The TROY token has gone parabolic, soaring over the past eight consecutive days and reaching its highest level since July 2023.

Troy (TROY), a cryptocurrency at the intersection of artificial intelligence and gaming, rose to $0.0042, marking a 342% increase from its lowest level in October. This rally has boosted its market cap to over $41 million.

TROY’s surge followed listings on Bitget and Binance, two of the top crypto exchanges, which added TROY futures to their platforms.

These listings helped push open interest in TROY futures to a record high of $57 million, with most of it concentrated on Binance, Bitget, and BingX. This open interest is significantly higher than last week’s low of $3.5 million. Cryptocurrency prices often see jumps following listings on major exchanges.

TROY also gained momentum after receiving a strategic investment from Unicorn Verse, a company with investments in other cryptocurrencies like LeverFi, Simon’s Cat, Ponke, and CoralApp.

🎉 Troy AI is thrilled to announce that we've received a strategic liquidity investment from @Unicornverse_io! pic.twitter.com/xxJJQwQozB

— TROY AI(The Pure Joy of AI) (@TROY_DAO) October 28, 2024

According to its white paper, TROY is a blockchain network that operates TROY Play, a marketplace for AI agents accessible through TROY ID. This platform allows users to import agents from networks like AgentLayer’s AgentStudio and other third-party applications.

The network also includes TROY DAO and TROY Trade. TROY DAO is a membership platform granting holders privileges such as early access to AI agents, while TROY Trade supports the growth of AI projects within the network. As part of its expansion, developers have announced a $10 million ecosystem fund.

A key risk for TROY investors is that the number of holding addresses has dropped from 2,197 on Sunday to 2,160. Additionally, the top ten holders own 98% of all tokens, meaning that the price could be significantly impacted if they decide to sell.

TROY token gets overbought

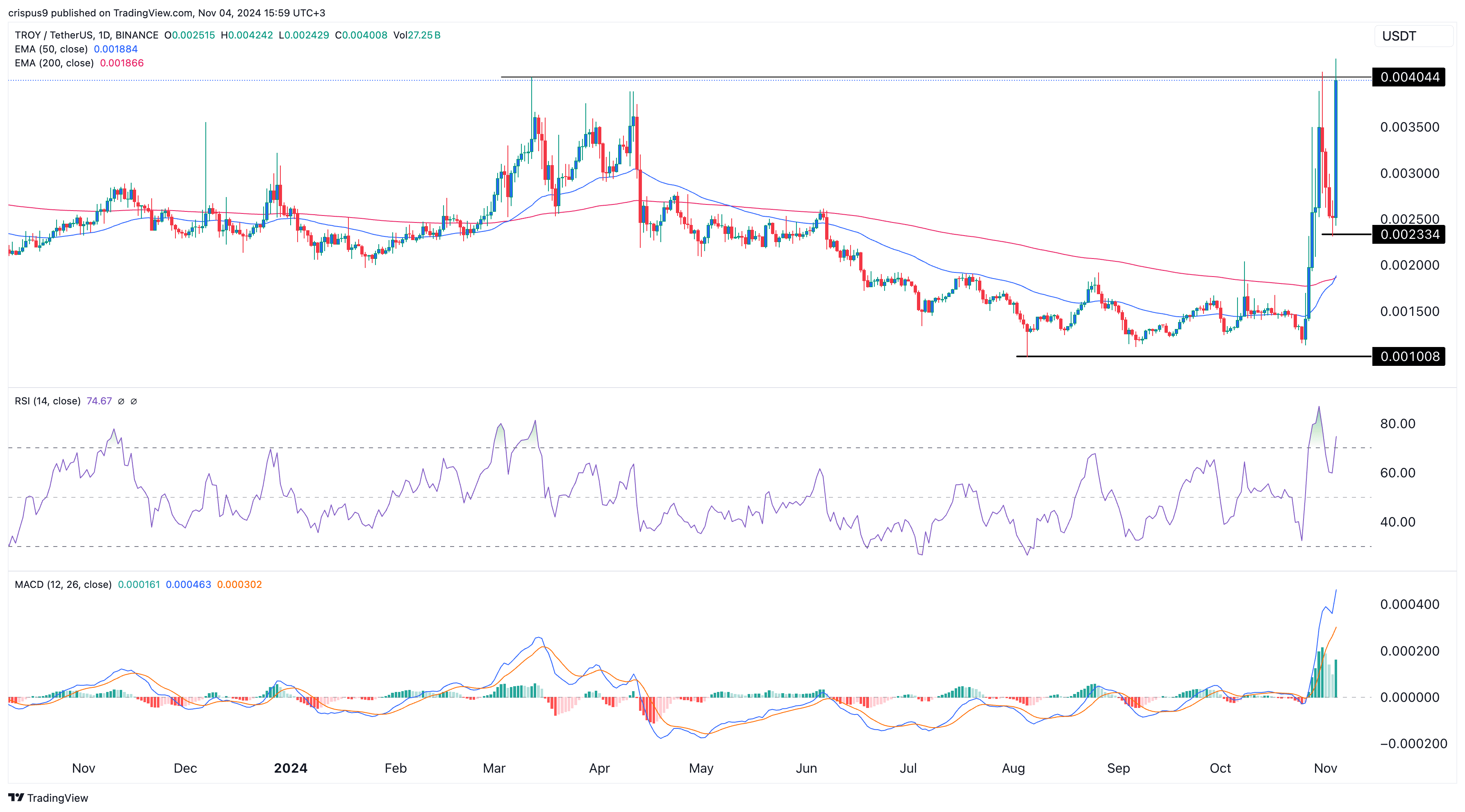

The daily chart shows that the TROY token bottomed at $0.00097, its lowest point since Aug. 8, and has since surged by triple digits. It has formed a golden cross pattern as the 200-day and 50-day moving averages crossed.

The MACD indicator has continued to rise, with the two lines reaching their highest point in months. The Relative Strength Index has surged to an overbought level of 74.57.

Therefore, the token may pull back in the coming days as the upward momentum fades. If this happens, the next support level to watch will be $0.0023, its lowest point on Sunday, Nov. 3. Further gains will be confirmed if the price surpasses this week’s high of $0.0042.