-

BlackRock’s IBIT led Bitcoin ETFs with a significant $872.04 million daily inflow.

-

Grayscale’s GBTC saw no inflow, facing a $20.13 billion cumulative outflow, but maintains high trading volume and asset value.

-

Franklin’s EZBC and WisdomTree’s BTCW ETFs recorded stable performance without inflows, with moderate BTC shares and solid net asset values.

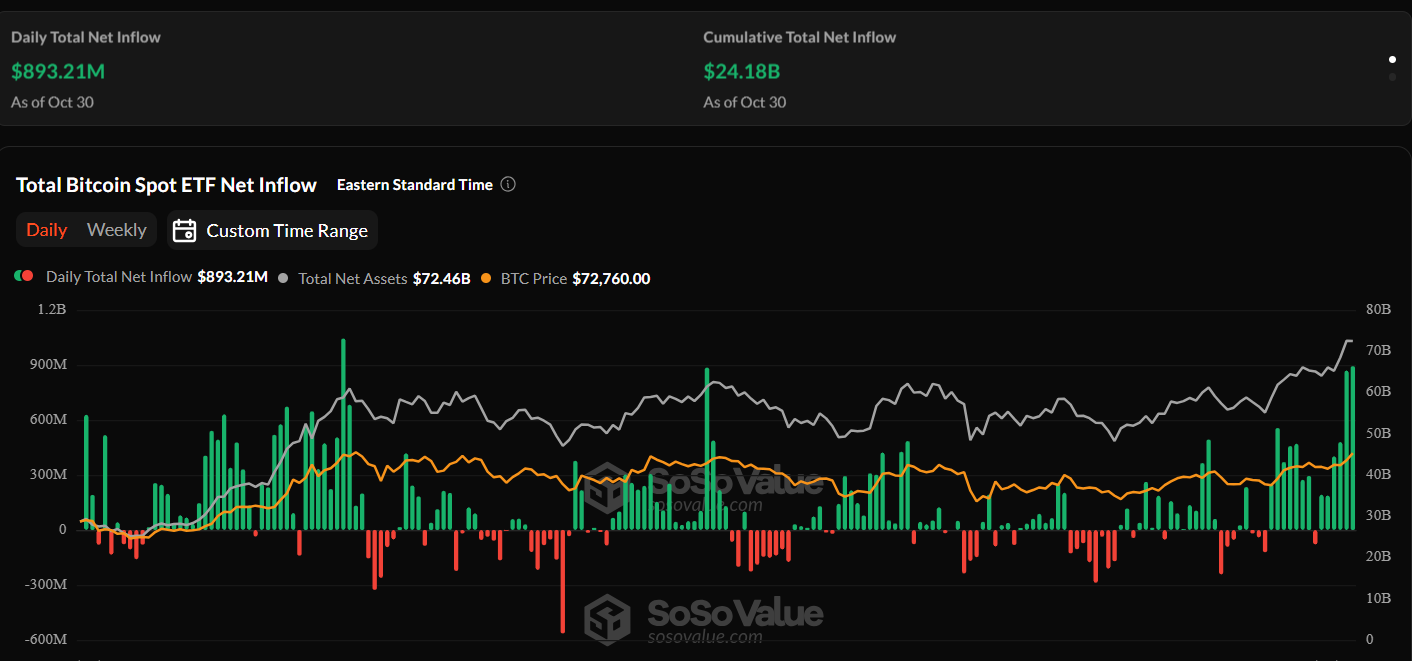

In a recent market update by SoSoValue, the cryptocurrency exchange-traded funds (ETFs) as of October 30 have shown varied market movements in inflows, net assets, and other metrics. The data has indicated the performance and asset management of each ETF, showing trends in net inflows, market price, daily changes, and traded volumes.

According to SoSoValue, Cumulative net inflows currently amount to $24.18 billion, with total net assets reaching $72.46 billion, equivalent to 5.03% of Bitcoin’s market cap as Bitcoin’s price traded at $72,760.

Source: SoSoValue

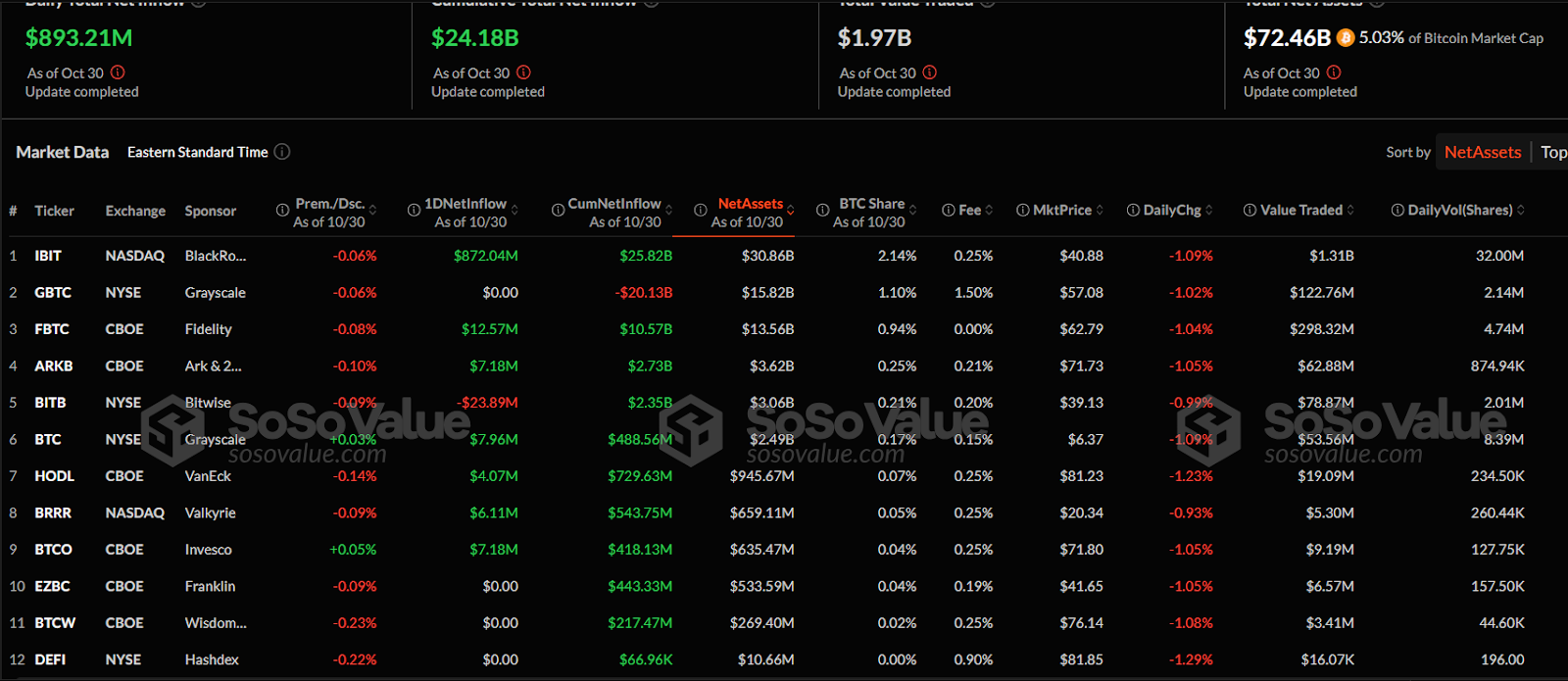

Sorted by net assets, different ETFs ranked, providing an overview of market movements as of October 30, with the total daily net inflows amounting to $893.21 million.

Source: SoSoValue

BlackRock Leads with $872M Inflows, and Grayscale GBTC Sees Outflows as Fidelity Gains

In detailed insights, BlackRock’s IBIT, listed on NASDAQ, recorded a discount of 0.06% as of October 30, indicating slight undervaluation. It experienced a daily net inflow of $872.04 million, the highest among listed ETFs.

Additionally, cumulative net inflows for IBIT reads $25.82 billion, with total net assets valued at $30.86 billion. IBIT’s market price was $40.88, and it saw a daily price decline of 1.09%, suggesting bearish sentiment. The traded volume reached $1.31 billion, with a share volume of 32 million shares.

Grayscale’s GBTC on the NYSE, another known ETF, noted a discount of 0.06%. GBTC had no net inflow for October 30 but accumulated a net outflow of $20.13 billion. Despite this, GBTC currently holds net assets valued at $15.82 billion and has a BTC share of 1.10%. Its market price settled at $57.08 with a daily change of −1.02%. The total value traded for GBTC was $122.76 million, with a share volume of 2.14 million.

Fidelity’s FBTC on CBOE recorded a discount of 0.08% and daily net inflows of $12.57 million. Its cumulative net inflows reached $10.57 billion, and total net assets stood at $13.56 billion. With a BTC share of 0.94%, FBTC’s market price was $62.79, dropping by 1.04% on October 30. The value traded for FBTC amounted to $298.32 million, with a share volume of 4.74 million shares.

Ark Invest’s ARKB, also listed on CBOE, saw a discount of 0.10% and net inflows of $7.18 million on October 30. Its cumulative net inflows totaled $2.73 billion, and its net assets were valued at $3.62 billion. ARKB held a BTC share of 0.25% and had a market price of $71.73, which declined by 1.05% during the day. The trading volume reached $62.88 million, with approximately 874,940 shares exchanged.

Bitwise Outflows $23.89M, Grayscale BTC, VanEck, Valkyrie, Invesco See Inflows

Bitwise’s BITB on the NYSE posted a 0.09% discount and experienced a daily net outflow of $23.89 million, marking a capital movement. BITB’s cumulative net inflows stand at $2.35 billion, while net assets totaling $3.06 billion. This product has a BTC share of 0.21% with a market price of $39.13, reflecting a daily decrease of 0.99%. The daily traded volume reached $78.87 million with 2.01 million shares.

Grayscale’s BTC ETF recorded a premium discount of 0.03%, achieving daily net inflows of $7.96 million. Cumulative net inflows amounted to $488.56 million, with a total net asset value of $2.49 billion. It held a BTC share of 0.17% and traded at $53.56, experiencing a 1.09% daily drop. The trading volume for BTC reached $53.56 million with a share volume of 8.39 million shares.

VanEck’s HODL, traded on CBOE, showed a discount of 0.14% with daily net inflows of $4.07 million. Its cumulative net inflows totaled $729.63 million, and net assets were valued at $945.67 million. HODL’s BTC share is relatively low at 0.07%, with a market price of $81.23, which dropped by 1.23% for the day. The total traded value for HODL stood at $19.09 million, with a share volume of 234,500 shares.

Valkyrie’s BRRR on NASDAQ showed a discount of 0.09% and daily net inflows of $6.11 million. The cumulative net inflow reached $543.75 million, and its net assets were valued at $659.11 million. BRRR had a BTC share of 0.05% with a market price of $20.34, reflecting a 0.93% decrease. The daily trading volume was $5.30 million, with a share volume of 260,440 shares.

Invesco’s BTCO, listed on CBOE, registered a premium of 0.05% and daily net inflows of $7.18 million. Its cumulative net inflow was $418.13 million, with total net assets amounting to $635.47 million. BTCO has a BTC share of 0.04% and a market price of $71.80, which fell by 1.05%. The trading volume reached $9.19 million, with 127,750 shares exchanged.

Franklin, WisdomTree, Hashdex Stable with No Flows

Franklin’s EZBC on CBOE showed no discount or premium and no net inflows for the day. Cumulative net inflows for EZBC reached $443.33 million, while its net assets totaled $533.59 million. EZBC holds a BTC share of 0.04%, with a market price of $39.34, experiencing a 0.08% daily decline. The trading volume amounted to $6.57 million, with a share volume of 157,500 shares.

WisdomTree’s BTCW on CBOE recorded a discount of 0.03%, with no net inflow on October 30. Cumulative net inflows reached $217.47 million, while total net assets stood at $269.40 million. BTCW has a BTC share of 0.02%, with a market price of $76.14, reflecting a 1.08% decrease. The daily trading volume was $3.41 million, with 44,600 shares.

Hashdex’s DEFI on the NYSE registered a discount of 0.06%, with no daily net inflows. Its cumulative net inflows totaled $66.96 million, and net assets were valued at $10.66 million. DEFI now holds a BTC share of 0.09%, with a market price of $81.85, experiencing a 1.29% drop. The traded volume for DEFI reached $16.07 million, with a share volume of 196,000 shares.

The market update by SoSoValue indicates that BlackRock’s IBIT noted the most significant daily net inflow and holds the highest net assets among other Bitcoin ETFs. Grayscale’s GBTC has a sizeable cumulative outflow but remains highly traded with a notable asset value. Fidelity’s FBTC and Ark Invest’s ARKB show moderate net inflows with consistent asset values.

cryptonews.net

cryptonews.net