The integration of THORChain, with Ledger Live marked a significant step in cryptocurrency, introducing streamlined cross-chain transactions within Ledger’s secure app.

Now, users could swap assets across various blockchains without relying on wrapped tokens or third-party solutions. This update granted them full control of their assets during transactions, emphasizing both security and ease of use.

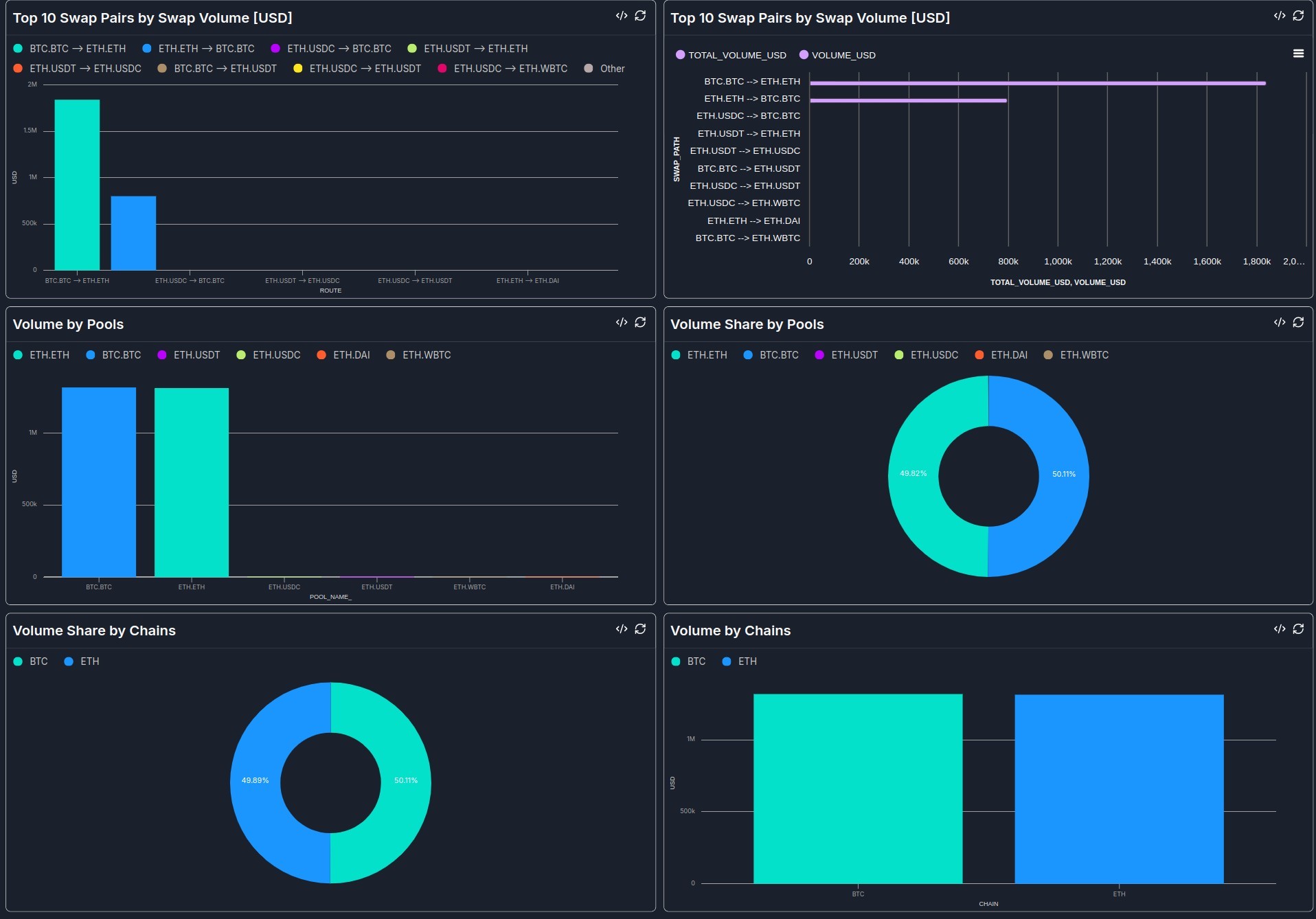

This collaboration quickly gained traction, with THORChain’s swap volume skyrocketing. Shortly after the integration, Ledger Live recorded over $2.6 million in swap transactions, positioning itself as one of THORChain’s top affiliates.

These transactions generated more than $18,700 in affiliate fees, suggesting that Ledger’s participation in the THORChain ecosystem could only grow. Notable transactions included high volumes for ETH-to-BTC and BTC-to-ETH swaps, with respective trades of $378,000 and $331,000 each.

Daily Volume and Count of Swaps

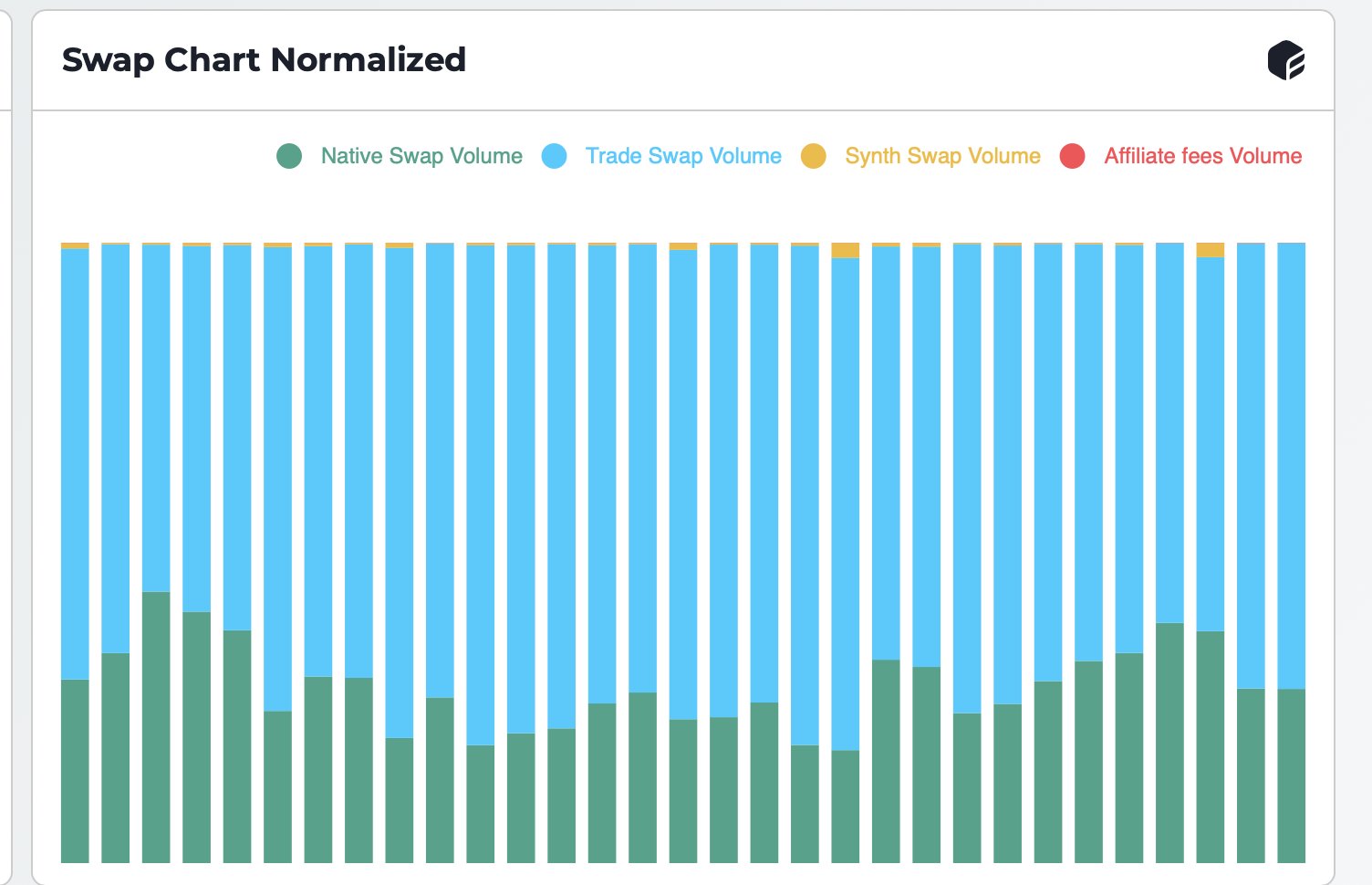

This week promised further momentum for THORChain, especially as BTC swaps launched on Jumper Exchange, a platform that uses THORChain’s liquidity through the Lifi Protocol.

This move simplified cross-chain exchanges, as Jumper integrated SwapKit technology, improving user experience. Moreover, upcoming announcements, including Binance’s anticipated Web3 Wallet rollout, signaled growing interest in THORChain’s potential.

THORChain’s ambitious roadmap showed plans to double its system income to $200 million through increased integrations, an active application layer, and potential gains from a bullish market.

Plans also aimed to cut block rewards by half while raising the burn rate to 5%, a move to bolster RUNE’s value.

Additionally, the Distributed Liquidity Pool (DLP) yield would offer returns in RUNE, setting the protocol for sustainable growth. This economic shift could lead to a significant annual bid on RUNE, alongside a steady $10 million yearly burn rate.

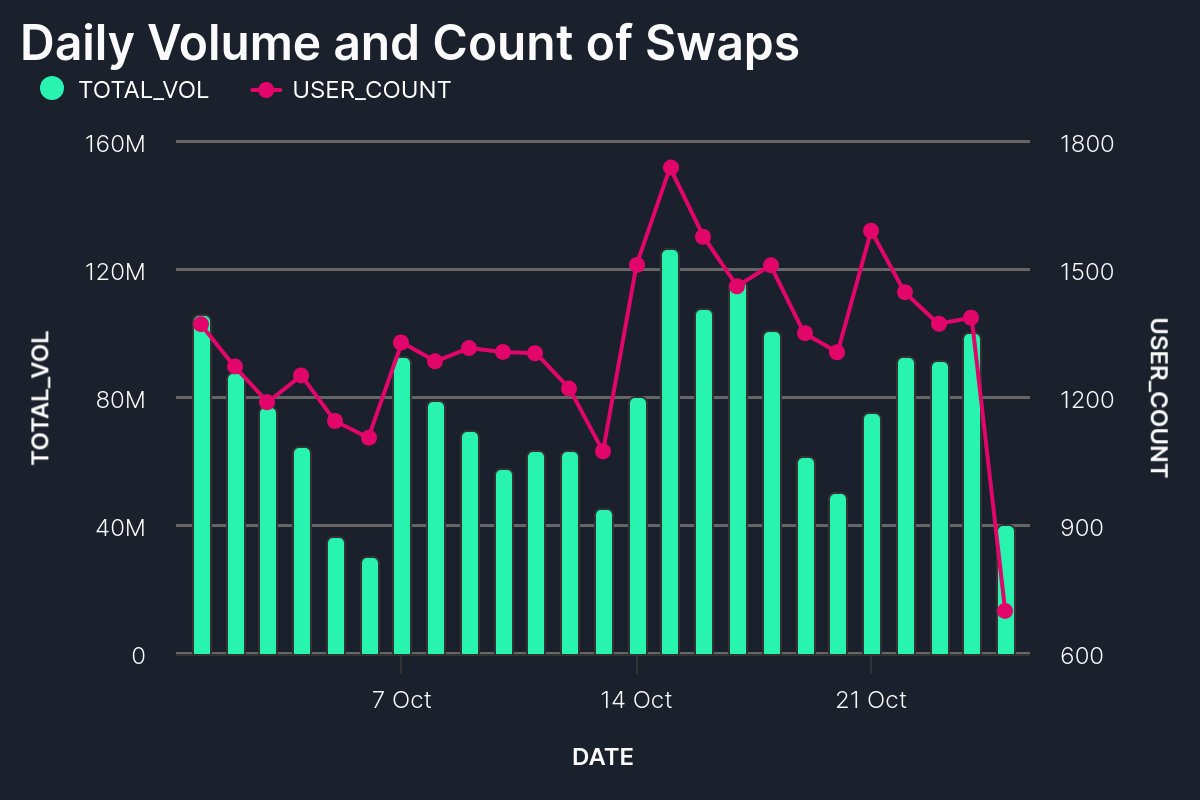

Ledger’s entry has also fueled user engagement on THORChain. In October, 52% of THORChain’s daily swap users were new, driven by strong trade volumes on the platform.

For each dollar swapped, four dollars of arbitrage activity balanced liquidity flows, as traders moved assets to stabilize prices.

With current monthly trade volume near $2 billion, analysts predicted that Ledger’s full integration could add $500 million to $1 billion in new monthly flows.

This influx could double THORChain’s annual income, potentially raising node and liquidity provider (LP) yields from 10% to 20%.

October witnessed a record-breaking 390,000 swap transactions on THORChain, led by 24,000 unique traders, with October 15 alone seeing a remarkable $126.5 million traded in 1,750 transactions.

THORChain also reported a notable increase in active nodes, nearing the maximum of 120, essential for full decentralization and supporting further growth in RUNE’s utility and price.

Impact on Price of THORChain (RUNE) Price

Amid rising trade activity and increased user engagement, RUNE’s price followed an upward trajectory.

Trading patterns showed an uptrend, with RUNE building a compression phase that positioned it near a key resistance level. Analysts expected that if RUNE maintained this trend, it could experience a bullish breakout in the coming weeks.

Notably, THORChain was close to forming a Golden Cross on the daily chart, a bullish indicator suggesting potential gains. This pattern, last seen in September 2023, previously led to a six-month rally, culminating in the March 2024 peak.

The THORChain ecosystem’s current strength, combined with Ledger’s integration, had analysts forecasting promising gains for RUNE.

The Golden Cross pattern could mark an ideal buying point, hinting at a potential target of $38,000 for RUNE.

With THORChain’s continuous development, increasing swap activity, and strategic partnerships, the ecosystem appeared ready for sustained growth, drawing attention to RUNE as a token with robust long-term potential.

thecoinrepublic.com

thecoinrepublic.com