Despite a prolonged drawdown, First Neiro on Ethereum (NEIRO) holders are holding firm, opting not to sell their tokens even after a 20% surge in the past 24 hours. This sentiment reflects growing optimism that the meme coin’s recent uptrend is far from over.

But is this optimism justified? In this on-chain analysis, BeInCrypto examines whether NEIRO holders’ decision to cling to the meme coin could pay off.

Neiro Investor Sentiment Soars as Adoption Rises

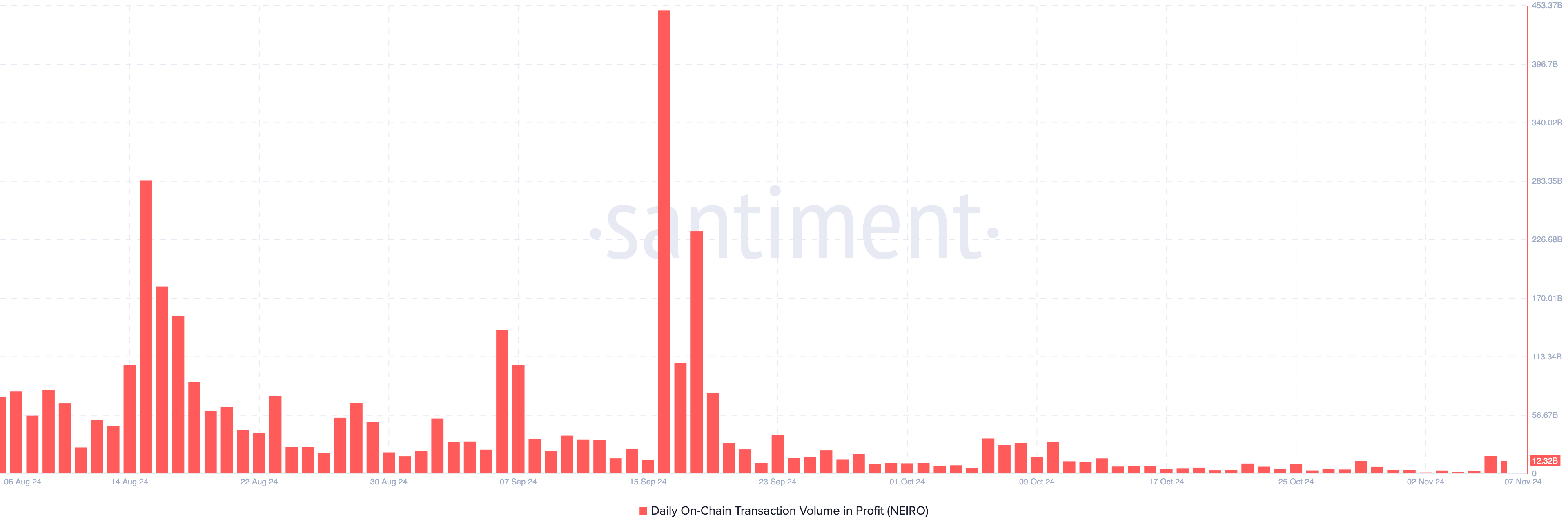

NEIRO’s recent price increase means the meme coin is now 10% from reaching its all-time high. Currently trading at $0.0021, on-chain data from Santiment shows that the daily on-chain transaction volume in profit is about 12.32 billion.

This volume is relatively low compared to previous times when NEIRO experienced notable jumps. For instance, on September 16, realized profits skyrocketed to 448.33 billion. In October, the profit volume was also higher than the current one on several occasions.

Further, this surge indicates that many NEIRO holders have strong investor sentiment. If this momentum continues, NEIRO’s price could maintain its uptrend.

Read more: What Are Meme Coins?

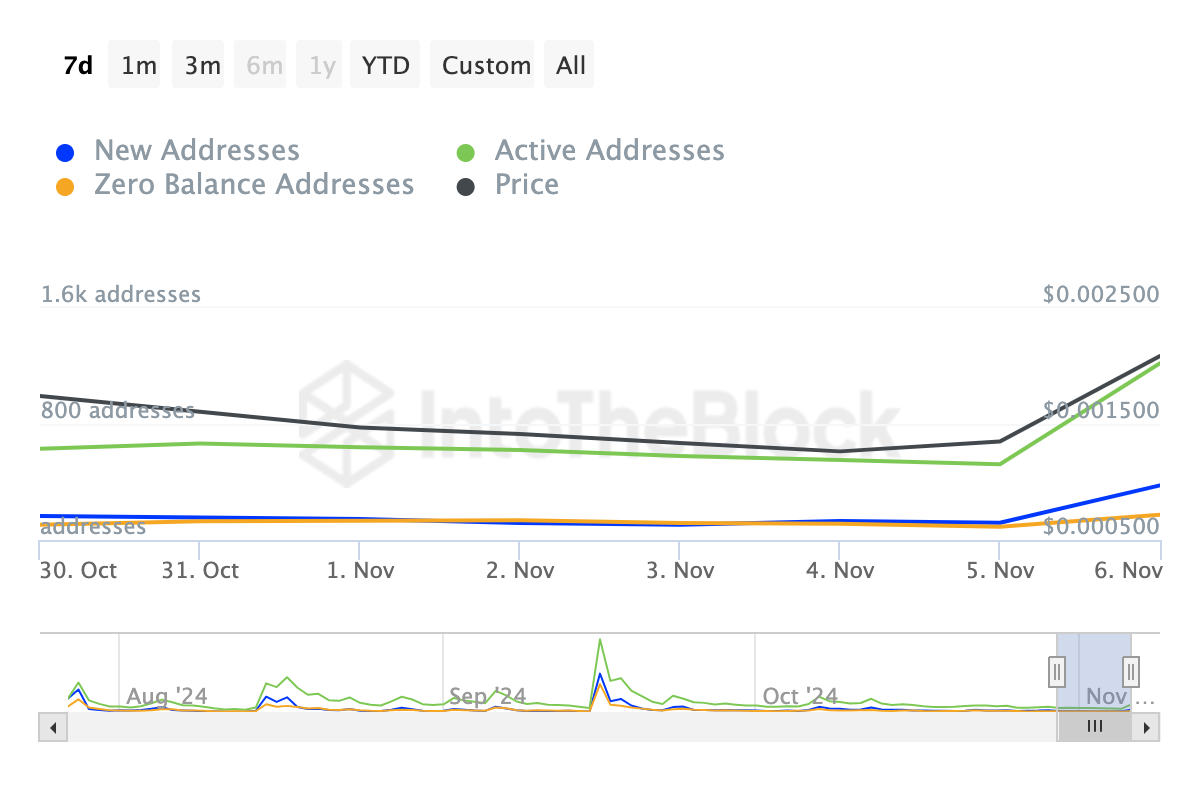

Additionally, network activity highlights a surge in investor sentiment. According to IntoTheBlock, active addresses have spiked by 130% over the past week, with new and zero-balance addresses also experiencing significant growth.

Active addresses are a key metric of user engagement, and this uptick indicates that more investors are actively interacting with the meme coin.

Meanwhile, the rise in new addresses signifies a growing adoption of First Neiro on Ethereum, pointing to heightened demand. If this trend persists, NEIRO’s price could maintain its upward momentum.

NEIRO Price Analysis: New High on the Radar

Between October 30 and Tuesday, November 5, NEIRO’s price plunged from $0.0017 to $0.0013. However, the 4-hour chart, as shown below, shows that the selling pressure has reduced as the meme coin broke out of the descending trendline.

This breakout, alongside the support at $0.013, ensured that the cryptocurrency did not go lower than that. Meanwhile, the Average Directional Index (ADX) also follows an upward trend.

The ADX is a key technical indicator used to assess the strength of a trend. A reading below 25 typically signals weak directional momentum, but with the ADX currently at 42.49, it suggests that NEIRO’s uptrend is gaining strength and could continue in the near term.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Should NEIRO holders stick to their sentiment and refrain from selling, the price might surpass $0.0023 and probably hit a new all-time high. But if profit-taking comes in before this, the token might not hit that price. Instead, it could retrace to $0.0015.

beincrypto.com

beincrypto.com