Polygon’s native cryptocurrency, MATIC, has been on a prolonged downward trajectory, losing its market value throughout the year. With a steep 47% decline since March and trading near $0.30, the token has retraced to a level last seen in April 2021, marking a 76.07% drop from its $1.29 peak.

Now hovering around $0.3355, the MATIC token is experiencing a slight rebound, suggesting the possibility of shifting sentiment, as this level has demonstrated historical resilience. Yet, despite this recent uptick, MATIC still reflects a 1.49% loss over the past day and 5.27% over the past week, indicating that any meaningful recovery could face hurdles. For many traders, the question looms: will the $0.30 support hold, or will it cave under bearish pressure?

Technical Analysis Hints at Near-Term Correction

From a technical standpoint, MATIC’s indicators raise cautionary signals, with the RSI implying likely overbought conditions in the near term. Positioned at 34.98 and slipping below its signal line, the RSI reveals the bearish sentiment that has dominated the market since July.

Though not yet in overbought territory, the cryptocurrency could experience additional price slippage if bearish sentiment continues to dominate. The DMI further underscores this bearish outlook. Currently, the +DI, representing bullish momentum, stands at 14.1981, lower than the -DI reading of 24.0387, reflecting stronger bearish dominance.

Advertisement

However, the ADX sits at a moderate 21.7381, signifying that while bearish sentiment exists, the trend is weak to moderate, lacking the strength for an extended decline. This tepid trend strength suggests that, while bears are in control, the sentiment may not endure indefinitely.

Can MATIC’s $0.30 Support Reverse the Downtrend?

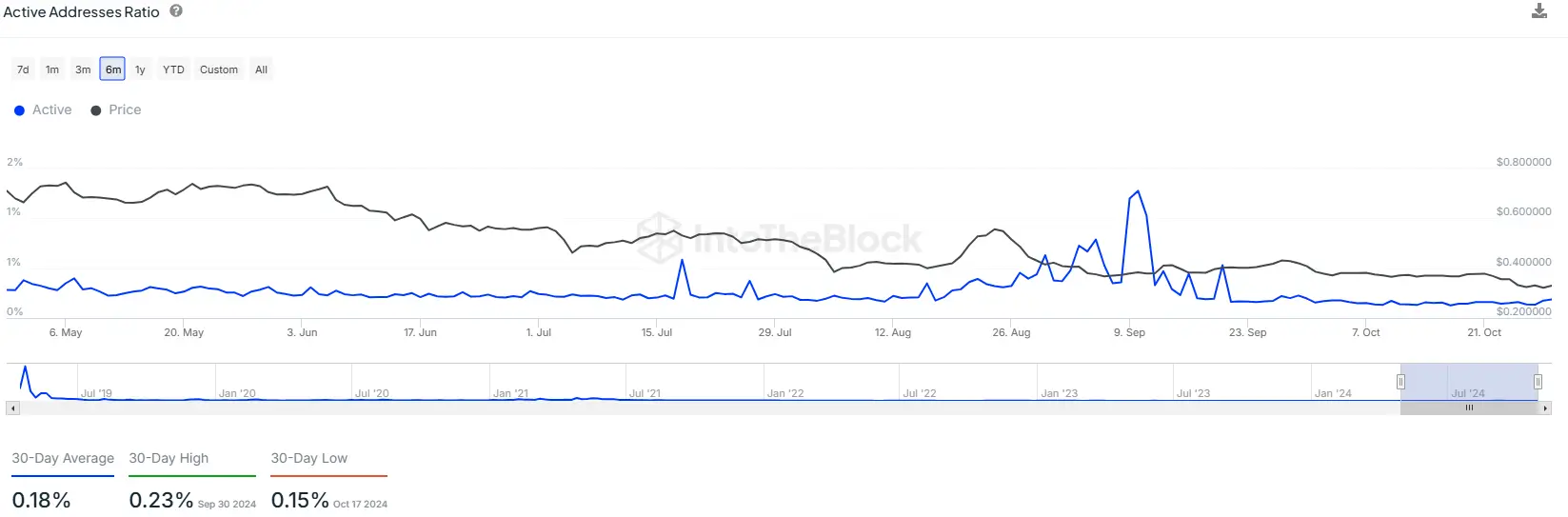

Adding to this technical picture, Polygon’s on-chain data reveals an uncertain outlook for the MATIC token. Over the last six months, MATIC’s active address ratio has been relatively low, averaging around 0.18%, with brief spikes to 0.23% in September. This stagnation in user engagement reflects a lack of strong on-chain activity—often a key factor in sustaining price rebounds.

Moreover, the reduced address ratio and limited trading volume indicate that traders and investors may be approaching the MATIC cryptocurrency cautiously, favoring bearish sentiment in the current market environment. As illustrated by its recent price trend, the token’s sluggish on-chain activity may prevent a robust recovery, suggesting that the token could soon retest its $0.3088 support level, with a potential breakdown in sight.

A successful breach below this threshold could lead to further lows, possibly testing the liquidity gap created in March 2021 between $0.2545 and $0.3457. Such a scenario would drive the cryptocurrency into deeper bearish territory unless renewed on-chain activity or improved sentiment sparks a reversal.

However, should market dynamics shift favorably and the $0.30 support hold firm MATIC could witness renewed bullish momentum. This key level has previously acted as a solid base, and sustained support here could foster a shift in sentiment, paving the way for the cryptocurrency to revisit resistance targets around $0.48 and $0.58.

cryptonewsz.com

cryptonewsz.com