It can be tough to determine a project’s true value in the ever-shifting crypto market. While technical analysis works well for traders, fundamental analysis in crypto goes deeper, helping you understand a project’s strengths and weaknesses. This approach allows for more strategic, informed decisions that can beat or contextualize temporary market trends. This guide covers everything you need to know about fundamental analysis in crypto in 2024.

- What is fundamental analysis?

- What are the key metrics for fundamental analysis?

- How to analyze a crypto project using fundamental analysis

- What are the best fundamental analysis tools?

- Pros and cons of fundamental analysis in crypto

- When look beyond fundamental analysis?

- Frequently asked questions

What is fundamental analysis?

Fundamental analysis (FA) in crypto is a method of evaluating the intrinsic value of a cryptocurrency by examining its core aspects, such as on-chain metrics, project development, and market position.

In crypto, fundamental analysis examines unique aspects like blockchain technology, the project’s goals, the team behind it, and the activity on its network.

By focusing on these core elements, investors can better understand a cryptocurrency’s value based on its foundation rather than just market price movements.

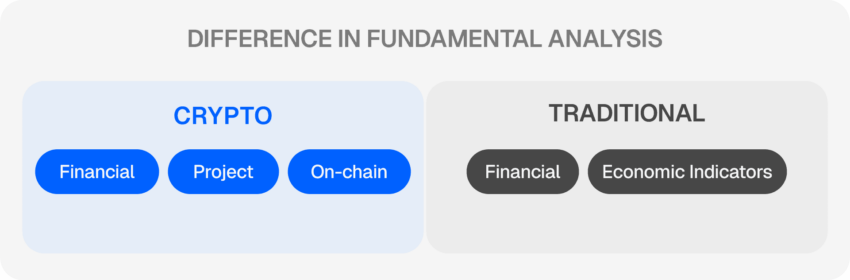

For traditional assets, fundamental analysis uses financial statements and revenue reports. In crypto, however, it focuses on on-chain metrics such as transaction volumes and tokenomics (the supply, distribution, and management of tokens).

Since cryptocurrencies are decentralized, analyzing network activity, community engagement, and developer involvement provides a meaningful look at an asset’s potential.

What are the key metrics for fundamental analysis?

In crypto fundamental analysis, key metrics help investors evaluate the value and potential of an asset. Unlike technical analysis, which is price-specific, the fundamental metrics look at the actual structure and activity of a project. Here’s a breakdown of some key metrics.

On-chain metrics

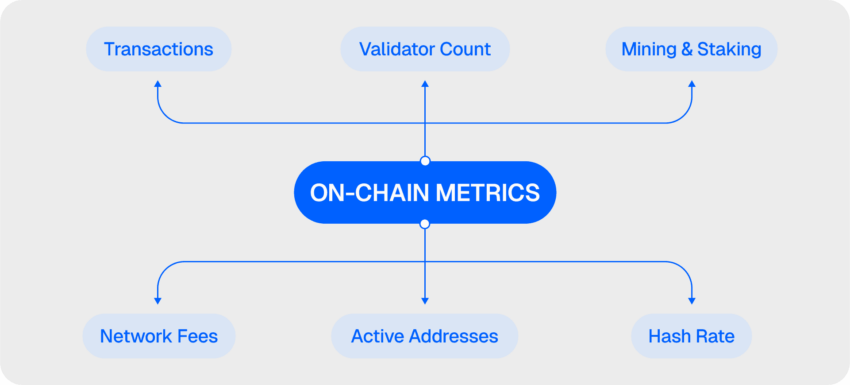

On-chain metrics focus on data from the blockchain itself, giving insights into network usage and user activity. Key on-chain metrics include:

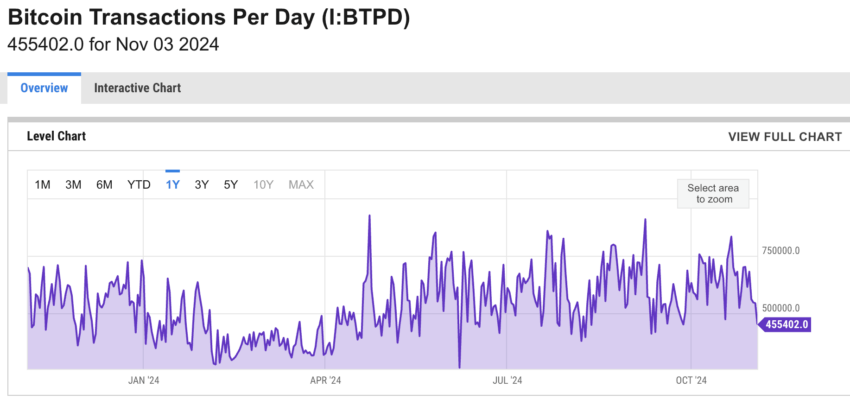

- Transaction volume: High transaction volume, indicating active use of the network, is like foot traffic in a popular store — more traffic suggests greater adoption and utility.

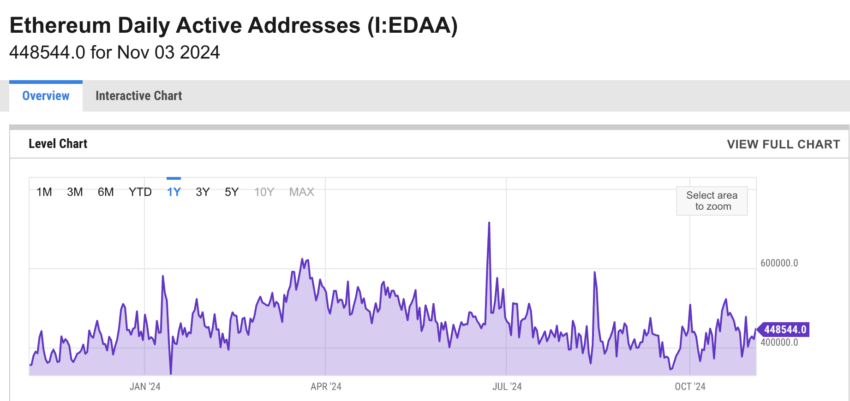

- Active addresses: The number of unique active addresses points to the network’s user base. Think of it as the number of unique clients a business serves, reflecting adoption.

- Hash rate and staking data: In proof-of-work networks, a high hash rate demonstrates strong network security. Similarly, with proof-of-stake networks, high staking participation reflects user commitment.

- Token velocity: This measures how frequently tokens are used within the network. Higher velocity may suggest more circulation and utility, while low velocity could imply tokens are being held, indicating potential for long-term value.

Project metrics

Project metrics evaluate a project’s activity, growth, and community strength, which are critical for its long-term outlook.

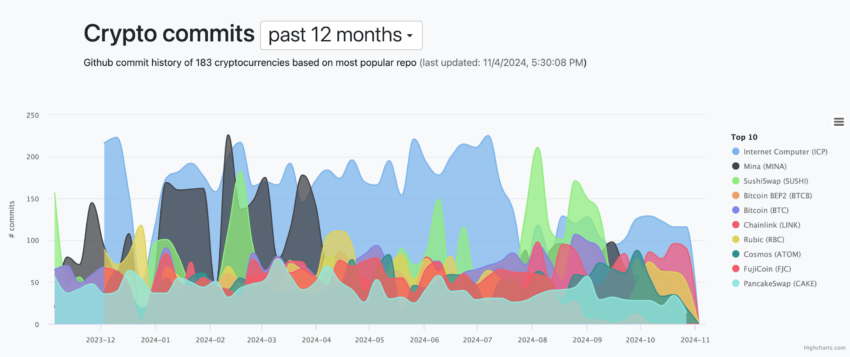

- Development activity: Regular code updates and GitHub commits suggest active development, which could signal a committed team. A project with ongoing improvements is more likely to adapt and remain relevant.

- Community engagement: A strong, engaged community can be a key asset for a crypto project. In traditional terms, it’s like brand loyalty — projects with a dedicated following often have better support and resilience.

- Partnerships and alliances: Collaborations with reputable organizations or other blockchain projects can bolster a project’s credibility and broaden its potential reach. These partnerships are often seen as a sign of validation within the industry.

Financial metrics

Financial metrics assess the market aspects of a cryptocurrency, giving a view of its size, liquidity, and trading behavior.

- Market capitalization: The market cap represents the network’s size but doesn’t equate to revenue as in traditional markets. It’s simply the circulating supply multiplied by the token price.

- Liquidity and trading volume: High liquidity and trading volume mean an asset can be bought or sold with minimal price impact, reducing volatility and vulnerability to market manipulation.

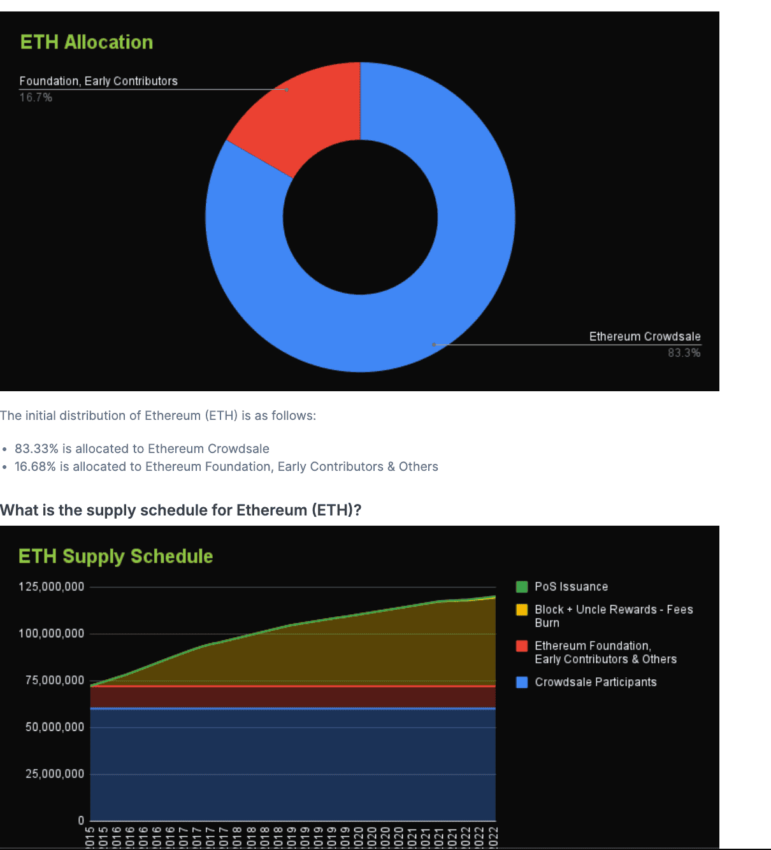

- Supply metrics: Supply metrics, such as circulating, total, and maximum supply, can impact a token’s scarcity and value. Cryptocurrencies with limited maximum supply, like Bitcoin, can be compared to assets like gold, where scarcity may drive value over time.

How to analyze a crypto project using fundamental analysis

Evaluating a cryptocurrency project requires taking structured approach to understand its strengths, weaknesses, and potential for long-term success. Here’s what to look for.

Whitepaper analysis

A project’s whitepaper provides an in-depth look at the project’s objectives and the problem it aims to solve. By understanding its goals and technological foundation, investors can assess if the project addresses a real need and has a viable long-term vision.

Community and ecosystem

A strong, engaged community is essential for a project’s longevity. Communities can provide valuable feedback, promote awareness, and contribute to a project’s adoption. Projects with active, supportive communities often show greater resilience and adaptability.

Social media and forum engagement

Analyzing social media channels and forums can reveal community sentiment and interest. Platforms like Reddit, X, and Discord are excellent resources to gauge ongoing community discussions, enthusiasm, and involvement.

Development activity (code repositories and updates)

Development activity is a strong indicator of a project’s progress and potential. Checking GitHub or similar repositories helps investors track updates, bug fixes, and new features, which can reveal the level of commitment from the development team.

Team and partnerships

The team’s experience and track record can significantly impact a project’s success. Understanding the team’s expertise, past achievements, and involvement in other successful projects adds credibility and reliability.

Partnerships with reputable organizations can enhance a project’s adoption and network effects. A project that collaborates with known institutions or tech companies might have a stronger foundation and credibility in the market.

Market capitalization and liquidity

Market cap and liquidity provide insights into a project’s market position and ease of trading. High market cap and trading volume suggest stability, while low liquidity can indicate higher risk and susceptibility to price manipulation.

Tokenomics

Tokenomics focuses on the supply structure, issuance model, and distribution. Projects with well-defined tokenomics — such as limited supply and staking mechanisms — may offer the potential for value appreciation and sustained ecosystem engagement.

Analyzing an actual crypto project using fundamental analysis

As an example, consider a step-by-step analysis of Cardano (ADA) using FA principles:

- Whitepaper analysis: Cardano’s whitepaper outlines its goal of creating a scalable, secure, and sustainable platform for smart contracts, backed by academic research.

- Community and ecosystem: Cardano has an active community on social media and forums, with substantial support and engagement on platforms like Reddit and Twitter.

- Development activity: Cardano’s GitHub repository shows consistent updates and active development, signaling a dedicated team focused on long-term growth.

- Team and partnerships: Founded by Charles Hoskinson, a co-founder of Ethereum, Cardano brings extensive industry experience. The project has partnerships with educational institutions to drive blockchain research.

- Financial metrics: With a significant market cap and trading volume, Cardano holds a solid position in the market. Its maximum supply of 45 billion ADA and staking options encourage network security and engagement.

Overall, the fundamentals of Cardano look solid, with no red flags across any of the key parameters.

What are the best fundamental analysis tools?

While several tools and platforms exist, the top picks relate to the following categories:

Popular crypto data aggregators

Crypto data aggregators like CoinGecko and CoinMarketCap offer a wide range of metrics, including price, market cap, trading volume, and supply information. These platforms are useful for quickly assessing a project’s market position and liquidity, which are essential for informed decision-making.

Specialized tools for on-chain data

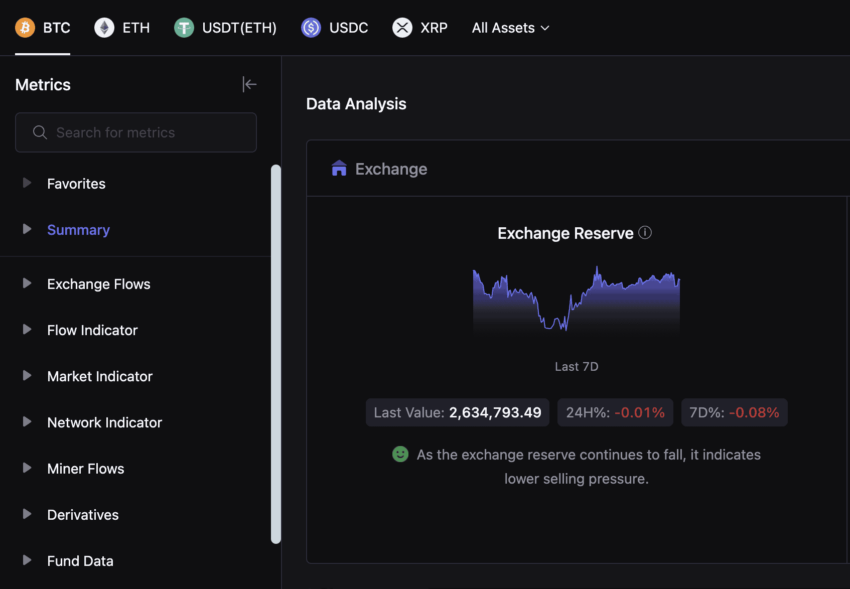

For deeper insights into on-chain metrics, tools like Glassnode, Dune, and CryptoQuant allow investors to examine blockchain data such as transaction volume, active addresses, and token flow.

These metrics help assess network usage, security, and the overall activity level, which can indicate a project’s user engagement and adoption.

Development and GitHub tracking platforms

Tools like CryptoMiso and GitHub itself are valuable for tracking a project’s development activity. These platforms allow users to see how often code is updated, the number of commits, and the contributions from developers. High activity suggests a committed development team, while low activity might raise concerns about a project’s progress.

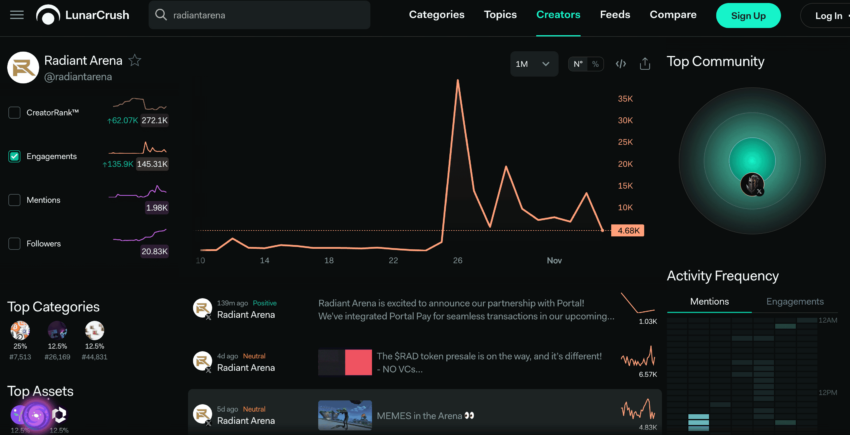

Community engagement and sentiment analysis tools

Platforms like LunarCrush provide data on social engagement by analyzing mentions, trends, and overall sentiment on social media channels like Twitter and Reddit.

High community engagement is often a positive sign, reflecting trust and interest among users. By tracking sentiment and activity, investors can gain insights into a project’s popularity and potential resilience.

Pros and cons of fundamental analysis in crypto

Fundamental analysis offers unique insights into the value of a cryptocurrency, but it also has its limitations due to the volatile nature of the market. Here is a table to make sense of the benefits and drawbacks of the tool.

| Advantages | Limitations |

| Long-term insights: Fundamental analysis focuses on a project’s core strengths, providing a clearer view of its potential for growth and stability over time. | Market volatility: The fast-paced crypto market can make long-term analysis challenging, as prices can be driven by hype or sudden trends. |

| Informed decision-making: By examining factors like on-chain metrics, development activity, and community support, investors can make decisions based on a project’s actual value, not just price movement. | Data interpretation: The decentralized nature of crypto means reliable data can be harder to find, and analyzing on-chain metrics may require specialized knowledge. |

| Reduced speculation: Fundamental analysis reduces the reliance on speculation by focusing on tangible project metrics and development efforts. | Time-intensive: Analyzing multiple metrics and project details can be time-consuming compared to technical analysis, which is often quicker to perform. |

| Identifying undervalued assets: Fundamental analysis can help investors spot promising projects that may be undervalued by the market, offering potential for long-term gains. | Limited historical data: Crypto projects, especially new ones, may lack sufficient historical data, making it harder to analyze long-term viability. |

When look beyond fundamental analysis?

While fundamental analysis in crypto is invaluable for understanding a project’s core value, as outlined in this guide, it may not capture sudden market shifts or trends driven by hype. For short-term trades or highly speculative assets, combining fundamental analysis with technical analysis can offer a more balanced view, helping you determine both intrinsic value and market momentum. However, fundamental analysis itself can be a crucial tool in keeping safe when interacting with crypto. Poor fundamentals can be a key indicator that a project is a scam and should not be overlooked.

beincrypto.com

beincrypto.com