Shiba Inu’s price held steady on Wednesday as most meme coins bounced back, with a golden cross pattern nearing.

Shiba Inu (SHIB), the second-largest meme coin, rose to $0.000020, marking an 82% increase from its lowest level in August.

The main catalyst for this rally was a shift to risk-on sentiment among investors followingDonald Trump’s election victory. This election means that the crypto industry could see more friendly regulations in the next four years.

Additionally, there are signs of a strong uptrend in the number of Shiba Inu tokens being burned. Data from Shibburn shows that the burn rate surged by 3,674% to 53,312 tokens on Nov. 6.

This increase brings the total SHIB tokens burned to over 410 trillion from the initial supply, reducing the circulating supply to 583 trillion coins. Token burns typically support a token’s value by limiting supply.

The increase in SHIB burns occurred even as transactions and fees in Shibarium declined. According to ShibariumScan, the average transaction fee dropped to 0.00002 BONE, while total fees fell to 32 BONE. Some BONE collected in Shibarium is converted to SHIB and burned.

Meanwhile, SHIB’s futures open interest rose to $51.1 million, its highest level since Oct. 30, indicating growing demand.

Shiba Inu price has strong technicals

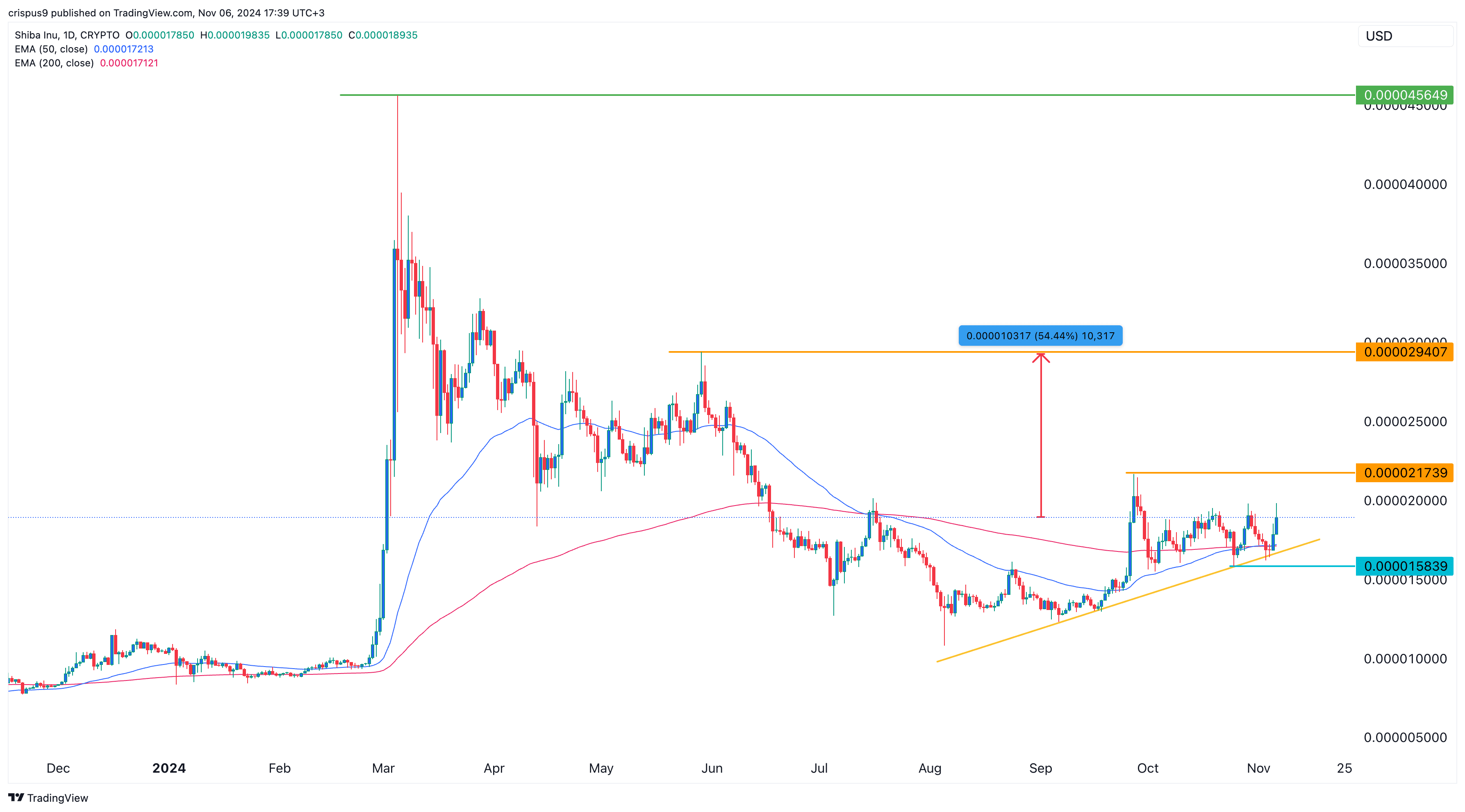

Technical indicators suggest that SHIB’s price may have further upside potential. It remains above an ascending trendline connecting the lowest swings since Sep. 5.

Most notably, it is nearing a golden cross pattern as the 50-day and 200-day Exponential Moving Averages approach a crossover. In most cases, cryptocurrencies rally after forming this pattern.

For instance, Shiba Inu formed a golden cross in October last year, leading to a rally that reached a year-to-date high of $0.000045.

SHIB only needs to break the key resistance level at $0.000021, its high on Sept. 27. A successful move could pave the way for a rise to the resistance level at $0.00002940, its high in May, representing a potential 54% gain from the current level.

On the downside, a drop below the support level at $0.000015 would invalidate the bullish outlook, signaling increased selling pressure.