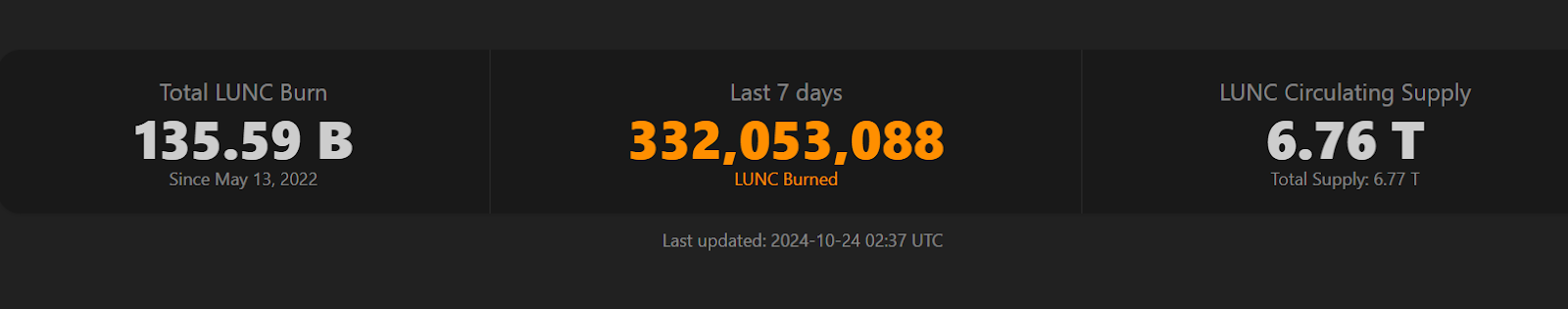

After a burn of 320 million tokens last week, Terra Luna Classic (LUNC) has seen a stable price performance. The burn aims to reduce LUNC’s oversupply, which soared to 6.9 trillion after Terra’s collapse.

Traders are optimistic that these burns could lead to price appreciation, as reduced supply increases demand.

LUNC Price Consolidation After Token Burn

The price of Terra Luna Classic has experienced consolidation, trading at $0.00008975 with a 0.09% increase on the day. The recent 320 million LUNC token burn is part of the Terra Classic network’s strategy to reduce the circulating supply and regain stability.

However, the LUNC price action is still neutral and trades within a tight range between $0.00008827 as support and $0.00009051 as resistance. Traders are expecting a breakout as supply decreases.

Future Price Outlook Amid LUNC Burn Initiatives

Terra Luna Classic’s price largely depends on the future of continued token burns in general and on market conditions more specifically. For now the price has remained stable, but traders expect the price to rise if the burns continue at this rate.

However, a court-ordered LUNC burn as part of their $4.5 billion settlement with the SEC could also have a major effect on the price. If Terraform Labs complies by the end of the month, that could cause a supply shock and raise prices. Nevertheless, failure to abide by this rule might lead to fines that could stall the project.

As such, analysts predict LUNC to see a tight range until major burns or external factors change market sentiment. A breakout beyond the $0.00009051 resistance could signal renewed bullish momentum, particularly if supply continues to decrease. But if LUNC fails to maintain the current burn pace, it may struggle to sustain price gains.

Technical Analysis and Market Trends

Currently, LUNC shows a neutral technical indicator. It has an RSI of 51.09, thus implying balanced buying and selling pressure.

The MACD also reveals weak bearish momentum in which the MACD line is just below the trend line. Price consolidation is expected in the short term as LUNC remains in a tight range. However, there is a chance for a breakout if the token supply continues to shrink from strategic burns.

Traders are keeping an eye out to see if the $0.00009051 resistance level will be broken in the coming days. If the burns work as planned, buyers could return to LUNC, and the prices could skyrocket by year-end.

thecoinrepublic.com

thecoinrepublic.com