Since the beginning of October, XRP has lingered within a price range. It has faced resistance at $0.55 and found support at the $0.51 price level.

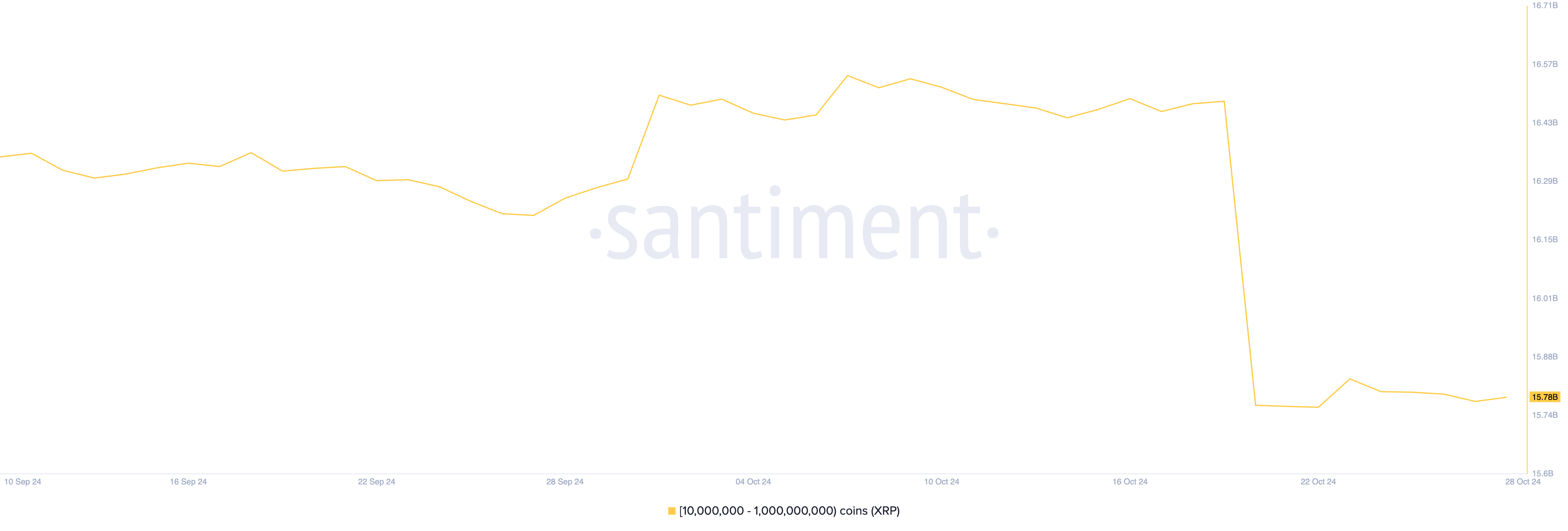

This sideways price movement has prompted XRP’s large investors, or whales, to start to reduce their exposure. Over the past two weeks, XRP whales have reduced their token holdings, causing it to fall to a multi-month low.

Crypto Whales Distribute XRP

XRP’s lackluster price performance in the past few weeks has caused its whales to distribute some of their tokens. Santiment’s data reveals that large investors that hold between 10,000,000 and 1,000,000,000 XRP tokens have sold 700 million XRP, valued at $357 million at current market prices, since October 19. This group now possesses 15.78 billion tokens, marking its lowest XRP holding since early August.

Read more: XRP ETF Explained: What It Is and How It Works

The decline in XRP whale holdings is a significant bearish indicator. Whales are large investors who often significantly impact market trends.

When they start selling off their positions, it signals a loss of confidence in the token’s future performance. This can lead to a decrease in demand for XRP, which can put further downward pressure on its price.

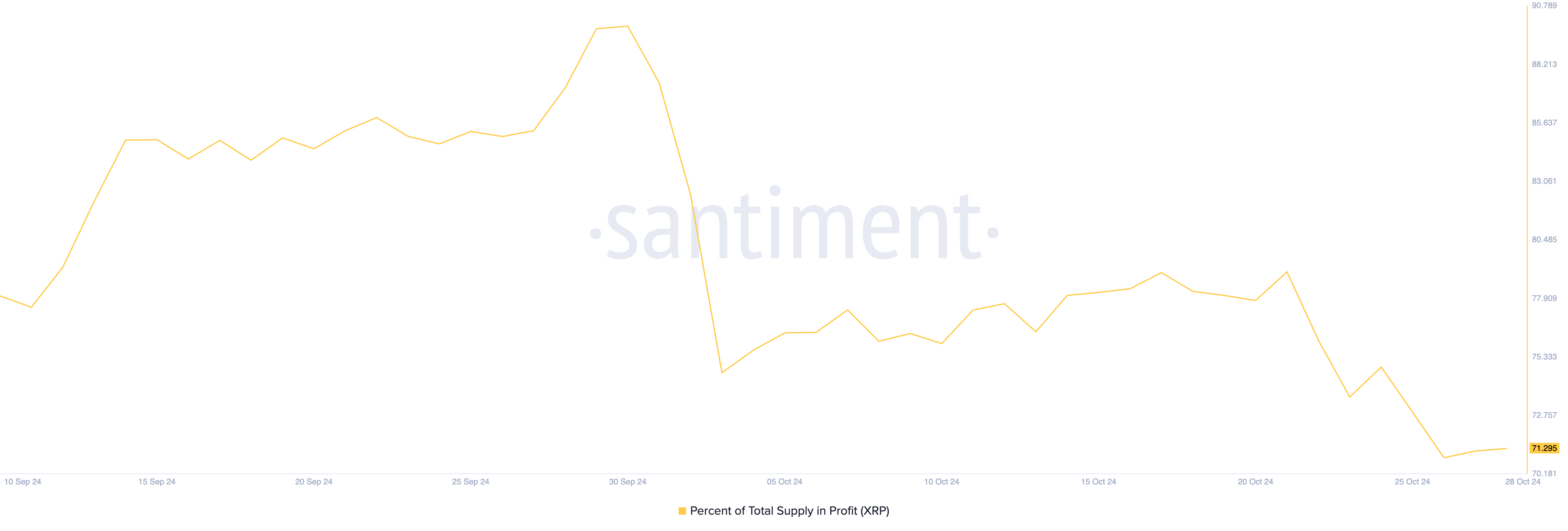

Moreover, the decrease in XRP whale activity coincides with a steady decline in the total supply held in profit. On-chain data indicates that 71.29% of the altcoin’s total supply is currently in profit, down from 89% on October 1. This represents a significant 20% decline over the past 27 days.

When an asset’s percentage supply in profit declines, it indicates that a large portion of the asset is now being held at a loss. This has a significant impact on market sentiment and price.

As more holders are underwater, there is a higher probability of them selling their positions to cut their losses, increasing selling pressure on the asset. This increased selling pressure can lead to a downward price trend.

XRP Price Price Prediction: Multi-Month Low on the Horizon

As of this writing, XRP is trading at $0.51, hovering near the support line of its horizontal channel. With decreasing whale activity and reduced supply held at a profit, selling pressure may increase.

If bulls fail to defend this support level, XRP’s price could dip toward $0.46. If bearish pressure escalates, the altcoin risks revisiting its July 5 low of $0.38.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Conversely, should the market experience a shift in momentum, XRP’s price could break above the resistance level at $0.55, with a target of $0.60.

beincrypto.com

beincrypto.com