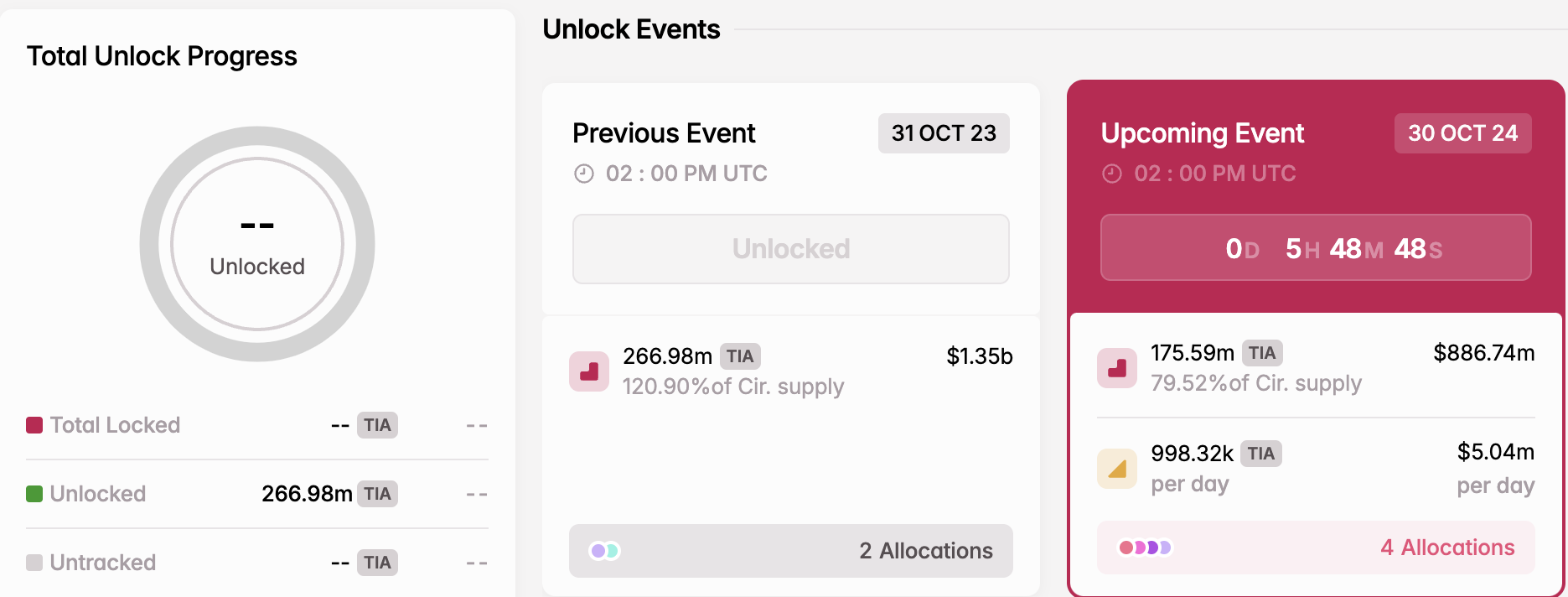

Modular data availability blockchain project Celestia (TIA) is set to release 175.59 million previously restricted. This Celestia token unlock today, October 30, marks the largest since the project’s launch in October 2023.

Given this substantial supply shock, TIA’s price is likely to face increased volatility, as this unlock will nearly double the tokens already in circulation. In this analysis, BeInCrypto examines what investors can expect from the cryptocurrency’s price after the event.

Celestia OTC Sales Could Mitigate Selling Pressure

According to Tokenomist (formerly Token Unlocks), the Celestia token unlock is valued at $890 million at the current price. When released, the total tokens in circulation will be 80% of the total supply.

Cryptocurrency projects often lock a portion of their token supply and release it gradually to prevent early investors and insiders from selling large quantities immediately after receiving their allocations.

When the projects unlock these tokens, they become available for sale, making such events typically bearish. According to this thesis, TIA’s unlock today is likely to contribute to its 14% decline over the past seven days.

Read more: 9 Best Blockchain Protocols To Know in 2024

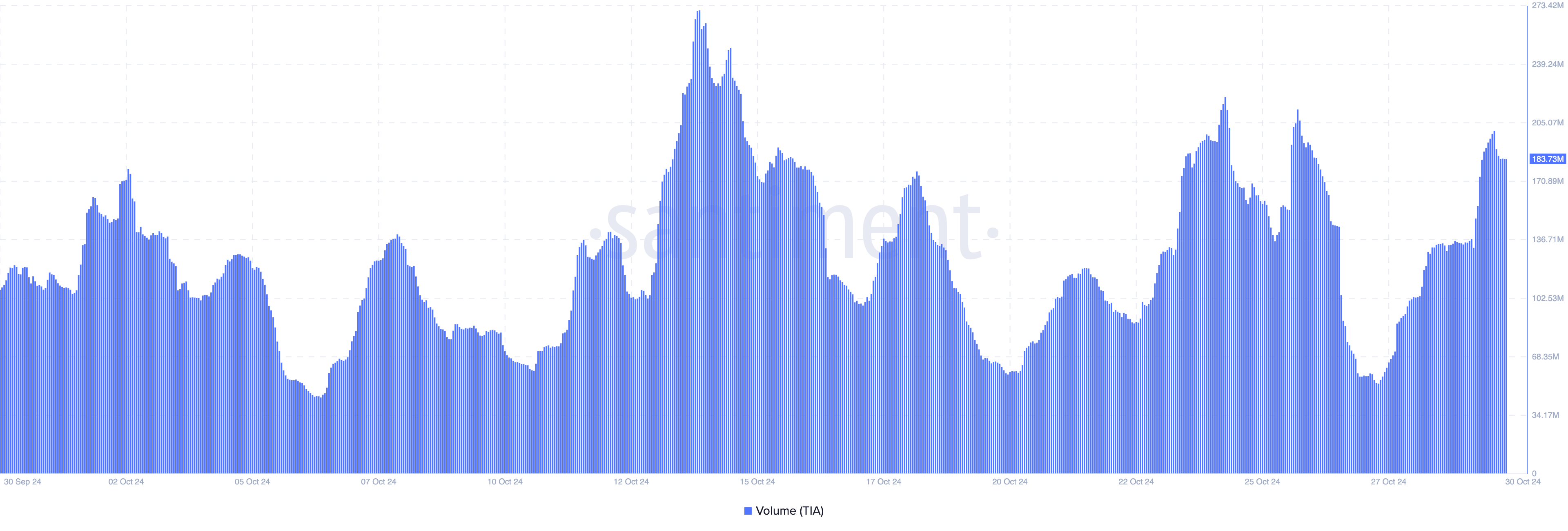

Amid this, on-chain data from Santiment shows that TIA’s volume has increased to $183.73 million. For context, a sharp increase in trading volume can validate the onset of a breakout or a breakdown.

Therefore, Celestia’s high trading volume suggests greater involvement from market participants. However, it also indicates rising selling pressure, which increases the likelihood of the downtrend continuing.

However, Taran Sabharwal, founder of an Over-The-Counter (OTC) trading platform, STIX, disclosed that some of these unlocked tokens have already been sold via OTC. This sell-off likely contributed to Celestia’s price decline over the past week.

As a result, the selling pressure from this unlock could be less than 50% of the anticipated value.

“Heavy amounts of the first unlock were sold to OTC buyers, who hedged on perps, sending open interest ballistic over the last few months. We expect a lot of these shorts to continue winding down, partially negating the spot-selling pressure. This funding reset may be a bull signal for spot buyers.” Sabharwal posted on X.

TIA Price Prediction: The Chart Favors Bears

At the time of writing, TIA’s price is $5.05 and is currently below the key Exponential Moving Averages (EMAs). As shown on the daily chart, the 20 EMA (blue) and 50 EMA (yellow) are around the same spot, suggesting that bears and bulls are struggling for dominance.

But since the altcoin’s value is below both indicators, bears have the upper hand. Should this remain the same, then TIA’s price could drop to $4.57 in the short term. However, if selling pressure intensifies, this drawdown could extend more than this, and the token could drop to $3.72.

Read more: Top 9 Safest Crypto Exchanges in 2024

On the other hand, if funding rates reset as Sabharwal envisages, this prediction might be invalidated. Instead, TIA might bounce and rally toward $6.16.

beincrypto.com

beincrypto.com