$RAY token has recently emerged as a prominent asset with an impressive surge nearing 200% in 1 month and ranking among the top performers constantly in the past weeks, largely due to its association with Raydium, a decentralized exchange (DEX) on the Solana blockchain. This article delves into the fundamentals of Raydium, the $RAY token, its relationship with the Solana ecosystem, and an analysis of its price movements to predict future trends.

What is Raydium?

Raydium is an innovative automated market maker (AMM) and decentralized exchange (DEX) built on the Solana blockchain. Its unique features include:

- AMM and Order Book Integration: Combines the benefits of an AMM with a centralized order book, facilitating efficient trading.

- High-Speed Transactions: Leverages Solana’s high throughput capabilities, allowing for minimal transaction costs and rapid trading experiences.

- Liquidity Provisioning: Offers users opportunities for yield farming and staking, enhancing liquidity on the platform.

Raydium plays a crucial role within the Solana ecosystem, attracting users and driving trading volumes, which contribute to its rising popularity.

Raydium and Solana: A Strategic Partnership

Raydium's success is deeply intertwined with the Solana blockchain, characterized by:

- High Performance: Solana’s capabilities enable Raydium to handle large volumes of transactions swiftly, attracting a growing user base.

- Interconnected Ecosystem: As a significant player within Solana, Raydium benefits from increased interest in the ecosystem, especially when $SOL prices rise.

- Market Dynamics: A surge in $SOL often correlates with heightened trading activity on Raydium, further driving demand for $RAY tokens.

What is the $RAY Token?

The $RAY token serves as the native utility token of the Raydium platform, with several key functionalities:

- Governance: $RAY token holders can participate in governance decisions, voting on proposals that influence the platform’s development.

- Staking Rewards: Users can stake their $RAY tokens to earn rewards and a share of the trading fees generated on the platform.

- Liquidity Mining: $RAY incentivizes liquidity provision, encouraging users to contribute to the platform’s liquidity pools.

With a total supply of 555 million $RAY tokens, the tokenomics are designed to reward long-term engagement and support the platform's growth.

$RAY Price Prediction: Key Metricsand Price Analysis

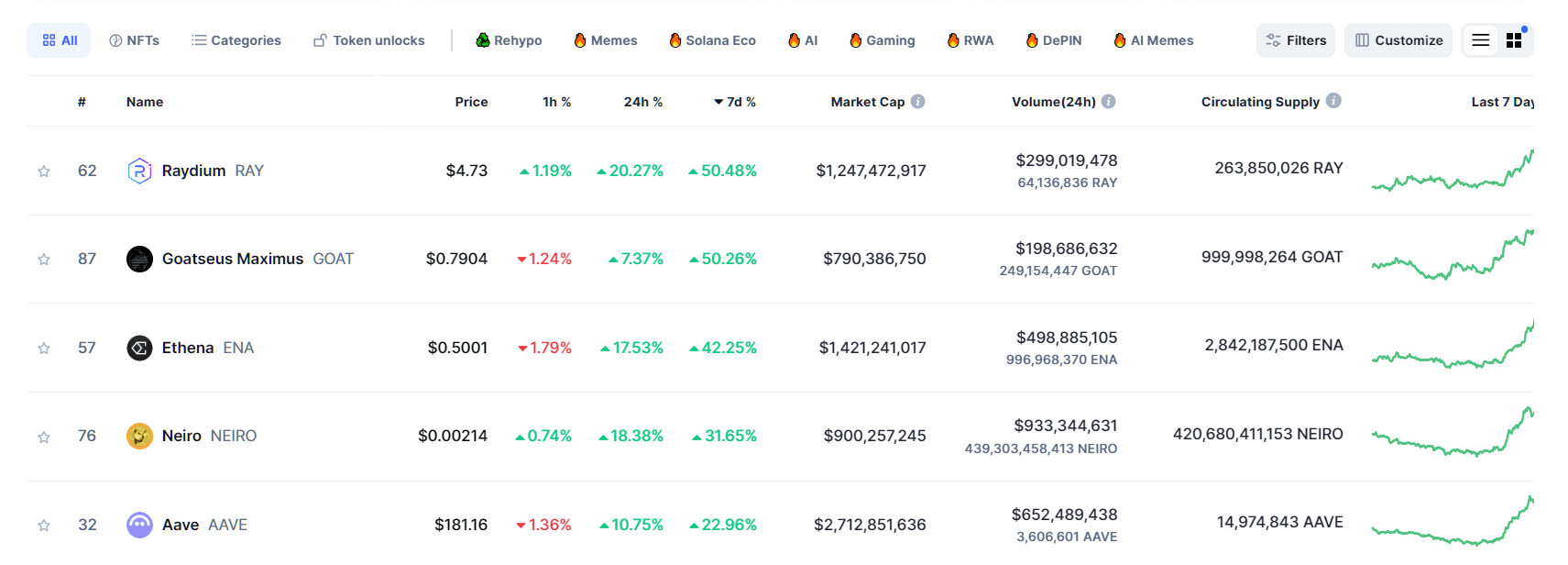

$RAY Key Metrics:

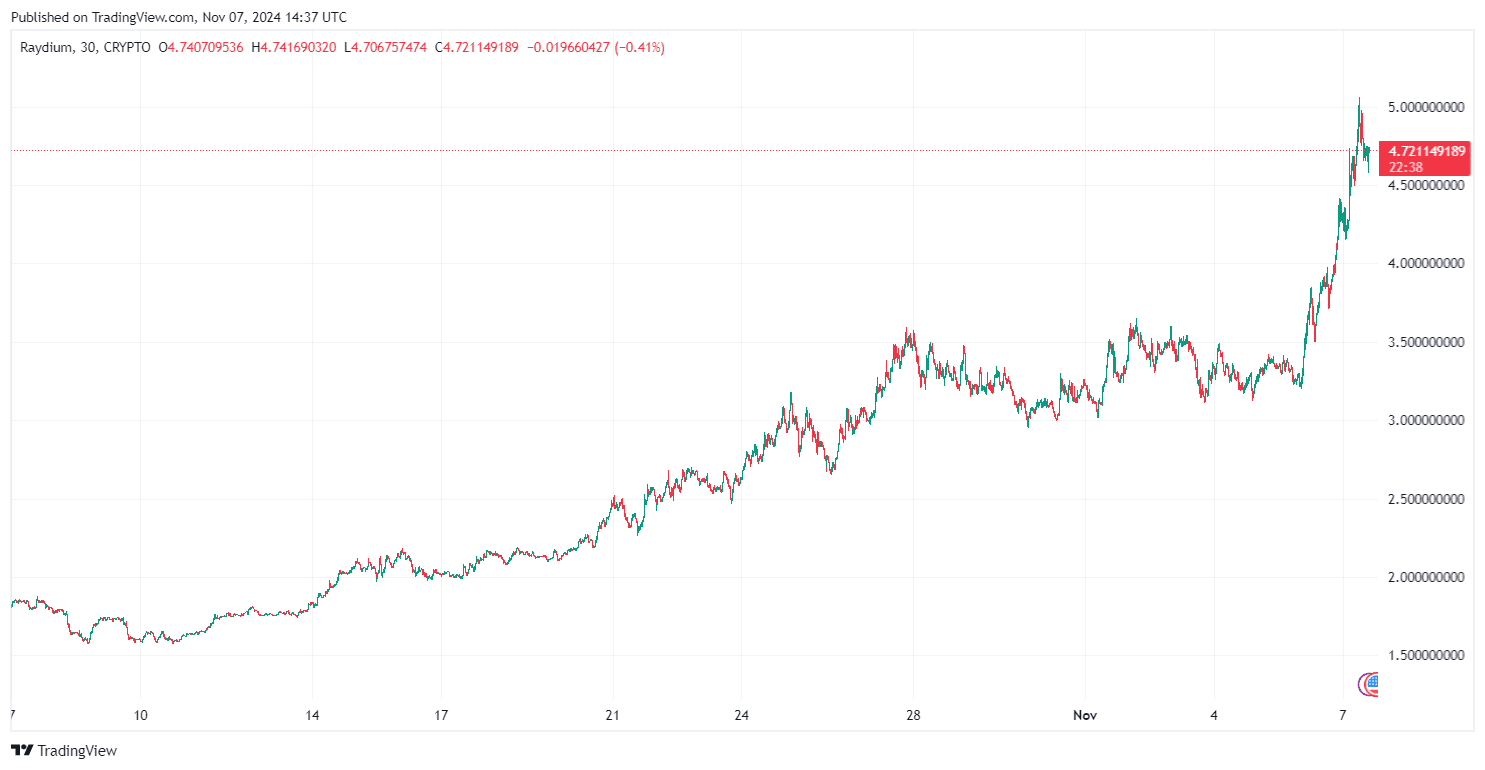

- Growth Over 1 Month: +186.63%

- Current Price: $4.72

- Distance from $ATH: -72.32%

- Weekly Surge: +50.48%

$RAY Price Prediction and Analysis:

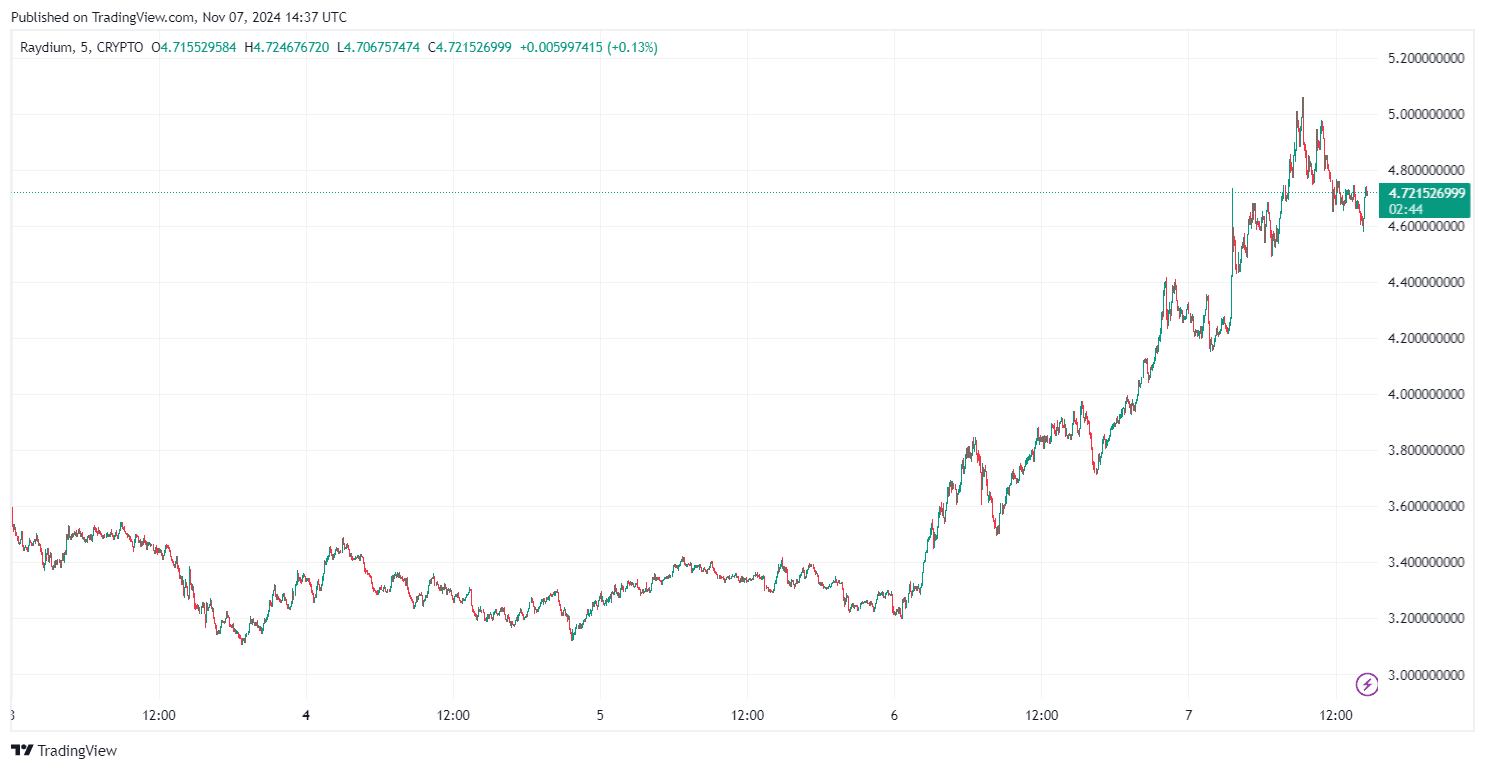

The recent performance of $RAY indicates a strong upward trend, suggesting robust market sentiment. Analysts predict that the US Election might have a potential influence on $RAY price, particularly if $TRUMP is elected, which could amplify speculative trading. Now that $TRUMP won the elections, what more to expect?

- Short-Term Price Target: $RAY may challenge its previous $ATH.

- Long-Term Projections: If momentum continues, $RAY could reach or exceed $20 in the coming months, driven by increased trading volumes and market participation.

So, to sum up briefly what to expect for the $RAY token, it is currently trading at $4.72 after reaching an intraday high of $5.05, sitting at -72.32% away from its all-time high ($ATH) but at less than half its growth of 186% of the past month. Adding to that, this week's surge of 50%, and the US Election in favor of its bullish momentum, make the chances of a price surge higher than that of a fallback. But with the market volatility by nature and cryptos all up now, $RAY might not reach its $ATH before the end of November. So traders must keep an eye out for its main support and resistance levels.

Conclusion

The $RAY token, underpinned by the Raydium platform on the Solana blockchain, represents a compelling investment opportunity in the cryptocurrency market. With its impressive growth trajectory and strategic position within the Solana ecosystem, $RAY is well-poised for future success. As market conditions evolve, investors should remain attentive to the factors influencing price movements and actively engage with developments within the Solana ecosystem to maximize their potential returns on $RAY.

cryptoticker.io

cryptoticker.io