Dogecoin (DOGE) surged by 20%, reaching $0.19 on November 6, as markets reacted to news of Donald Trump’s return to the presidency.

This sentiment positioned memecoins like Dogecoin as standout performers in the crypto market, with Musk’s endorsement adding further momentum.

Historically, DOGE has shown strong reactions to Musk’s involvement, often experiencing volatility spikes with each endorsement.

In a November 6 post on X, analyst Ali Martinez suggested that Musk’s alignment with Trump could spark a bullish wave for DOGE, highlighting the cryptocurrency’s strong connection to Musk’s influence.

Technical patterns point to a potential rally

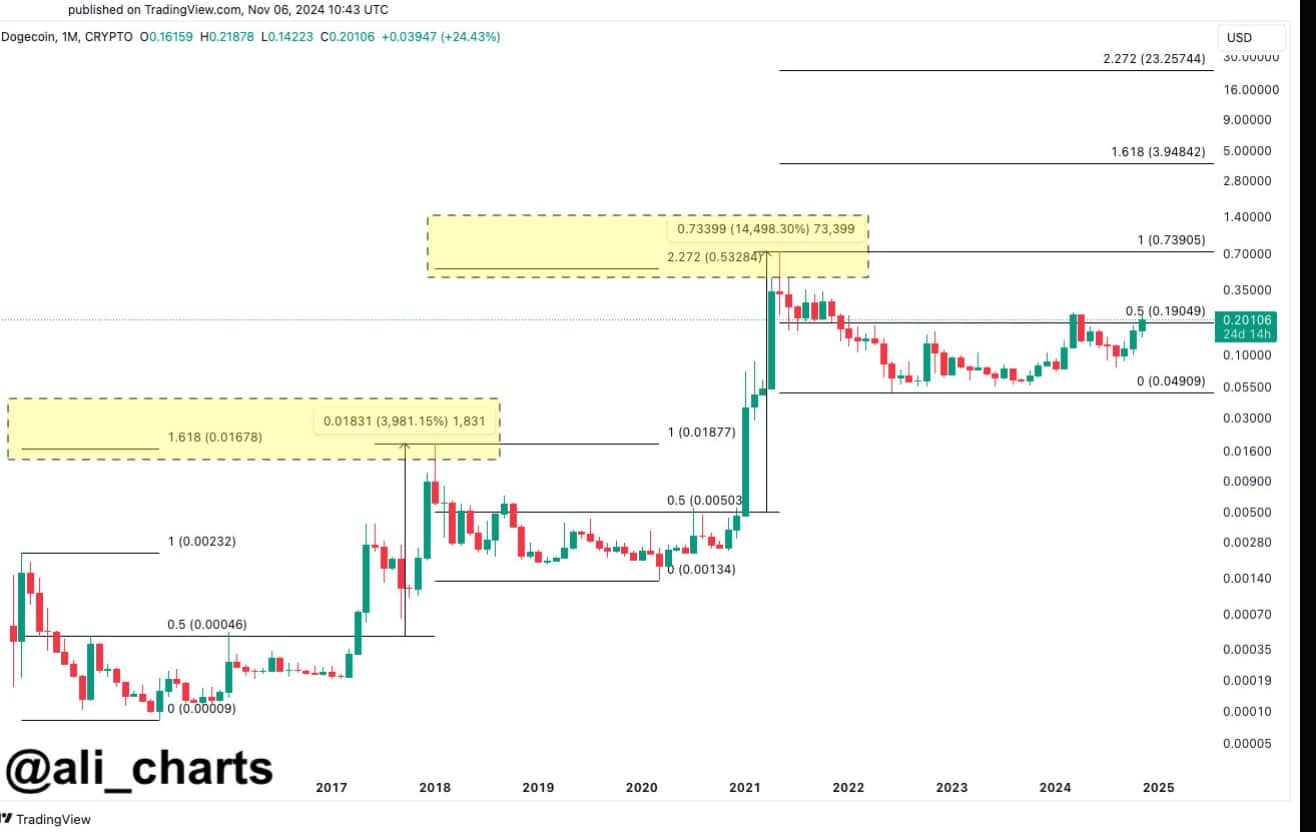

According to the analysis, Dogecoin’s price movements have consistently followed key Fibonacci levels, signaling possible breakout points.

Currently, DOGE appears to be testing the 0.50 Fibonacci retracement level around $0.19, a critical point that often signals the beginning of significant upward moves.

Historical trends show that once DOGE surpasses the 0.50 level, it tends to rally to higher Fibonacci extensions, specifically the 1.618 and 2.272 levels.

If these trends hold, DOGE could be on a path to reach prices between $4 and $23, driven by bullish momentum, community support, and Musk’s influence.

Such a leap would imply a substantial return for investors, though the pathway is not without volatility.

Given the unique factors in play, such as Musk’s influence and the renewed interest in digital assets under Trump’s administration, Dogecoin could witness heightened attention.

Profit-taking and price stability

As Dogecoin’s price surges, a substantial portion of its supply has entered profit territory, highlighted by key metrics such as ‘Total Supply in Profit’ and ‘Percent of Total Supply in Profit,’ as retrieved from Santiment.

This uptick in profitability, now at 94%, suggests that many holders are now sitting on gains, potentially leading to selling pressure as investors take profits.

While this could trigger a short-term pullback or bearish reversal, observing DOGE’s price action in the coming days will be crucial.

If the price holds steady or continues to rise amid high profit-taking, it would indicate strong buying interest from committed investors, signaling bullish resilience.

Conversely, intensified selling could mark the beginning of a bearish correction, advising caution for new buyers seeking a more stable entry point.

Looking further ahead, AI models also project that Dogecoin could be a good investment opportunity for 2025, factoring in sustained market momentum, increased investor interest, and technical indicators.

Musk’s influence, coupled with Trump’s return to the presidency, may keep Dogecoin in focus among speculative assets.

However, it’s essential for investors to consider the speculative nature of these moves and remain cautious as market conditions evolve.

Featured image via Shutterstock

finbold.com

finbold.com