Amid market corrections, Shiba Inu (SHIB) sees significant sentiment swings and rising large-holder inflows, hinting at the potential bullish activity.

With the ongoing market downturn in the crypto and equity sectors, Shiba Inu stands out as one of the potential outliers, according to a recent analysis by Santiment. SHIB demonstrates notable upside potential despite increasing crowd speculation that the earlier broader market bull rally may be fading.

Specifically, after an extended period of optimism, market sentiment has shifted, with traders showing doubt. As fear, uncertainty, and doubt (FUD) begin to dominate, Shiba Inu is emerging as one of the projects poised for gains, particularly for those willing to challenge the broader bearish outlook.

Shifting Sentiment and Market Reactions

Santiment’s analysis indicates that crypto assets remain highly speculative, even for established projects like Shiba Inu. It highlighted that historically, markets tend to move in the opposite direction of crowd expectations.

With popular market sentiment becoming cautious and taking on a bearish undertone, Santiment noted that this pattern could present opportunities for investors who resist the urge to follow the general trend.

For instance, Shiba Inu has experienced a 719.81% drop in 1-day sentiment, reflecting an overwhelming degree of investor negativity. This decline emerged as Shiba Inu crashed substantially from its Monday peak of $0.00001929 to just below the $0.000017 mark.

This increased negativity has weakened Shiba Inu’s 7-day sentiment, which now sits at a 2,827% positive change. The change is even more pronounced over a 30-day period, with SHIB’s weighted sentiment remaining positive at just 339.12%.

Despite these large fluctuations in sentiment, 1-day trading volume has decreased by 5.23%, suggesting that traders may be cautious about acting on these rapid sentiment changes.

Negative Sentiment Across Crypto

Shiba Inu’s fluctuations occur alongside a broader trend of negative sentiment within the crypto market. Other high-profile projects, such as ChainLink (LINK), Bitcoin (BTC), and Dogecoin (DOGE), have also seen significant declines in 1-day sentiment.

ChainLink saw a -371.73% drop, while Bitcoin and Dogecoin registered declines of -226.24% and -157.81%, respectively. Even popular meme coins like Pepe (PEPE) were not immune, with Pepe’s 1-day sentiment plummeting by -574.71%.

This widespread negativity signals that many traders may be anticipating further downside risk, although Santiment’s findings suggest that such bearish sentiment can sometimes lead to contrary market movements.

Inflows Indicate Strategic Accumulation

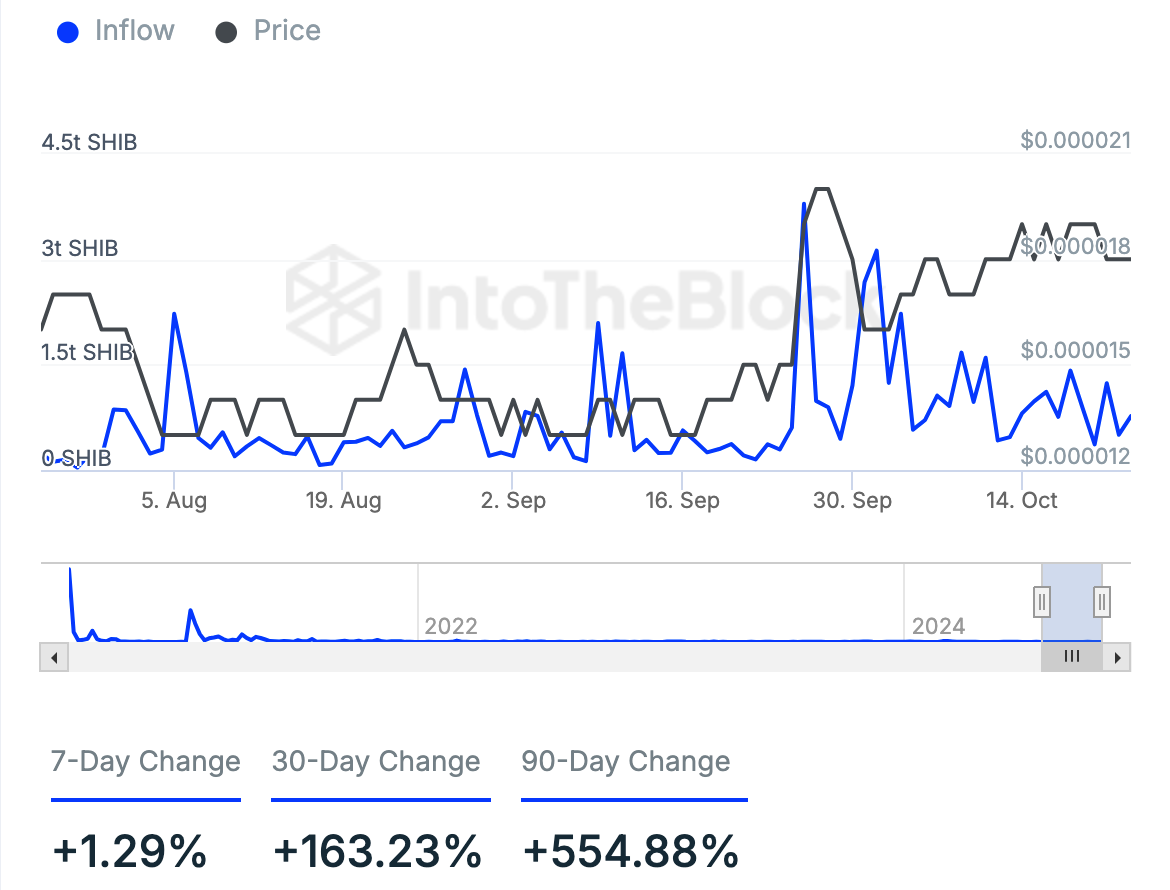

In contrast to the negative crowd sentiment, Shiba Inu has seen significant activity among large holders. Over the past 90 days, large holder inflows have surged by +554.88%, indicating sustained accumulation, suggesting that certain key players are preparing for a potential upward shift.

The 30-day change also reflects a significant +163.23% increase, further suggesting that large holders may be strategically positioning themselves in anticipation of future price movements.

Notably, even in the short term, 7-day inflows have risen by +1.29 %, signaling stable interest from large investors.

thecryptobasic.com

thecryptobasic.com