-

Uniswap achieves a significant milestone of $2 trillion in cumulative trading volume, yet the future of its governance token, $UNI, remains uncertain amid bearish market pressures.

-

The growing traction in decentralized finance (DeFi) raises questions about whether this achievement can significantly alter $UNI’s ongoing downtrend.

-

As noted by cryptocurrency analyst John Doe, “Despite the impressive volume figure, the market’s reaction to $UNI indicates underlying concerns that cannot be overlooked.”

Uniswap’s $2 trillion trading volume underscores its DeFi influence, but $UNI’s price struggles reveal the ongoing complexities facing the token.

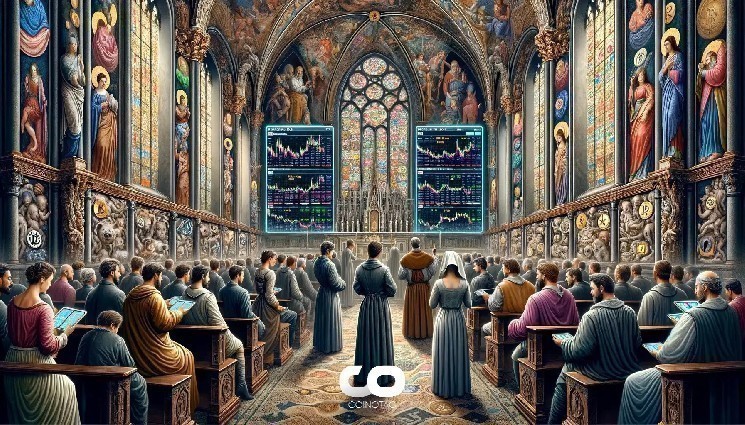

Key support and resistance levels for $UNI’s price trajectory

The current price action for $UNI reveals vital support and resistance levels that traders must monitor closely. The primary support zone stands at approximately $6.39, a critical boundary that if breached, could trigger further selling pressure.

On the flip side, initial resistance at $8.31 represents a key hurdle that $UNI must overcome to demonstrate potential bullish momentum. Should it manage to break this level, a more ambitious target could be set at $11.67, potentially heralding a stronger market recovery.

Investors should pay attention to these levels as they provide crucial insight into $UNI’s price dynamics and potential trend changes.

$UNI price chart analysis" src="https://cnews24.ru/uploads/252/252d469c26327623bf8177924fe1ca35b6600350.png" size="1772x1107">