According to the latest report by Next Generation, the crypto trend of the stablecoin sector could explode exponentially in the coming years.

The French fintech company estimates that the growth trend will continue until 2029, with the industry reaching a value of 3.4 trillion dollars.

Stablecoins will be one of the primary resources in the field of digital payments, capable of improving transaction efficiency and reducing cross-border costs.

Let’s see all the details below.

Summary

Next Generation report: bright future trend for crypto payments in stablecoin

According to the report by Next Generation, a French fintech company, the crypto stablecoin market is at the dawn of a strong growth trend.

The experts of this group believe that the capitalization of the sector will exceed 3.4 trillion dollars by 2029.

We are talking about a 19-fold increase in the current market value, considering that the industry as a whole is worth 177 billion dollars. This projection, although it may seem excessively ambitious, does not surprise the insiders of the crypto world.

Stablecoins are indeed becoming increasingly popular, with numbers that intimidate the main providers of electronic payments. As reported in the latest study report by A16Z, later shared by the user “Francesco Piccoli”, stablecoins have outperformed VISA in Q2 2024.

In total, in the last quarter, the digital payments giant recorded a trading volume of 3.9 trillion dollars.

The stablecoin have more than doubled this value, reaching 8.5 trillion dollars.

Despite this, Visa hosted a number of operations almost 54 times greater.

I just went through the newly-released @a16zcrypto "State of Crypto Report 2024".

— Francesco Piccoli (@francescpicc) October 18, 2024

The major highlight for me was the data on stablecoins. Stablecoin transaction volumes more than doubled Visa’s $3.9 trillion in transactions over the second quarter of 2024. Their volumes and… pic.twitter.com/ke82rHt7y4

The advantages of stablecoin and investments in the sector

Stablecoins, free from the condition of price volatility typical of cryptos like Bitcoin, offer significant advantages in traditional finance.

First and foremost, they are faster and more economical, with the blockchain technology acting as a settlement for smart use.

The cryptographic component also helps to eliminate the problems of liquidity fragmentation, offering a globally interoperable standard.

Furthermore, the use of stablecoin allows to remove fiduciary intermediaries and facilitate cross-border exchanges between different entities.

Regarding their recent expansion, the president of Next Generation, Suren Hayriyan stated that:

“2024 has become a turning point for the entire fintech sector, and for stablecoins in particular. The main growth factors have been determined in the current year, and at least for the next 5 years.”

According to Next Generation, currently the large companies are investing more than 500 million dollars per year in the stablecoin sector, seizing enormous financial opportunities.

In the coming years, investments in the crypto world are expected to increase further, reaching up to 24 times the current figures.

Furthermore, in 2029 institutional stablecoin transactions will represent 90% of the value exchanged virtually.

Suren Hayriyan clearly believes that the market has only now realized the firepower of this technology:

“It is 2024 when the financial sector realizes that the technological center of gravity of its development will increasingly shift towards blockchain.”

Expansion of the fintech world: the trends of Web3 and AI

According to the report by Next Generation, along with stablecoin, there will be two other factors that will have a dominant impact on our financial life.

We are talking about AI and web3: within the next two years, a significant complementary spread of these three promising technologies is expected.

Fintech companies will increasingly implement connections with the world of decentralized applications and with artificial intelligence products.

This condition will in turn encourage the company to push the market towards new levels of digitalization penetration.

Everything will be connected by the unstoppable power of new technologies, while stablecoin will serve as the economic foundation for accessing these worlds.

It is not a coincidence if Stripe, the famous fintech company from San Francisco, has recently reopened crypto payments (after a long stop) thanks to the stablecoin $USDC.

okee, crypto on @stripe is officially back!

— Jeff Weinstein (@jeff_weinstein) October 9, 2024

– accept stablecoins from 150+ countries

– buyers pay in usdc (via ethereum, solana, polygon)

– you, as a usa business, receive usd

– works with checkout, elements, or payment intents (and soon subscriptions)

see a live demo:… https://t.co/zPyQyAMvJd

In 2026, crypto stablecoins will become fundamental tools in the direct management of intercompany treasury and for P2P settlements, as well as in the field of remittances.

In that year, the market capitalization should hypothetically reach 1.5 trillion dollars, reflecting their disruptive potential.

In 2027, the overall value of the holdings is expected to rise to 1.9 trillion dollars, while for 2028 there will be a boom to 2.7 trillion dollars.

The landscape of euro-pegged crypto stablecoins

One of the most important topics covered in the Next Generation report concerns the impact of EURO stablecoins with the recent European crypto regulation MiCA.

The introduction of the legislative framework “Markets in Crypto Assets” has revolutionized the European crypto world and the companies operating in the sector.

With this new legislative framework, Europe has provided greater regulatory clarity by regulating the so-called “crypto attività”.

The text also includes guidelines related to the operations of bull and bear issuing companies of e-money tokens, comparable to stablecoins.

The new legislative framework has encouraged the transparent adoption of technology, in a trend of growing retail and institutional adoption.

In parallel with the approval of MiCa, several Fintech companies have entered the stablecoin world, propelled by the regulatory launchpad.

For example, the French bank Société Générale introduced its own currency EURCV with underlying EURO at the end of 2023, following the directives of the new law.

Also Circle, already present in the US market with $USDC, wanted to follow the ongoing trend by launching $EURC.

In a few months, the latter has seen its supply increase to over 90 million tokens.

New $EURC All-Time High 💶 ✅

— Patrick Hansen (@paddi_hansen) October 24, 2024

$EURC is the largest euro stablecoin by market cap and it's dominance is growing. For the first time, it has surpassed the €90 Million mark in circulating supply.

Fueled by an incredible growth on @base – now the chain with the largest amount of… pic.twitter.com/iY3J2RStY0

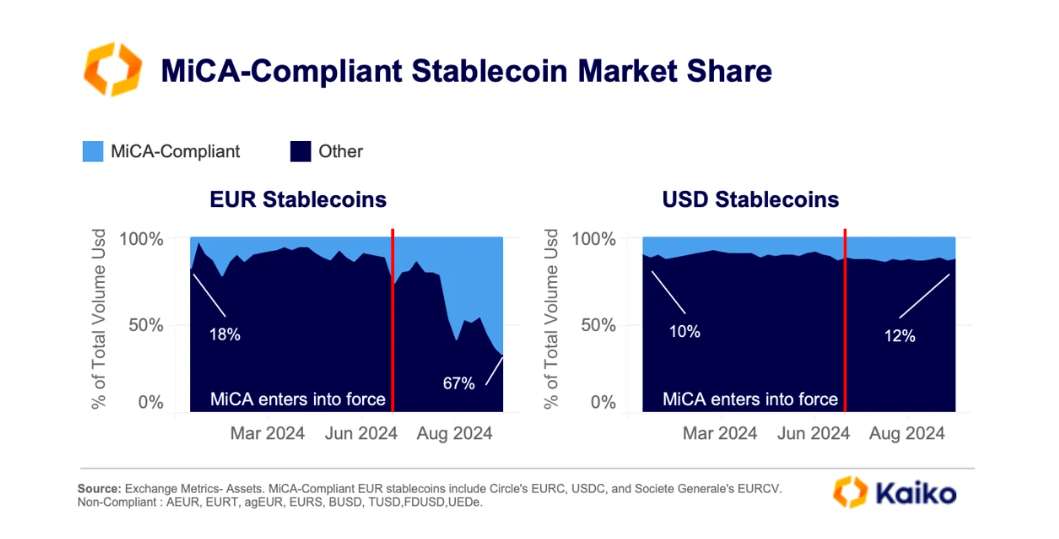

According to a report by Kaiko Research, the incentives of MiCA have led to a reshaping of the capital flows of crypto investors

The market share of stablecoins compliant with European regulation has indeed reached a new all-time high of 67% last week.

In 2028, this niche is expected to capitalize 25 billion dollars, while for 2029, projections indicate a value of 50 billion dollars.

A trend is clearly emerging in which compliant currencies are gaining more traction in Europe, to the detriment of those “outlaw” ones.

Confirming a similar framework for crypto stablecoins in the future, the president of Next Generation adds that:

“The growth locomotive will be the EURO coins. The reason is the significant boost that MiCA has given to EURO-pegged stablecoins in 2024. Additionally, the demand for EURO coins will exceed supply due to a strong gap between the trading volumes of fiat currency and EURO coins in the next 5 years.”

en.cryptonomist.ch

en.cryptonomist.ch