Bitcoin retested levels close to its previous highs during the early trading hours on Wednesday but faced rejection around $73,500.

Yet bulls managed to hold the reigns well above the psychological support level of $72,000, suggesting the rally is far from over.

Bitcoin’s latest rally seems to have breathed new life into the altcoin market, with memecoins stealing the spotlight over the past 7 days.

The top three gainers in that time frame were all memecoins with double-digit gains.

A wave of liquidity is sweeping through the cryptocurrency market, evident as the overall market capitalisation surged past $2.55 trillion—marking its highest point since July and hinting that crypto’s momentum is just getting started.

However, with Bitcoin’s dominance holding firm above 55%, the investors remain focused on the flagship cryptocurrency, anchoring the market’s momentum even as altcoins ride its coattails.

A significant portion of the liquidity flowing into Bitcoin is sourced from spot ETF products, with $2.1 billion pouring into the 12 offerings over the past five days alone.

Inflows have reached levels not seen since March when BTC hit a fresh all-time high.

This time, similar expectations are on the table, with analysts anticipating an eventual bullish breakout that could propel Bitcoin into price discovery mode, as current market conditions seem to align favourably for the leading cryptocurrency.

Several bullish predictions have surfaced following BTC’s rally over the past few days.

Beyond the demand driven by Wall Street, factors like the rising odds of former President Donald Trump returning to the White House and October’s historical trend as a “bullish month”—often termed “Uptober”—are fueling optimism.

Further, CryptoQuant recently reported that short-term traders are not taking profits despite the break above $72k.

Notably, Bitcoin’s short-term holder (STH) Spent Output Profit Ratio at 1.017%, and profit-taking has been limited.

Typically, this means traders remain confident that higher price levels could still be ahead.

Analysts are expecting a breakout soon

In an X post, Mando CT predicted that the bull run was gaining momentum stating that bullish sentiments in the crypto industry were “loud and clear.”

YouTuber and trader Lark Davis added to the optimism, highlighting the recent bull cross on the weekly MACD—a technical indicator often seen as a precursor to a strong rally.

Davis noted that this signal, combined with Bitcoin’s current momentum, suggests a breakout could be on the horizon.

However for a breakout to be confirmed, Veteran trader Peter Brandt, directed attention to the $76,000 level as a decisive marker for Bitcoin.

According to him, a true breakout would require a daily close above this threshold, ideally confirmed on a Sunday at midnight UTC.

While the recent price action has tested key resistance, Brandt notes that these moves are not definitive.

This approach is often used to avoid “false breakouts” where prices briefly exceed resistance levels but lack the momentum to maintain those levels, leading to a reversal.

On the Bitcoin hourly chart, the Ichimoku Cloud and RSI hinted at a positive, short-term trend.

Bitcoin is currently trading above the Ichimoku Cloud, which reinforces the bullish outlook.

The Relative Strength Index (RSI) was also in a healthy range and showed no signs of the coin being overbought.

Hourly BTC/USDT chart. Source: TradingView.

If Bitcoin stays above the cloud, it’s likely to continue its upward movement, with immediate resistance expected around recent highs near $72,000. At press time, one Bitcoin was selling for $72,149.

The top trading altcoins for the week were as follows:

Dogecoin

Dogecoin (DOGE) rose 21.3% over the past week exchanging hands at $01697, its highest point in six months.

The meme coin’s market cap had surged above $25 billion.

Source: CoinMarketCap

The rally coincided with a jump in open interest on the DOGE futures market which rose to $1.41 billion on October 29 up from $445 million seen at the beginning of September.

A rise in open interest means more investors are opening short and long positions in the futures market thereby adding more capital to the meme coin and driving its price higher.

Analyst Ali noted that historically November has been a bullish month for Dogecoin.

Previously, the meme coin rose over 15,000% after it broke out of a large descending channel in October 2020, formed over multiple years.

He added that a similar scenario might be on the horizon provided DOGE remains above the key support level of $0.20 at the end of October.

Despite the analyst’s bullish predictions, technical indicators like Bollinger Bands and Relative Strength Index suggest that DOGE has hit overbought levels and is likely to see a bearish trend reversal in the short term.

Popcat

Popcat (POPCAT) gained 20.3% over the past 7 days, rising to $1.79, its all-time high and 90% higher than the October low of $0.94.

The Solana-based meme coin which saw its market cap surpass $1 billion stood at $1.64 billion surpassing Bonk (bonk) and becoming the second largest Solana when writing.

Source: CoinMarketCap

Analyst Murad with over 375k followers on X noted that Popcat is breaking out of a rising diagonal resistance formed from March to October with higher highs and lower lows, a very bullish sign in technical analysis.

The analyst predicts that, if the meme coin breaks out of the pattern, it could experience a parabolic rise to $5 in the coming months.

SPX6900

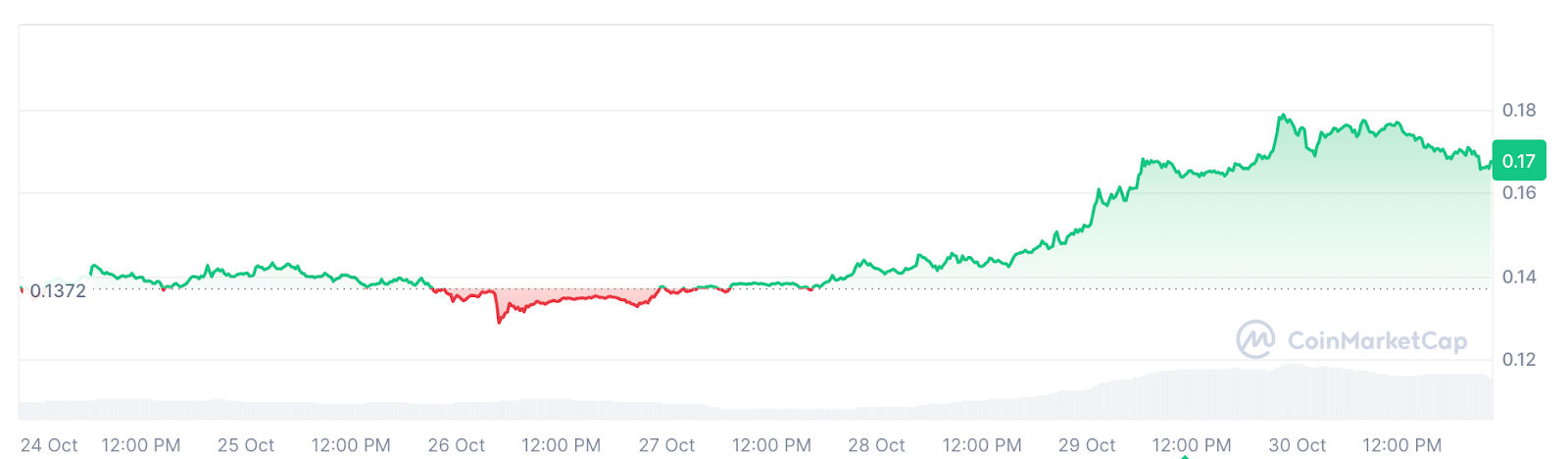

SPX6900 (SPX) also benefitted from Bitcoin’s rally this week and was up over 20% since Oct. 23 when writing.

The memecoin hit an all-time high on Oct. 29 and has since receded over 8%.

Source: CoinMarketCap

Momentum around the token remained strong and social media sentiment showed no signs of the hype around the token losing steam.

The price rally over the past 7 days was primarily driven by the broader sentiment in the market.

However, the altcoin’s listing on the decentralised exchange LogX and integration with the cross-chain protocol Wormhole have helped sustain the rally.

The post Bitcoin eyes breakout; DOGE, POPCAT, SPX lead weekly gains appeared first on Invezz

invezz.com

invezz.com