The market experienced a rollercoaster ride, with the global crypto market cap rising from $2.33 trillion to a three-month peak of $2.5 trillion by mid-week before settling at $2.38 trillion at the end of the week.

Bitcoin ($BTC) triggered the uptrend, having surged to retest the March 2024 all-time high above $73,000 before facing a major correction.

Here are some of the prominent crypto assets to pay attention to this week following their noteworthy price action:

$BTC retests $ATH

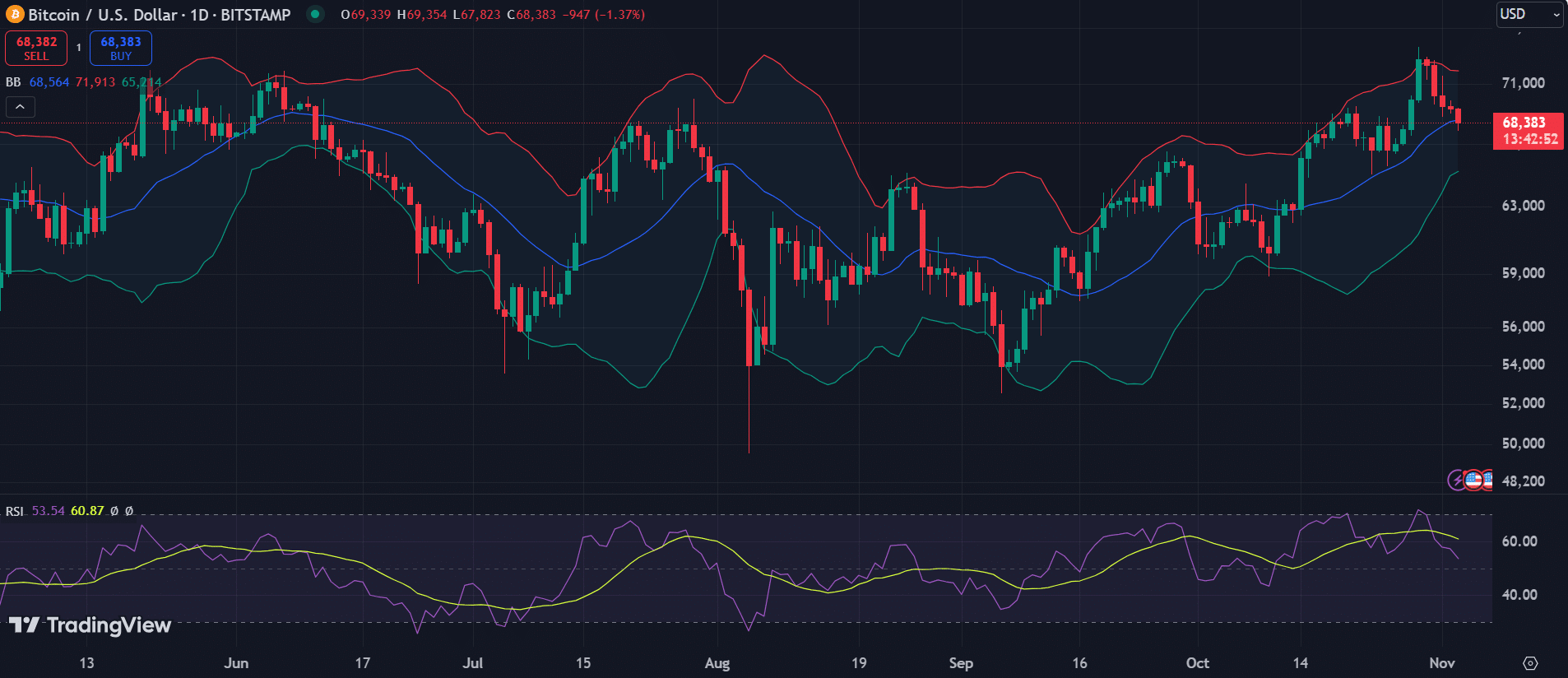

Bitcoin’s start to the week coincided with a bullish momentum that began on Oct. 26. By Monday, the asset had recorded three consecutive intraday gains, knocking at the $70,000 region.

$BTC, $EIGEN, $KAS: Top cryptocurrencies to watch this week - 1">

$BTC, $EIGEN, $KAS: Top cryptocurrencies to watch this week - 1"> The impressive uptrend spilled into Oct. 29, as Bitcoin first overcame the $71,000 resistance and pushed further to breach the elusive $73,000 level, reaching a seven-month peak. This allowed the leading cryptocurrency to retest its March $ATH.

However, this surge preceded a massive correction. Consequently, Bitcoin’s price action went downhill in the four days that followed, with the 20-day MA at $68,564 now acting as an immediate defense against further downside risk.

If the 20-day MA support gives way, $BTC would need to hold above the lower Bollinger Band at $65,214 amid the upcoming US presidential election this week. However, a recovery above $71,913 could grant the bulls renewed strength to again reach the $ATH.

$EIGEN slides 17%

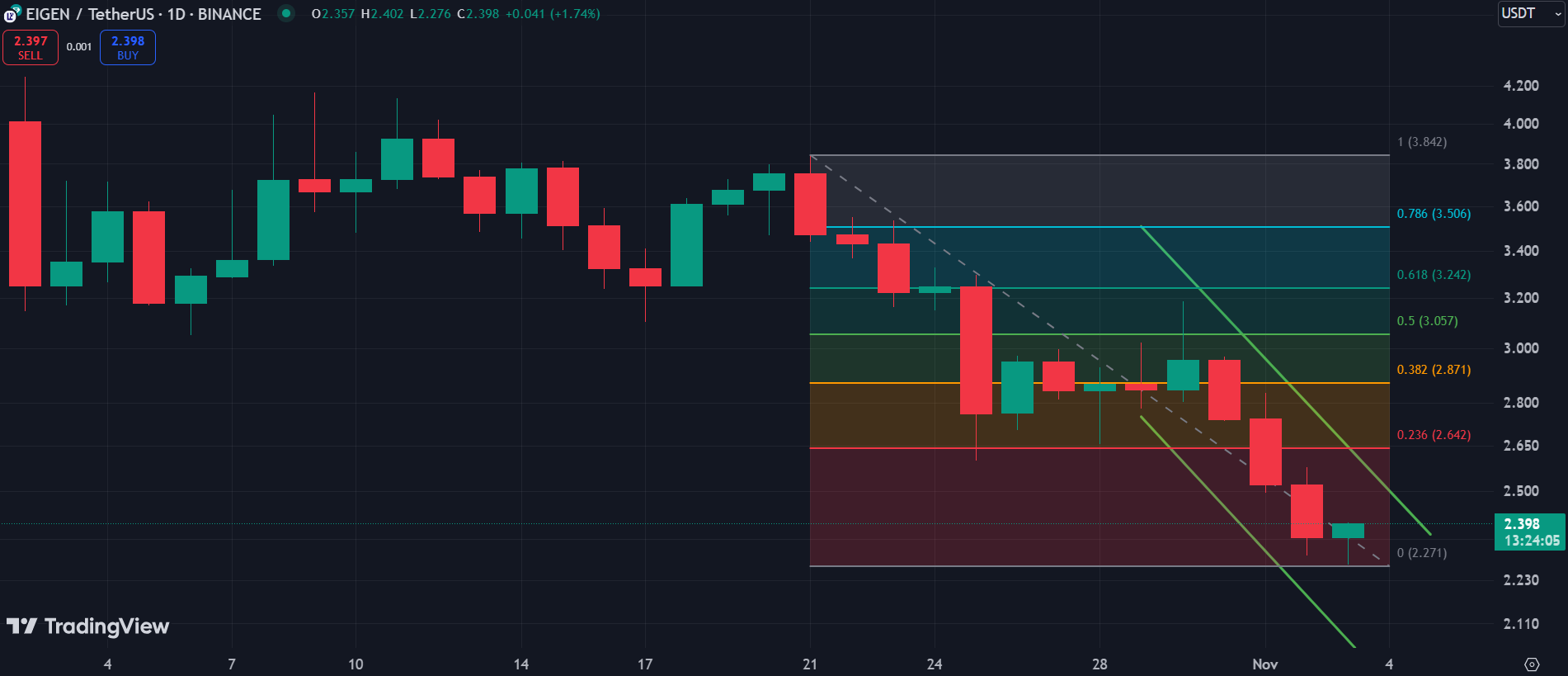

Despite the broader market seeing mild gains last week, EigenLayer ($EIGEN), the native token of the Ethereum restaking protocol of the same name, closed the week with a massive 17% drop after an initial rise.

$EIGEN has been struggling to reclaim its peak above $4 since the Oct. 1 debut. The asset had rallied to a high of $4.90 on Binance before correcting. It has since continued to consolidate, with last week introducing more bearish pressure.

As Bitcoin retraced mid-week, $EIGEN faced massive declines over three days, forming a downward channel. To overcome this trend, EigenLayer must close above the 23.6% Fibonacci retracement level at $2.642 this week.

$KAS faces uncertainty

Last week, Kaspa ($KAS) charted its course amid market uncertainties, diverging from broader market trends. Although it saw gains toward the end of the week, $KAS ultimately closed with a 4.4% decline.

The token experienced fluctuations throughout the week but remained below the pivot level of $0.2592, confirming the prevailing bearish momentum, as the -DI at 31.1 largely exceeds the +DI at 13.3.

For $KAS to shift momentum this week, it must break through this pivot level and recover the late October high of $0.1311.

Surpassing this level would introduce the first major resistance at $0.1492. Kaspa could use this zone as a springboard to reclaim the psychological levels of $0.15 and $0.16, with a second key hurdle at $0.1636.