Cryptocurrency bulls and bears have shared their insights and built their positions during a slightly bearish seven-month consolidation phase. Cryptocurrencies have now proved the bears wrong, adding over $800 billion in capitalization in two months, starting a bull market.

Finbold looked at TradingView’s Crypto Total Market Cap Index (TOTAL) on November 10, currently marking a $2.667 trillion capitalization.

TOTAL had been in a seven-month downtrend range, touching the range’s bottom for the last time in early September. Since then, the crypto market has added over $800 billion in capitalization, up over 40% in two months.

Notably, the highest inflow occurred in the last five days, adding over $465 billion. This happened after testing the range’s top as support for the second time, which was previously a resistance. TOTAL broke out of the downtrend in mid-October as “Uptober” was playing out.

Beware: Short squeeze first, long squeeze second

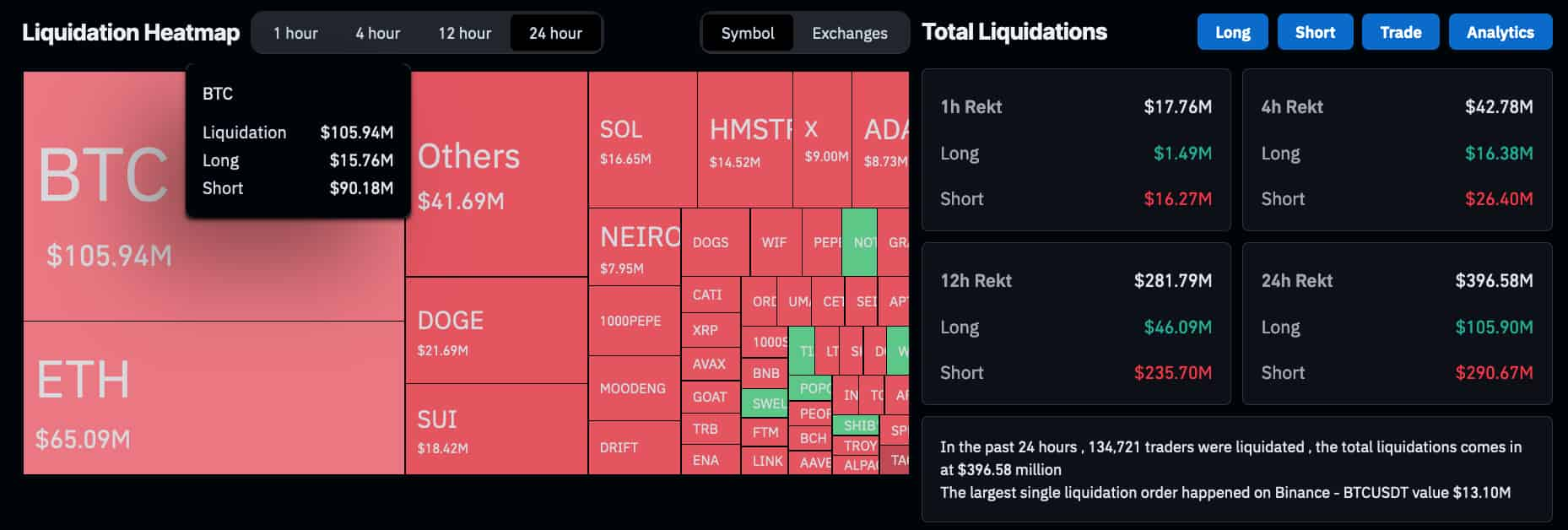

The weekend has already seen significant volatility after Bitcoin (BTC) reached a price target of $77,500, as Finbold forecasted. With that, the market registered nearly $400 million in liquidations from short and long positions in the last 24 hours.

In particular, $290 million was liquidated in a short squeeze, punishing the bears, while $105 million was of long liquidations. Bitcoin had the largest single liquidation of $13.10 million and a total of $105 million liquidated.

The move has punished bears like Credible Crypto, who were eagerly shorting Bitcoin and altcoins since early October.

As previously shared, the trader does not plan to open shorts here. Instead, CrypNuevo said he would use the pullback to open more longs, including in altcoins with high growth potential. Other analysts have also shown a bullish bias on altcoins, predicting Bitcoin’s dominance (BTC.D) will peak and drop soon.

Finbold reported some of these “altseason” ideas before, including a trading plan to prepare for a bull market. Nevertheless, traders and investors must remain cautious and avoid being caught by the fear of missing out (FOMO).

finbold.com

finbold.com