The Tron network has been reporting growth in multiple areas especially its adoption and this has consequently led to higher fees over time. Especially as TRX’s value continues to rally.

While higher TRX prices are often seen as a good thing for investors, higher fees threaten to make the network more expensive and less attractive. The network is reportedly planning to do something abot the situation through a recently passed proposal dubbed Proposal 95.

Reports indicate that the new proposal will slash Tron network fees by half. According to Luganodes, the network plans to adjust energy nodes in a bid to slash developer costs. The move is expected to make the Tron network more efficient and more attractive to developers.

3/

— Luganodes (@luganodes) October 26, 2024

Proposal #95 makes TRON more efficient by:

• Adjusting energy thresholds to reduce costs for developers

• Setting energy prices at 0.00021 TRX for smart contracts

• Optimizing energy allocation to ensure sustainable network operations

This move is designed to make TRON…

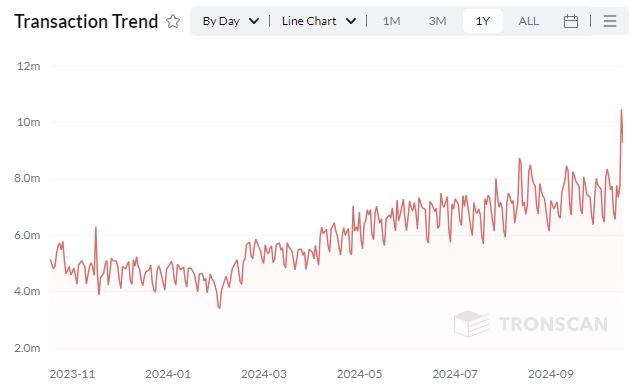

Tron Transaction Soar to New Highs

Daily total transactions on the network recently reached a 12-month high of 10.46 million transactions on 24 October. Although this was the highest level so far this year, it is worth noting that Tron record daily transactions was over 12.8 million in mid-June 2023.

A surge in transactions goes hand in hand with the number of addresses, and positive correlation is observed in most cases. Tron’s active monthly accounts have been pushing well above 260 million accounts. As for the last 30 days, the network averaged 2.61 million daily active addresses, a significant boost from August.

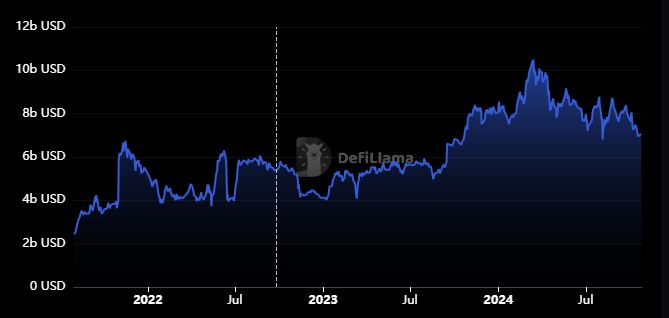

Despite the growth in transactions and active accounts, Tron experienced outflows in the last 2 months. This was unlike some of its rival networks whose TVL figures have been pushing to new highs as recent as last week.

Tron’s TVL was $7.09 billion at the time of writing. A significant decline from its August peak of $8.72 billion and an all-time high of $10.49 billion in March 2024.

Is TRX Forming a Double Top Setup?

Although Tron TVL figures have been on an overall decline, TRX bulls managed to put up a good fight and push higher in the last 4 weeks. Its latest rally earlier in the week peaked at $0.166, a 13% rally from September lows. It traded at $0.164 at press time.

The latest upside appeared to be forming a double top with the TRX price action in August. This means the cryptocurrency may encounter resistance above the $0.166 price level.

The double top could signal a higher possibility that TRX may experience a significant pullback in the coming days.

Although the price was quite close to the previous 2024 peak in August at the time of writing, its RSI was notably lower than its corresponding previous peak. This could be a sign that the latest bullish performance lacked the same level of zeal than its previous rally.

The above analysis suggests that TRX may experience substantial profit-taking at the tail end of October and early November. However, a potential extension to the upside may also occur depending on the level of demand that will manifest in the coming days.

thecoinrepublic.com

thecoinrepublic.com