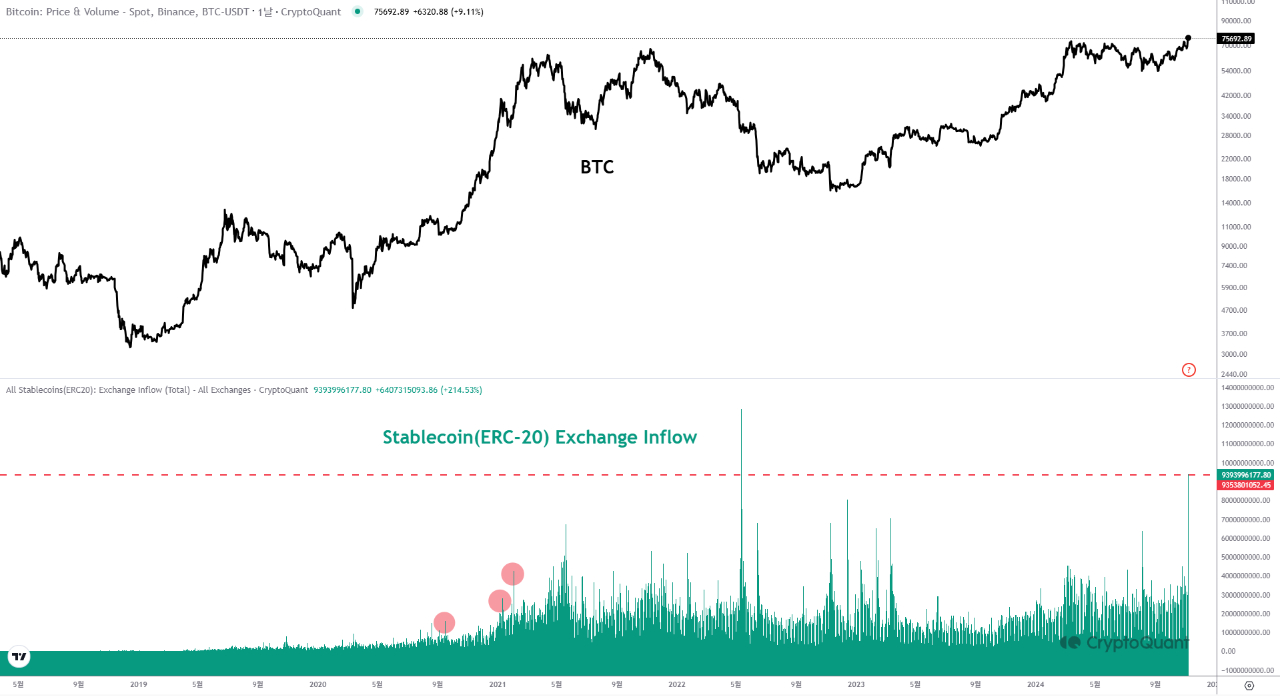

Two leading cryptocurrency exchanges, Binance and Coinbase, saw a whopping $9.3 billion worth of stablecoin inflows on the Ethereum network after Republican candidate Donald Trump won the U.S. presidential election.

According to analysis from on-chain analytics firm CryptoQuant, out of the $9.3 billion worth of ERC-20 stablecoins deposited not these exchanges, $4.3 billion flowed to Binance, while $3.4 billion moved to the Nasdaq-listed exchange Coinbase.

Per the firm’s analysis, large-scale stablecoin inflows and subsequent upward trends have historically “coincided with bullish market rallies.”

The stablecoin inflows come at a time in which spot Bitcoin exchange-traded funds (ETFs) saw record daily inflows of $1.38 billion as the price of the flagship cryptocurrency reached a new all-time high near the $77,000 mark after Republican candidate Donald Trump won the U.S. presidential elections.

According to data from Farside, BlackRock’s spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT), accounted for about 81% of the total inflows, bringing in $1.11 billion in net inflows, far above the runner-up, the Fidelity Wise Origin Bitcoin Fund (FBTC), which saw $190 million inflows.

The Ark 21 Shares Bitcoin ETF (ARKB) came in third place, with $17.6 million inflows. No spot Bitcoin ETF saw outflows on November 7. Data shows that in total, spot Bitcoin ETF’s cumulative flows are now at $25.57 billion.

These record inflows come at a time in which the price of the flagship cryptocurrency rose more than 9% over the past week to hit a new all-time high, fueled by Trump’s victory in the U.S. elections, given his pro-crypto stance.

A Trump victory was widely expected to help boost Bitcoin’s price, as the former U.S. President has expressed strong support for the cryptocurrency sector, meaning the regulatory outlook could improve through the reduction of regulatory ambiguity and the appointment of more crypto-friendly officials to key positions, for example.

Bitcoin’s price, however, has been known to rally after U.S. presidential elections, having seen 90-day returns of 87%, 44%, and 145% after the elections in 2012, 2016, and 2020, respectively.

Featured image via Pixabay.

cryptoglobe.com

cryptoglobe.com