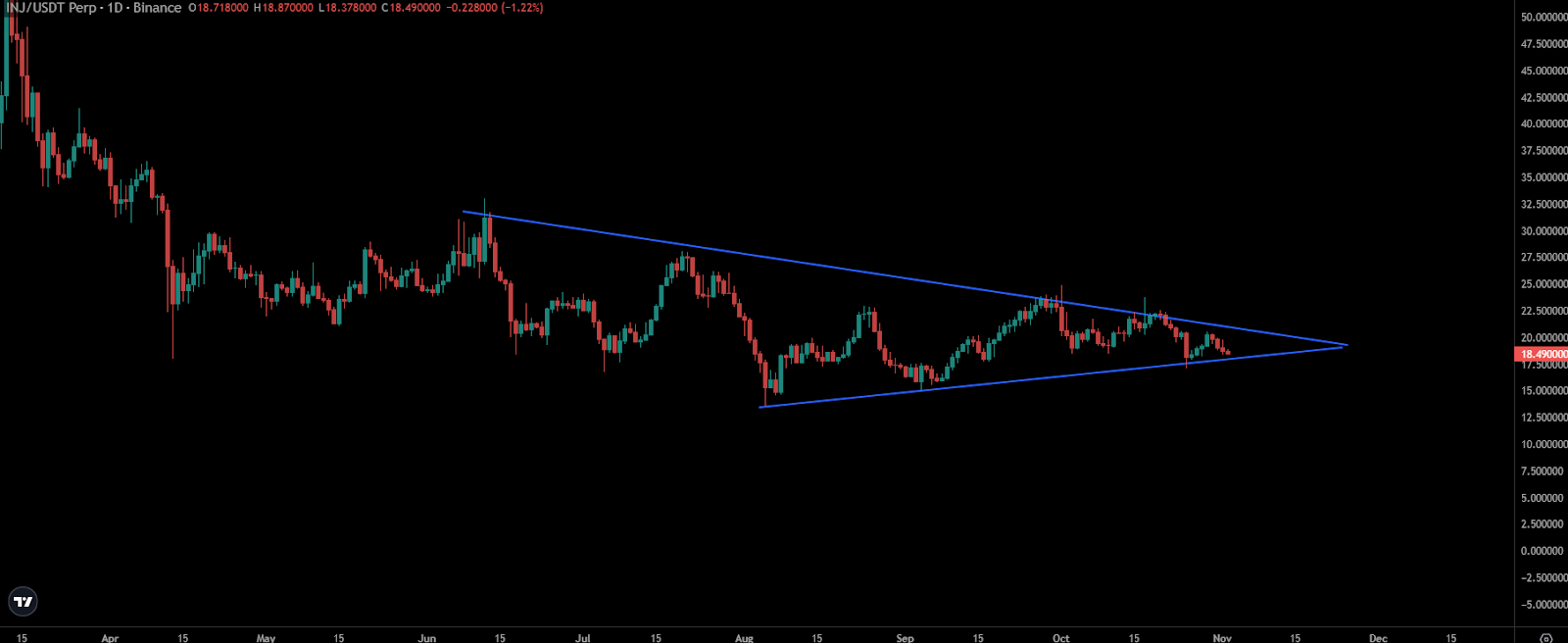

Injective, the DeFi-centric protocol, has recently been rejected from the 200-day EMA cluster and resembles bearishness. The chances of a successful breakout are bleak. The INJ price has moved below the key EMAs, guiding selling pressure throughout the week.

It stagnated in a significant range and could not climb above the $23 mark amid multiple attempts. However, the bulls are challenged to secure the rising trendline support around the $17 mark. They are aiming for a bounceback.

While a selloff is on the cards, the INJ price might stop near the $17 support. It may be destined for consolidation ahead. The token has witnessed considerable bearishness and dragged over 20% in the last two weeks.

Analysts’ View on INJ Price

In a recent tweet on X, Crypto Tony said that the Injective token price has traded close to the demand zone. A reversal candle would also confirm the bounce toward the $22 mark. One should watch it closely for a good entry to chase the long trade.

$INJ / $USD – Update

— Crypto Tony (@CryptoTony__) November 1, 2024

Waiting for that reversal candle to give me a good entry confirmation pic.twitter.com/YbHaruEQ7o

Additionally, AltcoinView highlighted that the Injective token was trading inside a falling channel. However, it still looked strong.

$INJ still playing around in the daily downtrend channel. However it does respect the levels at the BC correction box.

— AltcoinView (@AltcoinView) November 1, 2024

For now we want a breakout above $19 so we can see if we can close above $20.41.

If we do so, a breakout out of the downtrend channel is necessary to target… pic.twitter.com/a4QEEndPfN

A daily close above the $19 mark would permit the bulls to retest the $22. It would be followed by the $23.29 mark for a significant breakout attempt.

The token displayed less price movement over the past few sessions because of the sideways movement.

INJ Price Prediction: Sideways is the Way

INJ price prediction on a daily chart implied that INJ may continue to hover in a sideways consolidation phase ahead. The token may cross the $23 mark on the upside or the $17 mark on the lower side. Until then, a range-bound movement will persist.

Also, the price action signified that the sell-on-rise pattern was intact The buyers could not generate enough traction to sustain above the 50-day EMA mark. This conveyed a lack of investor buying interest.

The injective price was trading at $18.47, noting an intraday decline of over 2.30%. It ranked 46th among the top 100 cryptos, boasting a market cap of $1.83 Billion.

The token has a total supply of 100 million. It has noted a decline of over 30.20% in the trading volume over the past 24 hours.

Despite the price consolidation, the Injective token has generated enough bullish sentiment. This bullish sentiment could propel it toward a potential breakout in the coming days.

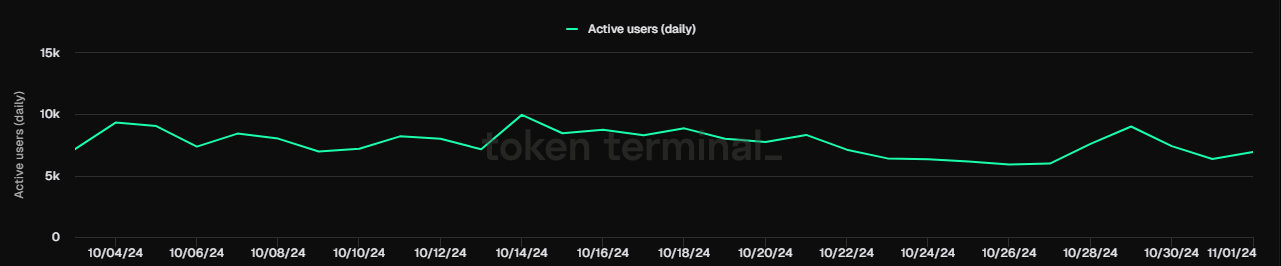

Active Users Data Noted a Surge

Injective’s token daily active users data noted a significant surge. It increased from 6.4k to 6.9k this week. This highlighted the market participants’ positive outlook.

However, the token’s Total Value Locked (TVL) data noted a significant range-bound move. It was around $49.58 Million at press time.

The Futures market data resembled a neutral cue. Also, indecisiveness was observed. The Open Interest (OI) has dropped over 1.20% to $101.14 Million, signifying a long unwinding move over the past 24 hours.

The immediate support zones for INJ were $16.80 and $15.50. At the same time, the upside hurdles were $19.70 and $21.20.

thecoinrepublic.com

thecoinrepublic.com