- Bitcoin hits $70,000 for the fourth time, while Ethereum drops significantly to $2,600.

- Ethereum’s price has declined with each of Bitcoin’s $70,000 peaks, reflecting shifting dynamics.

- Diverging trends highlight Bitcoin’s resilience while Ethereum faces declining investor support.

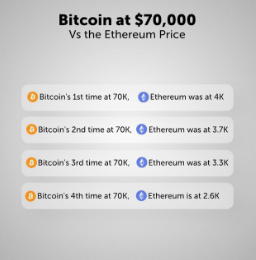

Bitcoin has reached the $70,000 mark multiple times, but Ethereum’s price has fallen each time. This trend shows a shifting relationship between the two top cryptocurrencies. Bitcoin’s continued high value contrasts with Ethereum’s lower performance over time.

Bitcoin first reached $70,000 when Ethereum was trading at $4,000. The two assets were performing more similarly at that time, with Ethereum showing strong growth. Market enthusiasm was high, and Ethereum was trading near its all-time highs.

When Bitcoin reached $70,000 for the second time, Ethereum had already fallen to $3,700. This decrease showed a divergence in market performance. Bitcoin maintained its value, while Ethereum started a gradual decline. This shift signaled a cooling off for Ethereum compared to Bitcoin.

Third time at $70,000 saw Ethereum at an even lower $3,300. The gap between the two assets continued to widen. Bitcoin’s resilience at $70,000 highlighted its strength, while Ethereum’s decline raised questions about its position in the market.

And now with Bitcoin reaching $70,000 for the fourth time, Ethereum has dropped further to $2,600. This is a significant difference from their previous levels. Ethereum’s current price reflects a 35% decrease since Bitcoin’s first $70,000 peak. Meanwhile, Bitcoin’s stability at this price point has attracted investor attention.

Shifting Trends in the Crypto Market

This trend highlights the shift in trends in the crypto market. While Bitcoin has easily reached $70,000 multiple times, Ethereum is struggling to sustain its earlier highs. The fact that Bitcoin is showing further strengthening as a store of value suggests that Ethereum’s value proposition is changing.

As investors consider these movements, they are looking at how Bitcoin and Ethereum react to different market pressures. Bitcoin’s consistent value could show broader confidence in its role as digital gold. Ethereum, on the other hand, may face challenges as it works to adjust to market demand.

Both cryptocurrencies play distinct roles in the market. However, Bitcoin’s repeated success at the $70,000 level underscores its resilience. Ethereum’s lower values show changing market perceptions. Investors are closely watching both assets for future shifts in this dynamic.

Related:

Crypto Liquidations Spike: Bitcoin, Ethereum, Dogecoin Traders Hit

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com