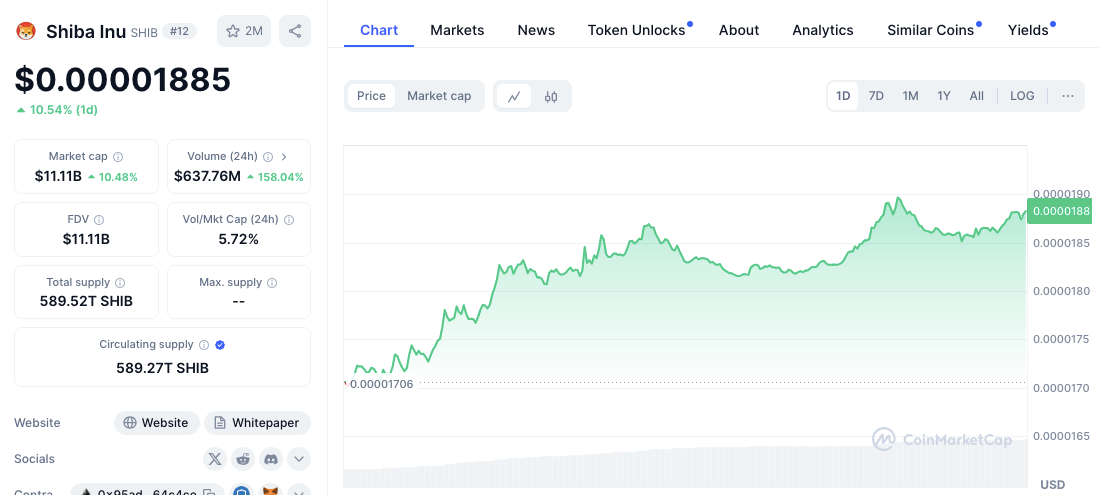

Shiba Inu climbed in market cap rankings, overtaking Avalanche ($AVAX) to reach the 12th position on CoinMarketCap (CMC). This surge was driven by strong buying interest, with $SHIB’s price appreciating by 8.75% for an impressive daily gain of around 10.3%. Meanwhile, Avalanche showed steady, albeit slower, gains with a 3.03% increase.

Shiba Inu’s Bullish Surge

Shiba Inu is currently trading at $0.00001882, continuing its notable upward momentum. A sharp increase in trading volume—up by 157.08%—signaled heightened investor interest. As $SHIB gained traction, a visible short-term uptrend emerged, further reinforced by recent price levels and technical indicators.

For $SHIB, two primary levels serve as potential pivot points. Support sits at $0.00001707, representing the recent low, which could act as a base if the price pulls back. On the upside, the $0.00001910 resistance level presents a significant hurdle. If $SHIB breaks through this resistance with sustained volume, it may unlock additional bullish momentum.

Technical Indicators Point to Possible Correction

A glance at $SHIB’s technical indicators suggests the rally may be approaching a tipping point. The 4-hour RSI reads 71.21, an indication of approaching overbought conditions, which often precede consolidation or slight corrections. Additionally, the 4-hour MACD sits above the signal line, hinting at a potential cool-off period that may see $SHIB’s price stabilize or retrace slightly before resuming its uptrend.

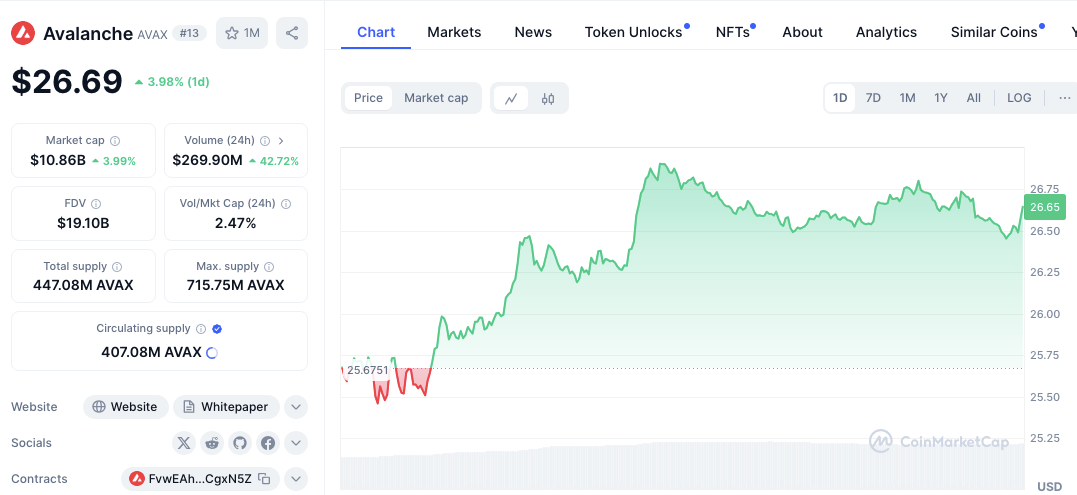

Avalanche’s Slower But Steady Climb

Avalanche ($AVAX), meanwhile, has experienced moderate growth, trading at $26.52 after a slight increase of 3.03%. The daily chart reveals $AVAX recovering from a low of $25.74 to a high of $26.75, suggesting a minor bullish trend. While $AVAX may lack the explosive growth seen in $SHIB, it remains in positive territory, supported by solid fundamentals and gradual price movements.

The $25.74 mark emerged as an important support level for $AVAX, while $26.75 serves as current resistance. A move past $26.75 may trigger a test of $27.00, a key psychological level that, if broken, could amplify buying interest.

$AVAX’s 4-hour RSI stands at 53.51, reflecting a neutral outlook that contrasts with $SHIB’s overbought status. Additionally, its 4-hour MACD is above the signal line, indicating potential for continued upward movement, though not yet in breakout territory.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com