After what has been a roaring September for the crypto market, with double and triple-digit growth on select projects, the month of October has managed to keep up the bullish momentum, with growth being visible across the board.

As always, Bitcoin has been one of the core drivers of growth on the market — rising from $65,000 by the end of September to over $72,000 over the past month of trading. There are a few reasons for this bullish momentum, with one core reason being particularly prevalent.

As it is widely known, The U.S. Presidential Elections are due to be held on November 5, with the broader crypto market being in favor of Donald J. Trump’s second bid for presidency.

The latest polling data has shown a considerable shift in favor of Trump, which has fuelled both the crypto and stock markets to new heights.

This interest has also spurred the crypto betting and prediction markets into action as well and a lot of online gambling websites in the US also offer presidential betting positions to their clients, such as the outright winner, popular vote winner, as well as individual state results.

Going forward, the results of the election are likely to have an outsized impact on the performance of crypto assets heading into the year 2025. However, the bullish momentum seems strong at present and investors and speculators alike have been trying to capitalize on the ample opportunities that have followed.

Top 5 Crypto Gainers of October 2024

As we have already mentioned, the month of October has been broadly positive for the crypto markets, with the likes of Bitcoin, Solana and Tron seeing some notable positive returns.

However, it is also worth noting that the Crypto Fear and Greed Index has shown a value of over 70/100, which indicates extreme greed. This also explains the prevalence of meme coins among the top gainers list this time around.

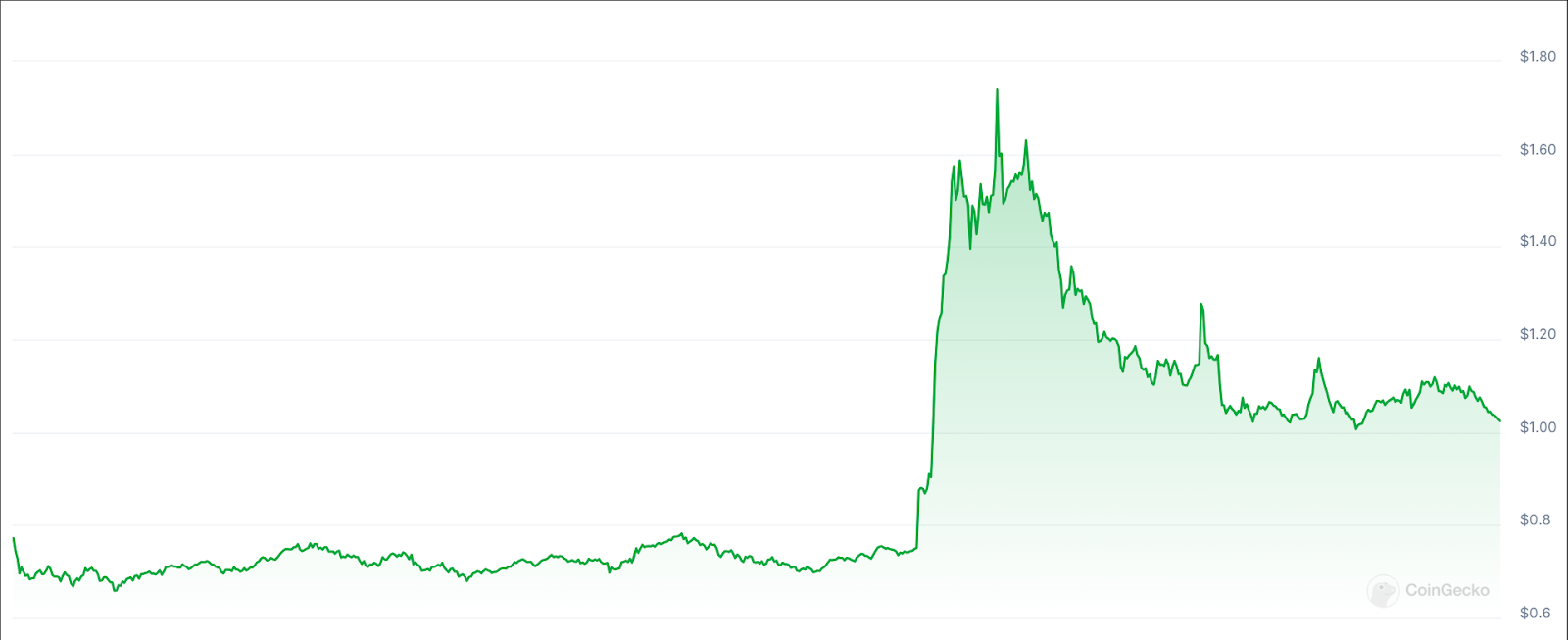

Raydium ($RAY) +66.2%

Raydium, which is an open source liquidity pool, has emerged as one of the best-performing cryptocurrencies of the year so far — gaining a whopping 1454% over the past 12 months of trading.

As for October, the month saw $RAY gain a solid 66%, which places the coin firmly at the top of the gainers leaderboard for the month.

While the coin is still far off from its all time high figure seen in 2021, investors will nonetheless be pleased to see Raydium posting such impressive gains heading into November.

While a short-term correction seems likely, this will also depend on political and macroeconomic data released in November, which could boost the already impressive performance of Raydium.

Popcat (POPCAT) +58%

Meme coins took the market by storm in October, with Popcat posting a 58% gain over the past month of trading.

This puts Popcat among the best crypto projects of 2024 — having only entered the market through its ICO in January of this year.

Overall, Popcat’s explosive growth started in late February and investors who entered the market at that time and refused to sell are now left with substantial holdings and

As with any other meme coin, the performance of Popcat is directly tied to the overall market sentiment prevalent at any given time, which explains why the coin has been performing so admirably over the past few months.

Dogecoin ($DOGE) +44.8%

The most watched meme coin of them all, Dogecoin has not fallen short in the month of October — posting just under 45% in gains over the past 30 days of trading.

This puts the annual performance of $DOGE at a nice and healthy 143%, which is likely to please investors who stuck with the coin in 2024.

As already mentioned in the prior section, Dogecoin’s overall performance is dependent on sentiment and with the latest Crypto Fear and Greed Index showing a value of 77/100, the party seems to not yet be over for $DOGE investors.

ApeCoin ($APE) +27.7%

ApeCoin has been another meme coin that showed a sharp rise in October. However, it is also worth noting that the coin reached a much higher value towards the latter half of the month, before declining towards the end — amounting to a 27.7% gain overall.

This may signal to investors that the October performance of the coin is not stable, or that a sudden surge in November is also on the horizon.

When we look at the annual performance of the coin, we can see that $APE has declined by 23% over the past 12 months of trading, which is not a good sign for long-term investors.

Overall, $APE is the most uncertain meme coin on our list and much of its performance will be tied to the overall market sentiment in November.

Bitcoin ($BTC) +13.2%

While Bitcoin is nowhere near the highest gainers of this month, its double-digit growth cannot be ignored, as it has been one of the major catalysts for the rest of the market to also enter a bullish run.

In fact, the rise of $BTC did not start in October, as the biggest cryptocurrency on the market has gained roughly 40% since the first week of September.

Much of this rally can be attributed to the positive shift in Donal Trump’s polling numbers, as well as positive market sentiment based on promising pre-election service sector growth in the U.S.

However, long-term investors are likely to be cautious about the correlation between election results and $BTC performance, as surprises could happen that are likely to trigger a sell-off on the market.

Top 5 Crypto Losers of October 2024

On the other hand, certain crypto projects that have gained considerably over the course of the year, seem to have lost some ground over the past month of trading.

The likes of Kaspa, Render, Theta and others have seen double-digit declines in October, which could be priming them for a November bull run, if the electron polls turn out to be any indicative of the actual results come November 5.

Kaspa (KAS) −27%

Kaspa, which has shown impressive results over the past few months, has closed the month of October with a 27% loss, which can be attributed to investors cashing in on their gains and waiting for the market to correct.

October has been in contrast with the overall 2024 performance of Kaspa, which saw the price of the coin more than double.

The year-long performance of the coin is still quite solid at 130%, which can give investors hope for the coin to rebound in November and continue with its upwards trajectory.

Render (RENDER) −26.6%

Similarly to Kaspa, Render has also shown decline in October after an overall successful year in 2024.

The past 12 months of trading have seen the price of Render doubled, while the coin dropped over 26% over the course of October.

The decline is particularly stark when compared to the September highs of Render, which was trading at $6.7, while the end of October saw the price drop to $4.8.

Going forward, Render investors are likely to be looking forward to a new market catalyst to boost the price of the coin.

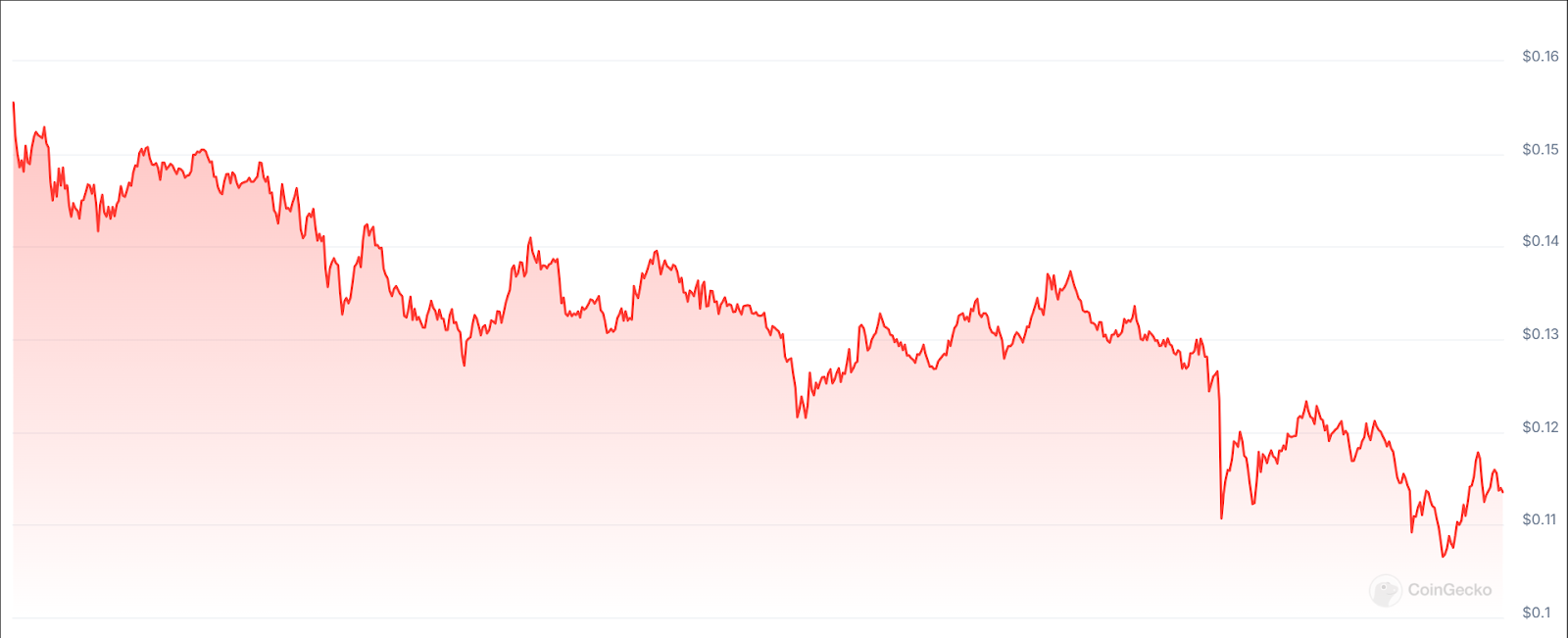

Notcoin (NOT) — 23.2%

The Telegram native coin, Notcoin, has been underwhelming over the course of 2024, which can be tied to the controversies surrounding Telegram and its founder and CEO, Pavel Durov.

The coin has lost over 23% over the past month of trading, which puts the annual performance at a 16% loss.

Investors in the coin will be looking forward to some positive news surrounding the company going forward, which could serve as a catalyst for potential gains in the future.

$NEAR Protocol ($NEAR) −22.1%

Blockchain $NEAR Protocol has lost 22% over the course of October, which comes at a considerable contrast with the annual returns of the coin, which stands at an impressive 225%.

This indicates that investors have cashed in on their gains in anticipation of new market catalysts, such as the election results on November 5.

Therefore, investors are unlikely to make major moves before the election date, unless polls show a major shift in the potential outcome.

Theta Network (THETA) −19%

Theta Network has been another one of the cryptocurrencies that lost value in October after solid annual performance. While October saw the coin lose 19%, the annual performance stands at a solid 68%.

Heading into November, Theta Network could rebound based on election results, which is the closest market catalyst on the radar of crypto investors.

A further decline before the election results reach the market are also likely, as more investors cash in on their gains and wait for the results.

Conclusion

While October continued the bullish trend of September and rounded out the month with solid gains, some smaller projects have seen declines on the market, which makes October a somewhat mixed month in terms of performance.

However, the solid performance of Bitcoin has been the main highlight of this month, which saw the largest cryptocurrency on the market reach over $72,000 in value — signifying the bullish momentum evident on the market, triggered by election predictions and polling data.

While this creates a unique circumstance on the market, most long-term crypto investors are optimistic about the Q4 of 2024, with some expecting a new ATH for Bitcoin before the end of 2024.

Image by Freepik

cryptonews.net

cryptonews.net