Traders and investors in the crypto market should brace for volatility, with $5.26 billion worth of Bitcoin and Ethereum options expiring today.

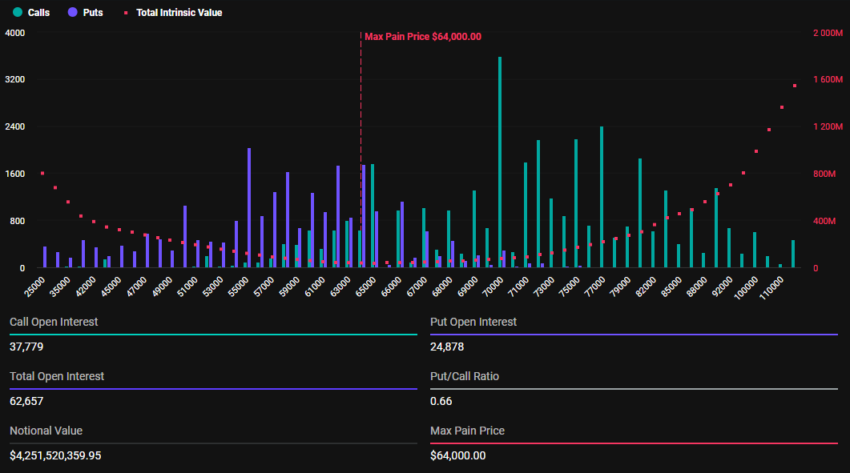

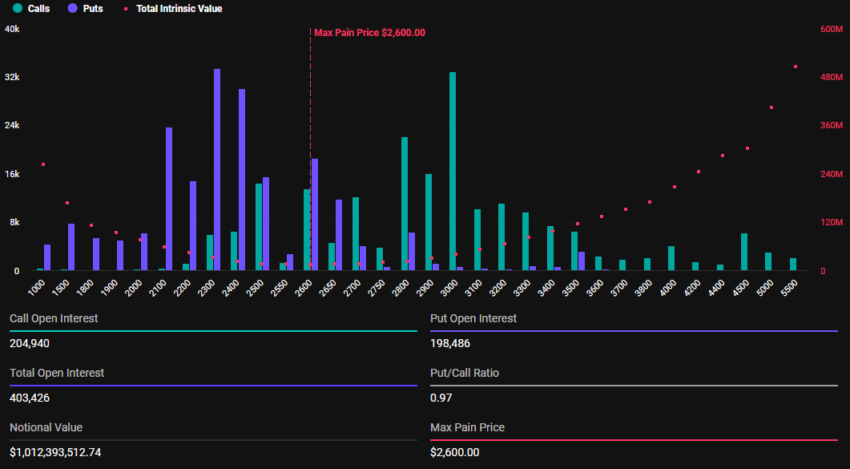

Specifically, Bitcoin (BTC) options due for expiry total $4.25 billion in notional value, while Ethereum (ETH) options account for $1.01 billion. With this, markets await the impact of such expansive contracts’ expiring.

What $5 Billion Bitcoin, Ethereum Options Expiry Means

According to data on Deribit, an expansive 62,657 Bitcoin options contracts will expire on October 25, with a put-to-call ratio of 0.66 and a maximum pain point of $64,000.

At the same time, Ethereum’s options market is set to expire with 403,426 contracts. Today’s expiring Ethereum contracts have a put-to-call ratio of 0.97, with a maximum pain point of $2,600.

Read more: An Introduction to Crypto Options Trading.

The put-to-call ratio is an important sentiment indicator in options trading. It compares the volume of put options traded to call options. When this metric is below 1, it generally signals bullish sentiment, with more investors expecting market gains. On the other hand, a ratio above 1 often suggests bearish sentiment, signaling concerns about a market decline.

Meanwhile, based on BeInCrypto data, Bitcoin is trading at $67,962 as of this writing, while Ethereum is trading at $2,490. This means that while BTC is trading above its maximum paint point, Ethereum is trading below it.

Price Implication Based On Max Pain Point Theory

With Bitcoin price currently above its max pain point, if the options expire at the current level, it would generally signify losses for options contract holders. The reverse applies to Ethereum, which is below its strike price as options holders stand to benefit. This is based on the Max Pain theory, which predicts that options prices will converge around the strike prices where the largest number of contracts — calls and puts alike — expire worthless.

Therefore, it means that as the options contracts near expiration, Bitcoin and Ethereum prices are likely to draw toward their respective maximum pain points. This means BTC value may drop while ETH price could rise in a calculated move by smart money. Nevertheless, the pressure on BTC and ETH prices will reduce after 08:00 UTC on Friday, when Deribit settles the contracts.

It is also worth mentioning that the volume of BTC and ETH options expiring today is significantly higher than what was seen earlier in the month. BeInCrypto reported $1.4 billion in the trading week ending October 4, followed by $1.6 billion in the week ending October 11.

Subsequently, the week ending October 18 saw up to $1.62 billion option contracts expire. The leap to over $5 billion options expiring is therefore significant, with a sustained rising trend. Meanwhile, analysts at BloFin Academy say there is also a notable change in implied volatility (IV) ahead of the US elections.

“The change in implied volatility first reflects the election’s impact on the expected volatility of the crypto market. Whether it is BTC or ETH options, the implied volatility level of options expiring on November 8 has increased significantly and exceeded that of far-month options,” said the analysts.

They ascribe the change in IV to investors’ hedging and speculative needs. The analysts also observe relatively higher increases in BTC’s “election day option.” This shows that BTC is relatively more sensitive to macro events. For now, however, most investors remain on the sidelines, limiting the amount of volatility that should be expected in October.

Read more: 9 Best Crypto Options Trading Platforms.

“Interestingly, investors seem to believe that there will not be much volatility in the rest of October. As most investors are on the sidelines before the election, the performance of the crypto market is mainly consolidation, which also boosts investors’ confidence in pricing lower volatility. Of course, affected by supply, demand, and sentiment, options expiring on Nov 8 are becoming more expensive,” BioFin Academy analysts added.

Another influencing factor, according to the analysts, is policy uncertainties in the US by the Federal Reserve.

beincrypto.com

beincrypto.com