Celestia showed a potential breakout pattern of movement within a descending channel but remained active, suggesting potential for significant gains. Investors maintained their holdings patiently, eyeing the potential for a breakout.

Over recent days, the price action hinted at stability despite the bearish trend, giving rise to optimism among traders. The setup mirrored conditions often seen before substantial rallies, where persistent consolidation led to explosive breakouts.

Historically, once TIA’s price approached the upper boundary of the descending channel, it sparked substantial buying interest.

If TIA were to breach this boundary decisively, a surge of 231% could be on the horizon, moving the price to around $13.16.

Such a rally would hinge on continued investor interest and increasing trading volumes, which might act as catalysts. Additionally, external market conditions and sentiment within the broader crypto space would play crucial roles in either bolstering or dampening this potential ascent.

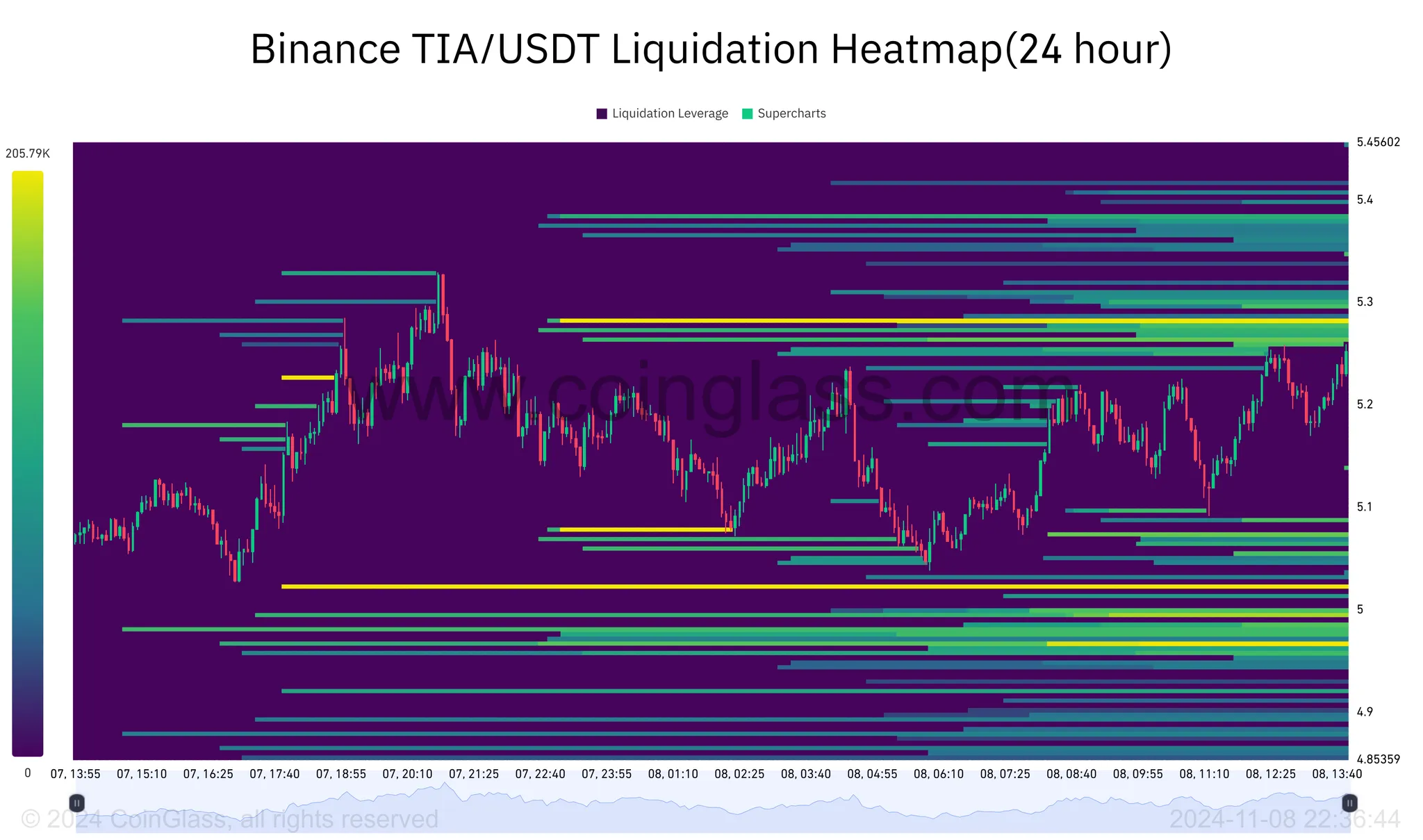

The Zone of Interest Liquidity-Wise

Additionally, TIA’s price reflected intense focus around the $5.3 liquidity zone, which ranked as the most attractive for traders near the current price levels. This area consistently drew the price towards it, evidenced by a strong pull due to its significant liquidity.

Investors observed this zone as a critical threshold that could dictate the next major move for TIA. The proximity of the price to this high liquidity zone led to heightened trading activity, suggesting that many viewed it as an optimal entry or exit point.

As TIA approached this zone, the potential for increased buy or sell orders could drive volatility and possibly trigger a larger price movement. If the price sustained above this zone, it could set off a bullish trend, whereas failure to breach could lead to a retest of lower support levels.

Such dynamics indicated that TIA’s next moves would heavily depend on its interaction with the $5.3 zone. Successfully holding above or breaking through this level could significantly influence its short-term trajectory.

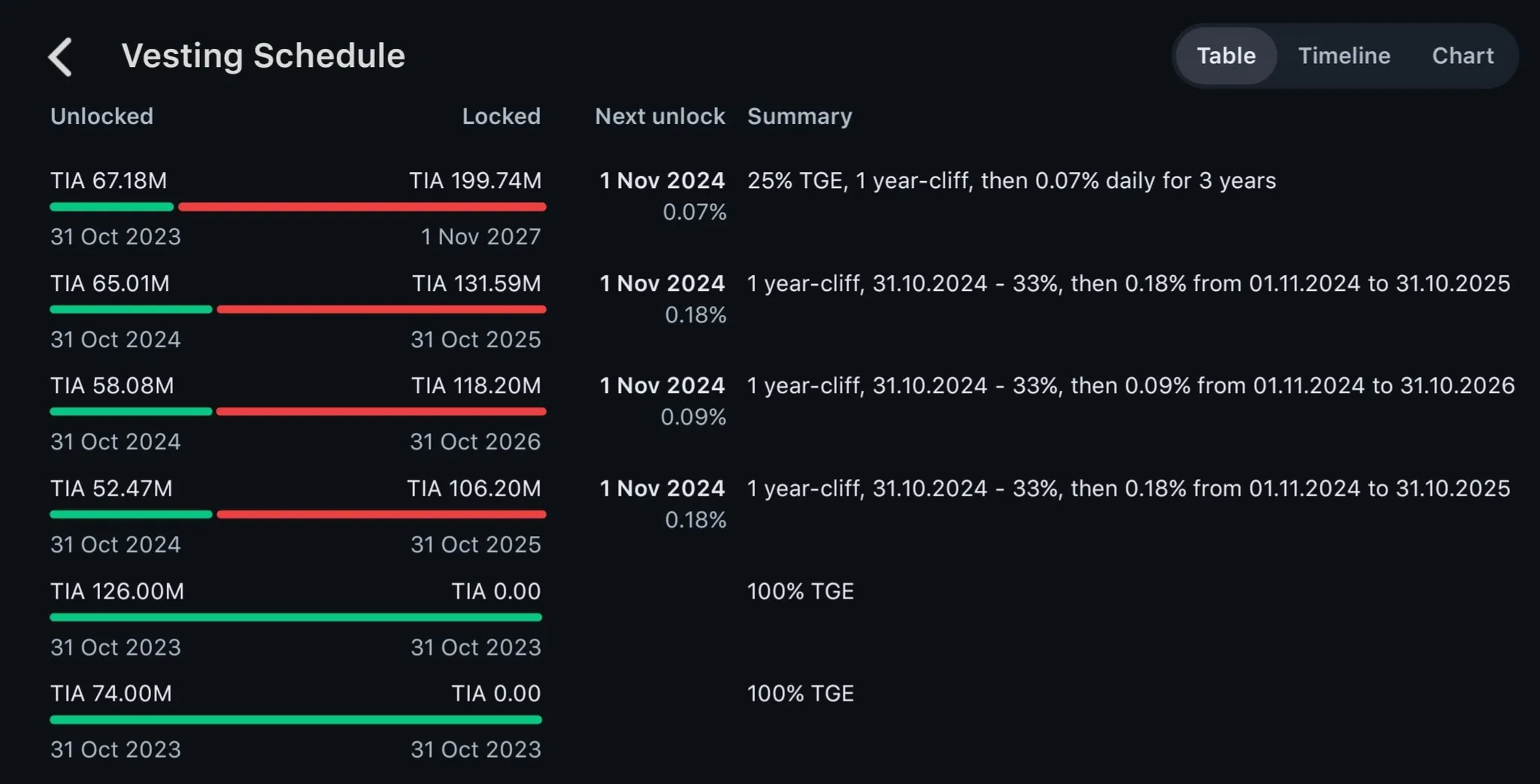

Price Remains Unaffected Despite Token Unlock

Lastly, TIA’s circulating supply almost doubled after the token unlock earlier this month, yet the price stability that followed suggested a strong underlying demand for the token.

The increased supply did not dampen the market’s appetite for TIA, which could be seen as a bullish indicator. If the liquidity in the $5.3 zone continued to attract buying interest due to its proximity to current levels, it could catalyze a significant breakout.

Considering the high trading volume and the stable market cap, despite the influx of new tokens, TIA has the potential to rally sharply.

Investors holding on through this phase of token unlocks may see substantial gains, with a possible 231% increase in price if momentum builds towards breaking out of the descending channel pattern.

The scenario mirrored the resilience and potential upside often observed in other assets post-major unlocks, where initial stability post-unlock leads to strong bullish trends.

thecoinrepublic.com

thecoinrepublic.com