The S&P 500 index (SPY) has soared to new all-time highs, smashing records and rallying past the 5,900 mark for the first time in history.

This remarkable surge came on the heels of the 2024 U.S. presidential election, which saw Donald Trump reclaim the White House in a historical comeback.

Notably, the market’s bullish response reflects investor optimism, with Trump’s pro-business policies and economic focus likely to set the tone for the next four years.

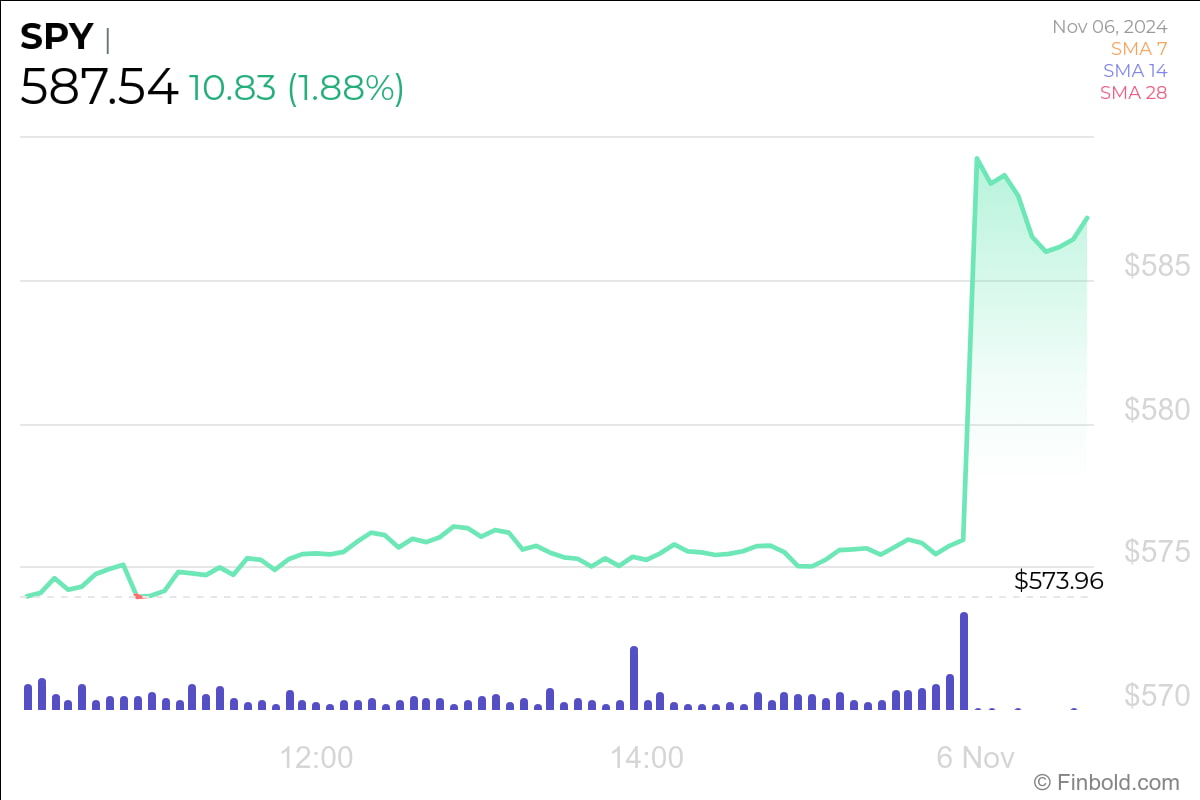

In early trading on Wednesday, November 6, the S&P 500 futures added a staggering $800 billion in market cap. Meanwhile, the U.S. Dollar also hit its highest level since July 2024, signaling a broader bullish sentiment across financial markets.

Trump Presidency market performance history

For context, the S&P 500 had previously thrived during Trump’s first term, exhibiting significant growth with occasional volatility:

- 2017: +19.42%

- 2018: -6.24%

- 2019: +28.88%

- 2020: +16.26%

Trump’s presidency was marked by robust economic policies, tax cuts, and regulatory rollbacks, which contributed to notable market gains. The current rally following his 2024 victory suggests that investors anticipate a similar economic environment, one focused on growth and reduced regulation.

Record-setting opening bell surge

The election results sent shockwaves through Wall Street. At the opening bell, major indexes reflected the market’s enthusiastic reaction, the S&P 500: Rose 82.1 points, or 1.42%, to reach 5,864.89. The Dow Jones Industrial Average: Climbed 628.5 points, or 1.49%, opening at 42,850.4 and the Nasdaq Composite: Gained 333.6 points, or 1.81%, reaching 18,772.76.

With the S&P 500 and Dow Jones scaling new all-time highs, the question arises: how much further could this rally extend by the year-end?

AI prediction year-end outlook for S&P 500

Considering the current trajectory and the market’s optimistic response to the election results, it’s plausible that the S&P 500 could maintain its upward momentum through December. With investor sentiment buoyed and key sectors like technology, financials, and industrials showing strength, the index may push even further into uncharted territory.

Based on AI-driven projections and market trends, the S&P 500 could see further gains before the year is out. Taking into account historical performance under Trump’s previous term and the present market climate, ChatGPT projects that the S&P 500 could potentially close around 6,200 by the end of 2024.

“Given the robust rally and positive market sentiment following Trump’s election win, there is a high probability that the S&P 500 could reach 6,200 by year-end. This projection aligns with historical performance patterns and anticipates continued strength across major sectors in the final months of the year.”

The S&P 500 is riding a historic rally, fueled by renewed investor confidence following Trump’s return to the White House. The index’s recent ascent above 5,900 and the continued strength across major sectors indicate that there may be further upside potential as we head toward year-end.

Wall Street will be closely monitoring Trump’s next moves and the Federal Reserve’s policy signals — both of which could ultimately determine whether this rally has the staying power to redefine the market’s upper limits.

Featured image via Shutterstock

finbold.com

finbold.com