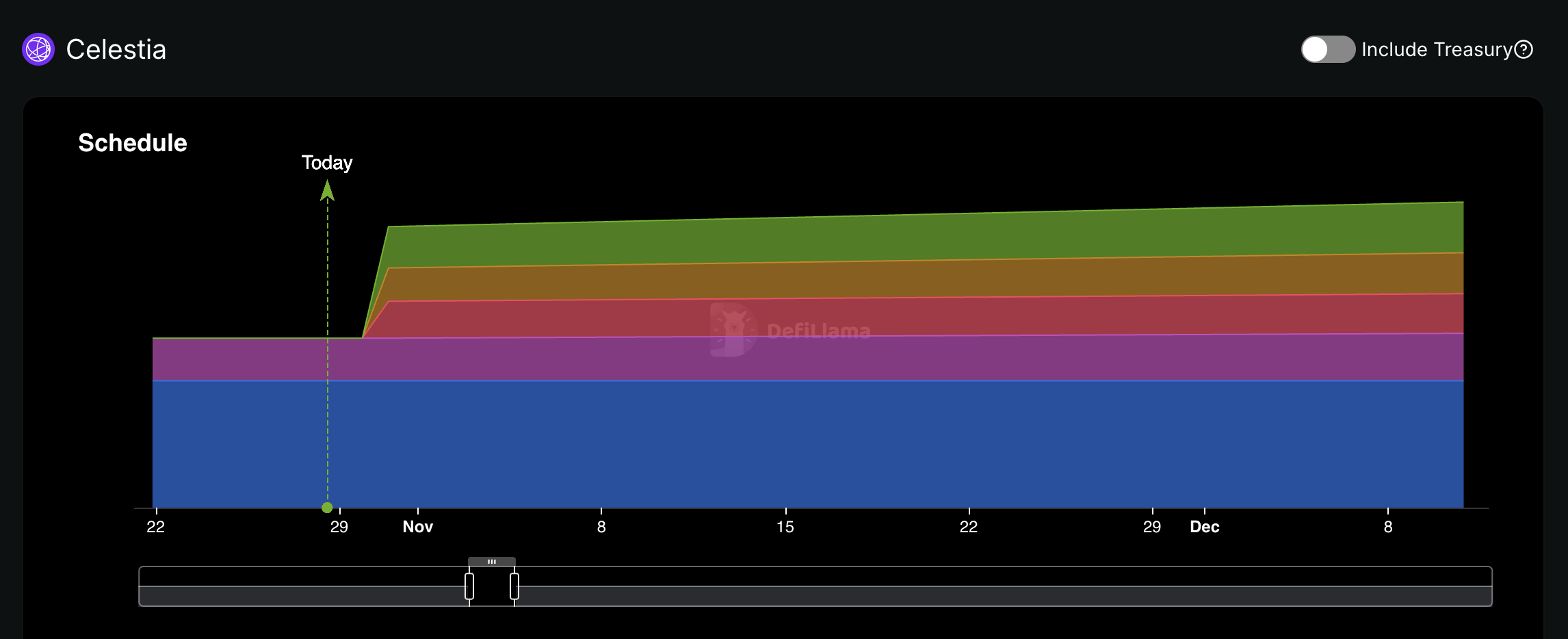

Celestia (TIA) price faces significant challenges in the coming days as multiple factors align to influence its movement. The upcoming token unlock event, which will introduce a substantial amount of new supply, could heighten selling pressure and add volatility.

Recent RSI movements indicate a slight improvement in market momentum, but the indicator remains close to oversold territory. Additionally, the EMA lines continue to signal a bearish trend, suggesting that the price could face resistance in any upward move amidst the looming supply increase.

TIA Token Unlock Could Impact Its Price In The Next Few Days

This week marks a significant shift for TIA, with 73.3% of its circulating supply set to enter the market. On October 30, 175 million TIA tokens, valued at approximately $859 million at current prices, will be unlocked.

Following this substantial release, TIA will continue a daily unlock of about 950,000 tokens, steadily expanding its circulating supply over time.

Given TIA’s total supply of 1 billion tokens, the upcoming release of 175 million tokens represents a massive increase, about 17.5% of the total supply. This sudden influx could significantly impact TIA price, especially in the short term.

A large increase in supply without a corresponding rise in demand could lead to increased selling pressure, as recipients of the unlocked tokens may choose to sell. Such a scenario might result in a price drop as the market absorbs this sudden increase in circulating tokens.

Celestia RSI Is Back From Oversold

TIA’s Relative Strength Index (RSI) has risen to 31.79 from 29 just a day ago, indicating a slight shift in market momentum. This recent increase shows that some buying activity has occurred, reducing the downward pressure and signaling a potential stabilization.

RSI is a momentum oscillator that ranges from 0 to 100 and is used to gauge whether an asset is overbought or oversold. Typically, an RSI below 30 indicates an oversold condition, while above 70 suggests an overbought one. The current TIA RSI of 31.79, while still near oversold territory, means that selling pressure may have eased slightly.

Given the upcoming token unlock, when 175 million TIA tokens will enter the market, this increase in supply could push RSI back into oversold levels. The influx of tokens might lead to heightened selling pressure, further negatively impacting price.

TIA Price Prediction: A Potential 24% Correction Ahead?

Currently, the TIA price is trading below all four EMAs, indicating bearish momentum. The crossover of the shorter EMAs below the longer EMAs shows a strengthening downward trend.

The separation between the EMAs further suggests that bearish pressure is growing, and there has been little evidence of a reversal attempt so far.

The blue lines above the current price indicate resistance levels around $5.73, $6.50, and $6.89, which are significant hurdles for the price to overcome in any bullish move.

On the downside, immediate support levels are marked in red at $4.68 and $4.47. If selling pressure continues and the TIA unlocks drive the price down, TIA could fall back to $3.72. That would represent a potential 24% price correction.

beincrypto.com

beincrypto.com