Solana is showing strong performance, with its Total Value Locked (TVL) hitting a 2-year high and daily DEX volume exceeding $2.4 billion. While bullish technical patterns suggest a rally to $300, recent large token sales introduce the possibility of short-term sell-offs.

Analysts Predict Solana Price Breakout to $300

SOL Price chart offers clues to a possible bullish breakout. CryptoExpertPro highlights three key patterns: the formation of a bull pennant, the formation of a giant cup and handle, and volatility contraction within the current price range.

According to the analyst, the combined technical signals could raise Solana’s price to at least $300 to $400.

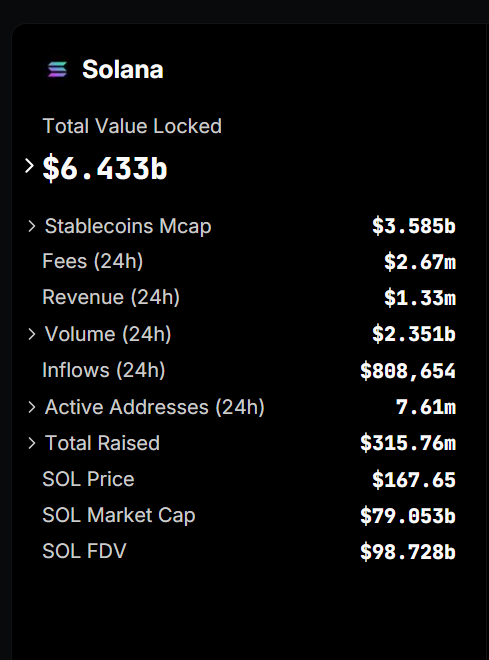

Reinforcing the positive outlook, Solana’s Total Value Locked (TVL) has risen to $6.433 billion, its highest amount since Jan. 2022, contributing to a bullish sentiment. The surge in TVL stems from increased activity within the Solana ecosystem as the DeFi products grow increasingly popular.

Solana’s DeFi Network is further boosted by a stablecoin market cap of $3.585 billion and 7.61 million active addresses within the top 24 hours.

With daily inflows of $808654 and a $2.351 billion trading volume, this is a good sign of rising confidence in the platform. This increased user engagement could fuel Solana’s rise out of the pennant.

Can Solana Sell-Off Amid Token Sales

Solana depicts bullish sentiment. But in recent times, a wave of token sales has kept questions circulating about the impact such sales on SOL.

In recent weeks, a meme coin launchpad built on Solana called Pump Fun has been actively selling large amounts of SOL. Thet sold 40,000 SOL in the latest sales. A further 14,409 SOL has also been sold via a new wallet account. This takes the total SOL sold to 54,409, equivalent to roughly $9.09 million.

These sales have also fueled speculations on whether they are causing short-term price pressure against Solana. Especially at a time when large-scale token sales could temporarily affect price movement.

SOL Price recorded 0.9% gains over the past 24 hours, but at the hourly scale, it’s 1.1% down. This indicates that the market isn’t as confident about the token sales and could be sending mixed signals.

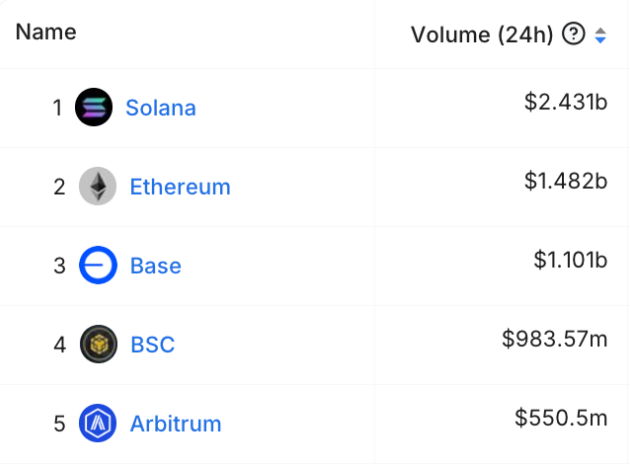

Solana Leads with $2.4 Billion DEX Volume

Decentralized exchange (DEX) activity on SOL remains dominant, with $2.431 billion in 24-hour trading volume, outpacing all other blockchains. This makes Solana rank ahead of Ethereum, which had a volume of $1.482 billion, and Base with $1.101 billion.

We can witness this in that even SOL can process high trading volumes quickly, thanks to its strong infrastructure and increasing user base.

The surge in DEX volume highlights the increasing demand for Solana’s ecosystem, fueling optimism that the network’s token price will rise.

Technical Analysis: SOL Price Eyes $200

SOL Price has strong support at $164. If this support level is maintained, Solana can rally towards $200, the next major resistance zone.

But if the $164 support fails, the bullish trend for Solana may be put to a halt until the $150 support levels are tested in the near future.

Currently, the Relative Strength Index (RSI) is 66.58, which implies positive momentum; however, it’s approaching the oversold region, suggesting a pullback or consolidation in the near term.

The MACD lines are now above the signal lines, at 5.38 and above 3.36. The positive cells in the histogram bars mean that the currency was handily bought, and its momentum is on the rise in favor of further gains.

thecoinrepublic.com

thecoinrepublic.com