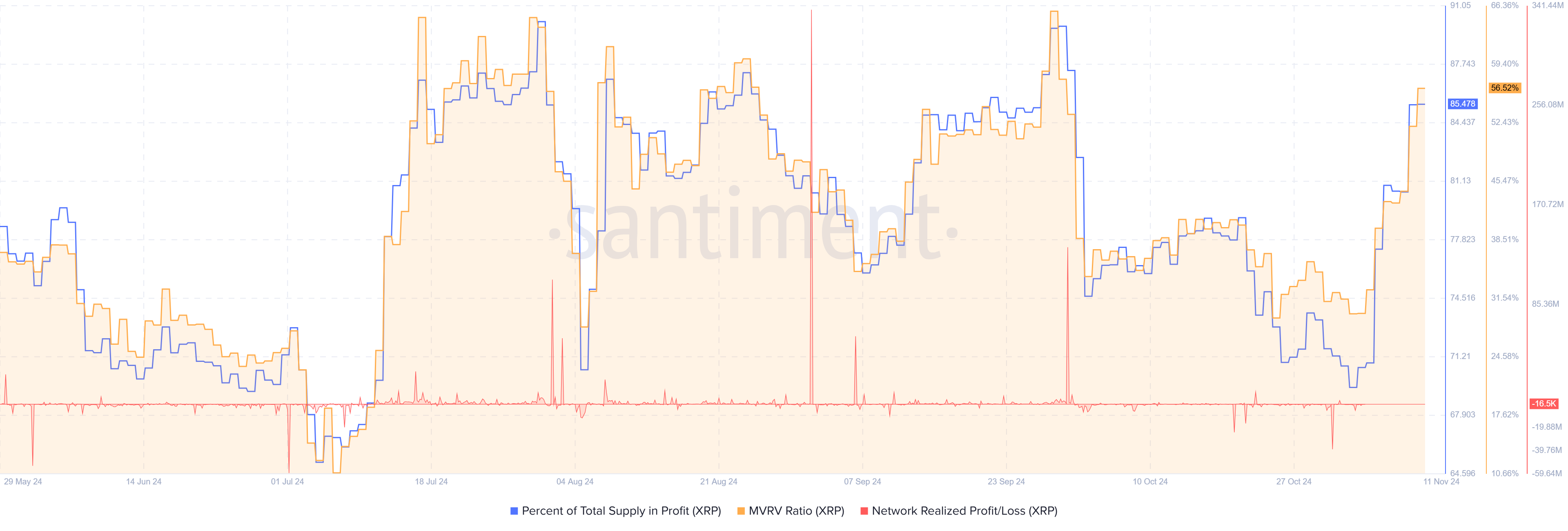

Meanwhile, the percentage of total XRP supply in profit has been rising steadily, growing to 85%, while its Market Value to Realized Value (MVRV) crossed 56%. MVRV calculates the average profit or loss of all XRP holders.

XRP On-chain data | Santiment

During bull markets, profit-taking often ensues when holders' profits spike, as they did in the past few days. However, XRP's Network Realized Profit/Loss — which measures the average profit or loss of all coins that change addresses daily — has remained at 0 since November 5, per Santiment data. This indicates that investors are holding onto their profits in hopes of more upside.

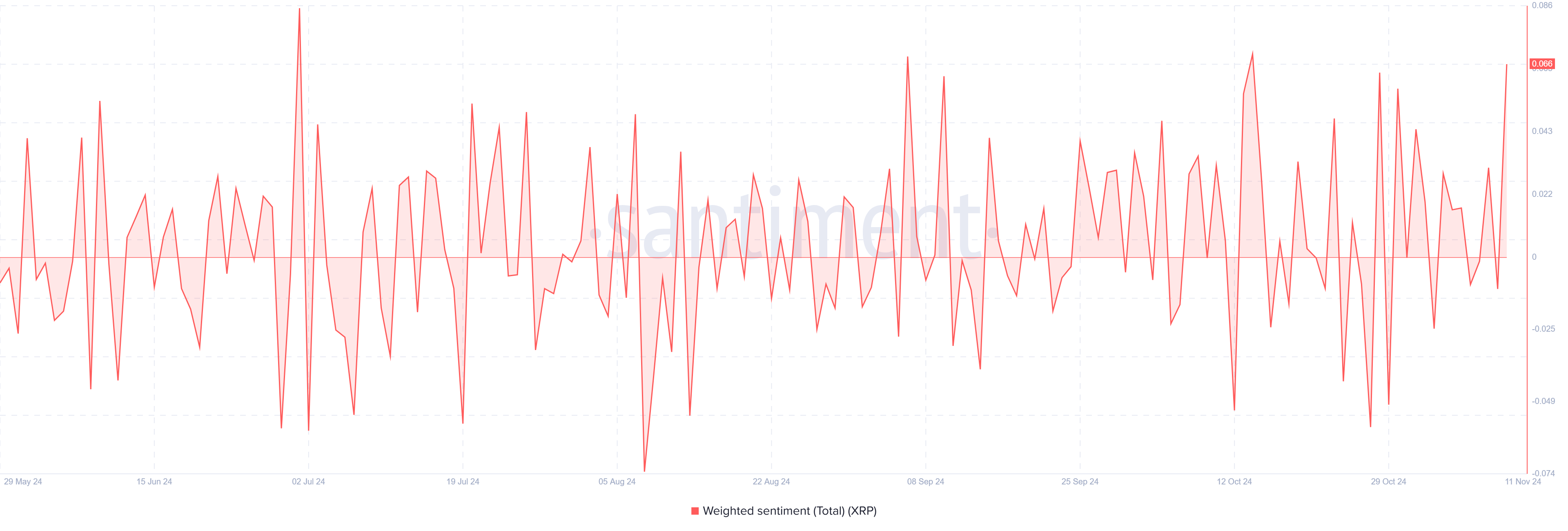

XRP's Weighted Sentiment is also at high levels, reaching 0.066 in the past 24 hours. Weighted sentiment measures the social volume and sentiment of investors regarding a token. An increase in this metric suggests an influx of positive sentiment surrounding a token, and vice versa for a decrease.

XRP Weighted Sentiment | Santiment

Ripple Price Forecast: XRP could rally to $0.7400 if it overcomes $0.6450 resistance

Ripple's XRP is trading near $0.6200, following $3.98 million in futures liquidations in the past 24 hours. Liquidated long and short positions accounted for $2.95 million and $1.03 million, respectively.

Over the weekend, XRP broke above its 200-day Simple Moving Average (SMA) and the upper resistance of a key descending channel.

The remittance-based token could continue the uptrend to tackle the resistance level near $0.6450. A firm close above this level could see XRP rally toward $0.7400.

XRP/USDT daily chart

On the downside, XRP could find support near the upper trendline resistance of the key descending channel.

The Relative Strength Index (RSI) is in its overbought region, indicating the likelihood of a potential price correction.

A daily candlestick close below $0.5608 will invalidate the thesis.

fxstreet.com

fxstreet.com