Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Blow it all up

The CEO of seminal perps DEX dYdX is back, five months after he resigned from a seven-year stint.

And he’s going full “founder mode.”

Antonio Juliano, a 31-year-old solo founder, told Empire co-host Jason Yanowitz that he went into deep contemplation after he left the project.

In his May blog post, Juliano said that he’d discovered profound satisfaction on a personal level — morphing his motivation for building dYdX from “competition, achievement and winning to creation, connection and passion.” That meant he felt comfortable stepping aside and letting someone else steer the ship.

About one month after leaving, Juliano had a moment where he “didn’t have a great understanding of who I was, or I felt like I had lost it.”

“I think I described it to somebody as ‘I’m going all the way down the blank,’ and in that space, it was scary, but you find more of yourself.”

Juliano realized that his inspiration for creation was fundamentally related to his identity — and the way out was through channeling it towards the continued development of dYdX.

“It’s actually with the perspective of not being here for a while that has brought me a huge amount of clarity on what we need to do. And I actually feel it’s incredibly obvious now: I’m basically just going to blow it all up. We’re going to start over, go into founder mode as they say, to run the company myself.”

(Check out the full Empire podcast episode.)

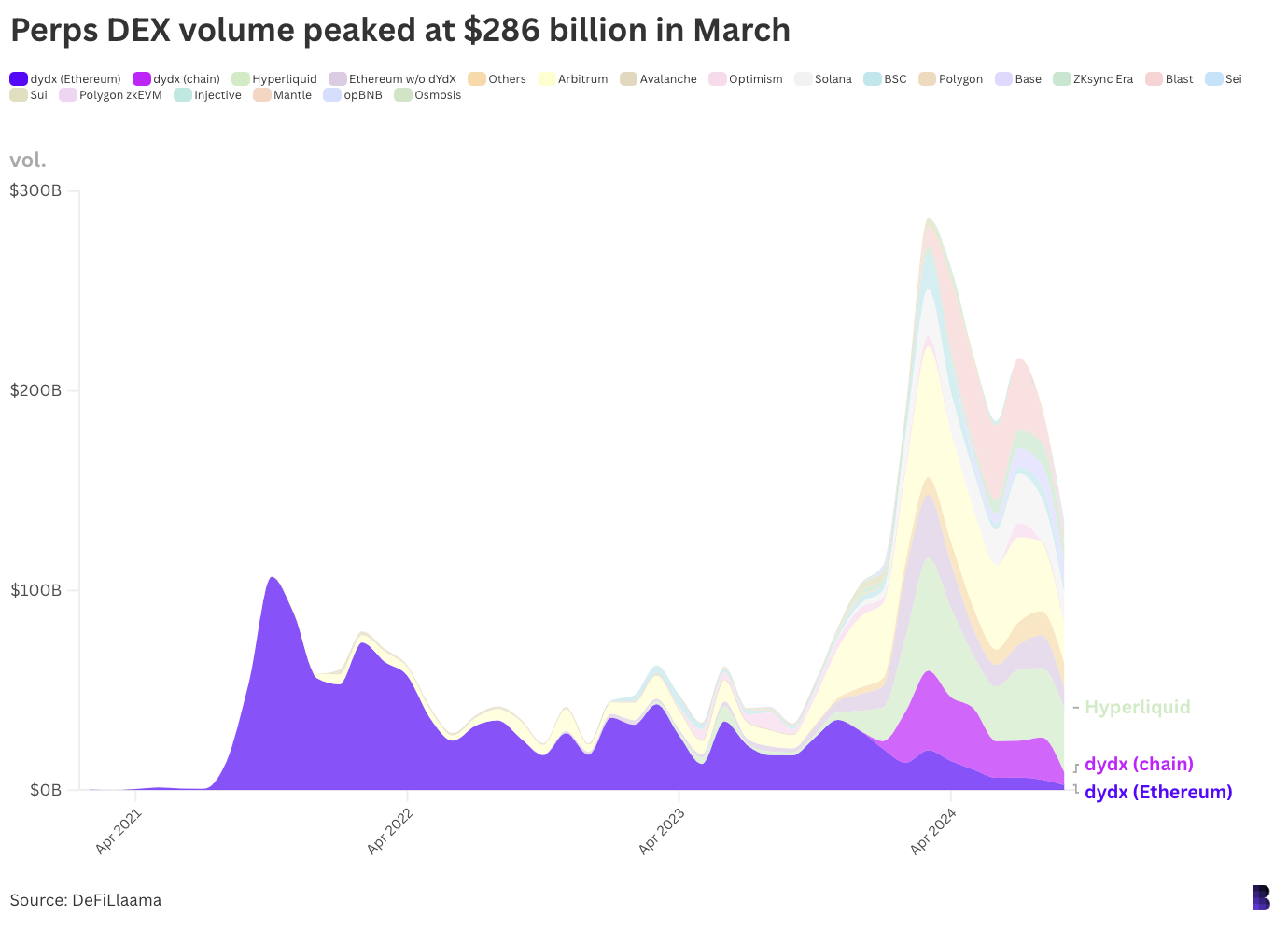

Juliano returns to stiff competition in the onchain leverage space. The term Cambrian explosion — a period of exponential growth in the number of new projects, resembling the sudden generation of complex life 540 million years ago — is thrown about often in crypto. But it directly applies to what has happened with perp DEXs.

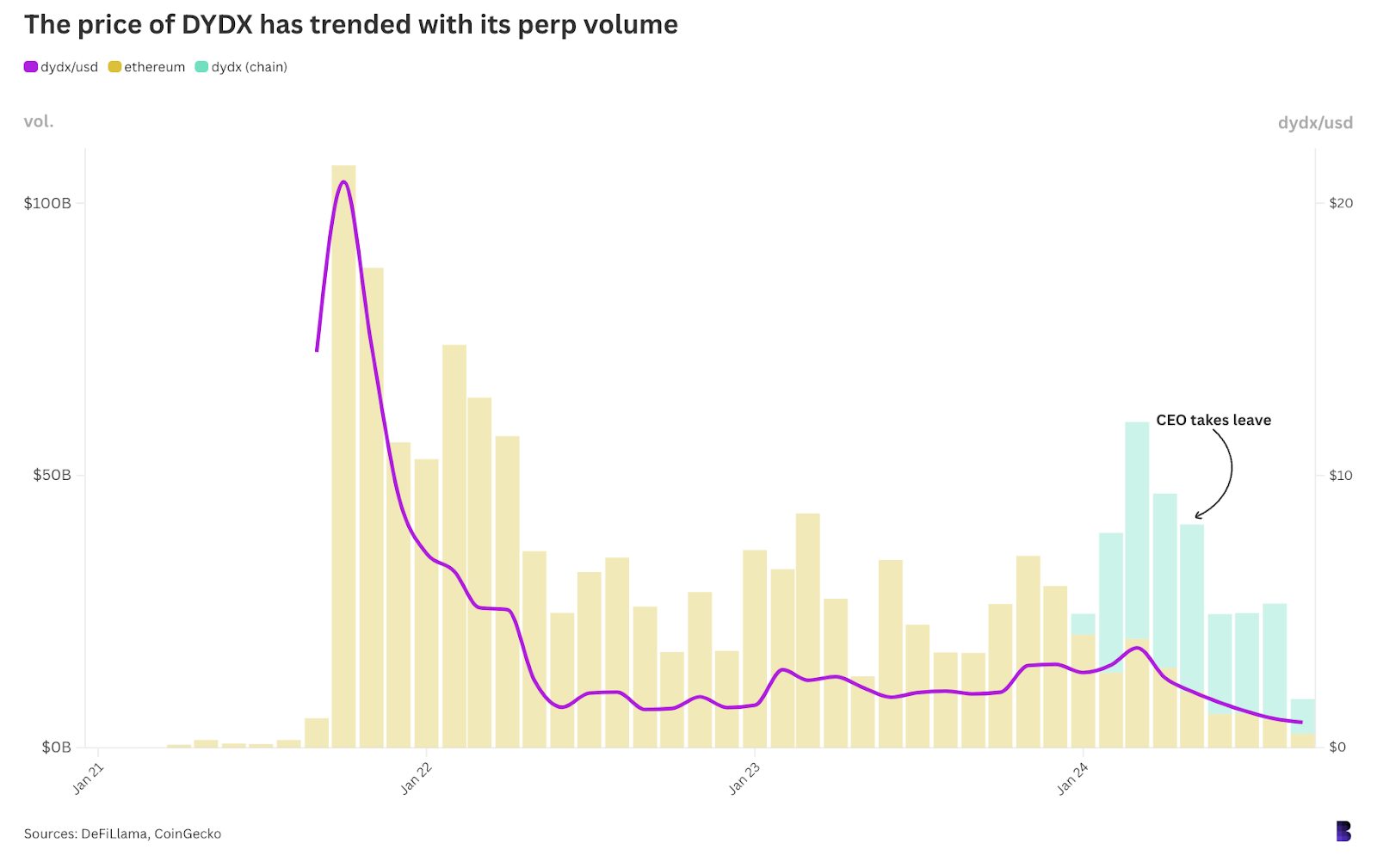

Last year, October saw $33 billion in perps traded on DEXs, and 80% of it occurred via dYdX (it was still native only to Ethereum at that time).

Last month, perps DEXs handled almost $135 billion in volume, per DeFiLlama, with under 7% occurring through either dYdX on Ethereum or its own Cosmos appchain.

The largest venues are now on Arbitrum, which altogether contributed 15% of September’s volume, including GMX and Orderly Network.

Hyperliquid, another app running on its own blockchain, meanwhile handled almost 25% of all perps DEX volume in September, and now plans the rollout of its native token.

Juliano was adamant on Empire that he’d be taking big bets moving forward. I’d say whatever they are, they must be focused on boosting value accrual for DYDX holders.

And if founder mode is worth its salt — as Y Combinator co-founder Paul Graham suggested in a viral blog post last month — then dYdX is on track to be a great case study at the very least.

— David Canellis

Data Center

- BTC has retreated from its potential retest of $70,000, now chopping between $68,000 and $66,700.

- ETH is down 2.5% in the past day to $2,640.

- MKR, WLD and ENA are among the worst hit in the past week, dropping between 16% and 8.4%.

- TON’s stablecoin supplies have grown 13% over the last seven days to $868.6 million.

- DEX volumes (not perps) have gone up 13.4% week-on-week, with Solana’s Raydium gaining over 50%.

Purchasing power

Two deals.

First, we have the Stripe/Bridge deal, which has obviously taken up the lion’s share of attention given that the deal is reportedly worth $1.1 billion.

TechCrunch co-founder Michael Arrington said the deal was done over the weekend before Bridge confirmed it on Monday.

Then there’s Komainu, the Nomura-backed custodian, which made its first acquisition. Unfortunately, it didn’t disclose the sum it paid for Singapore-based crypto custodian Propine.

The two M&A deals are wildly different. The Stripe/Bridge deal, if we had to make a comparison, is more like Robinhood buying Bitstamp than Komainu buying up a competitor. However, the deals show two things: Firms are looking to spend money to build strength in an area, and certain companies may start looking to consolidate within their space.

Perhaps it’s too early to judge the overall appetite, to see whether more deals will pop up. So instead, let’s take a look at how M&A’s been doing so far this year.

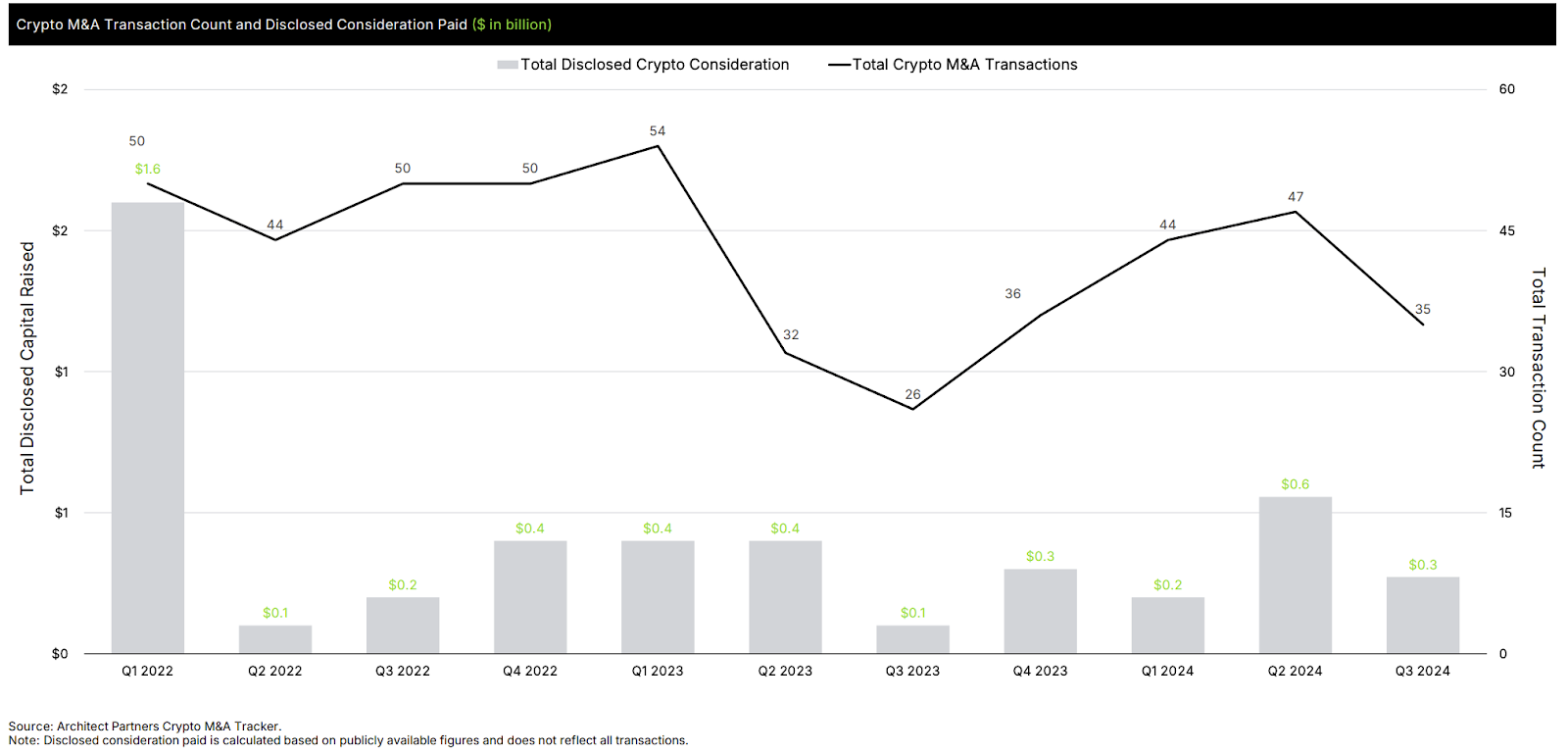

Earlier this month, Architect Partners released its M&A takeaways in its review of the third quarter.

Bitcoin mining has been the prime sector for M&A so far this year, which isn’t terribly surprising post-halving. We’ve seen Bitfarms buy up Stronghold, and Riot infamously tried to initiate a hostile takeover of Bitfarms.

What’s interesting is that Architect found crypto wasn’t alone in the weakening M&A department, with both fintech and technology suffering in the third quarter.

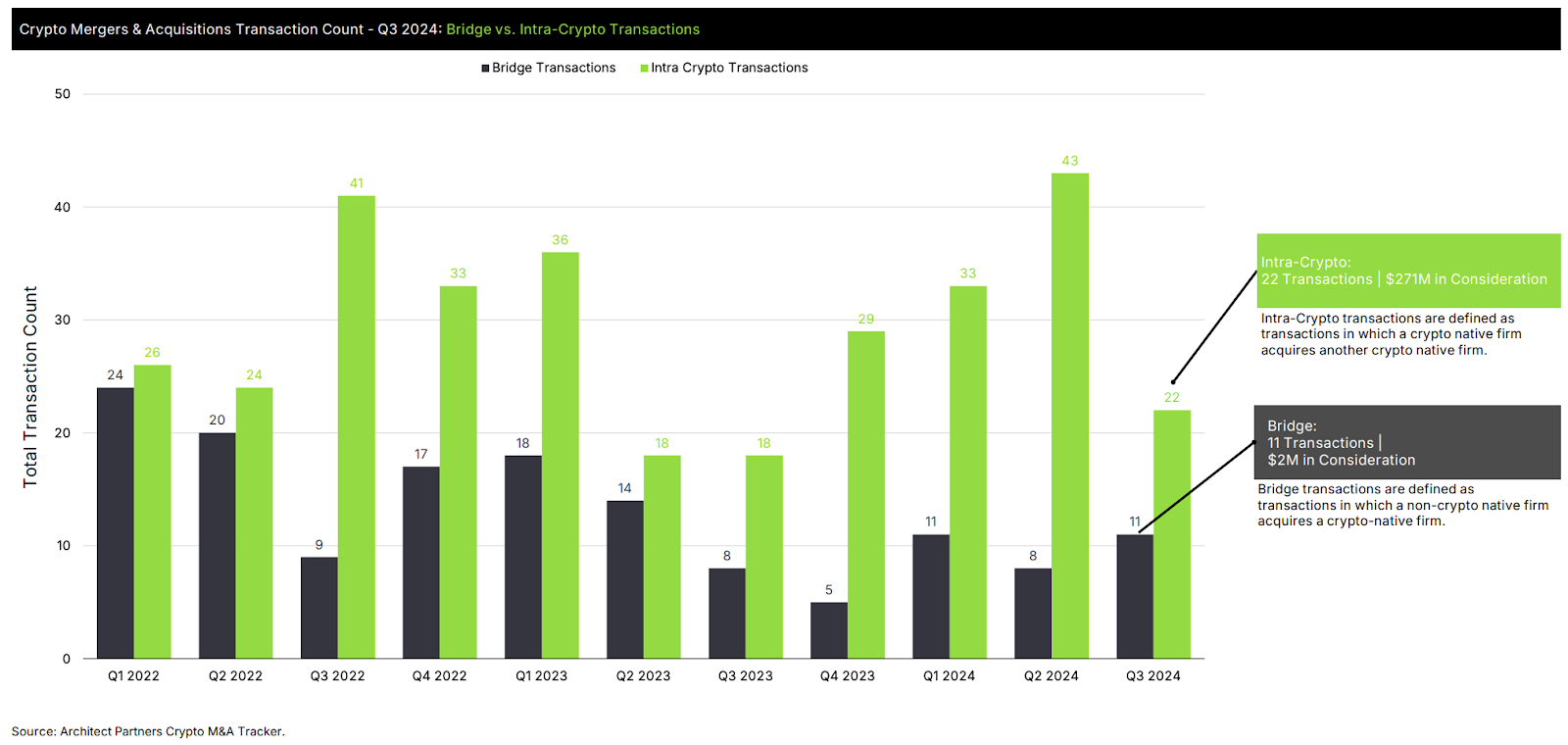

Anyway, last quarter saw 35 deals on the table, with the majority taking place in firms focused on investing, trading or infrastructure.

Of that total sum, 22 deals were intra-crypto — meaning that a crypto firm bought up another crypto firm. Only 11 were what Architect calls “bridge deals,” where a non-crypto native firm buys up a crypto company.

In traditional M&A, meaning outside of crypto, there tends to be a bump in activity toward the end of the year for a few reasons. Firms have capital to spend and, if we’re specifically looking at this year, the Fed’s decision to aggressively cut rates back in September could give some companies incentive (borrowing costs are lower for firms, making M&A more appealing).

Whether that translates to crypto is still uncertain. But a deal reportedly worth $1.1 billion may just put the wind back in some sails.

— Katherine Ross

The Works

- Tether-backed Northern Data is mulling the potential sale of its bitcoin mining unit.

- Legal & General, a UK-based pension manager with $1.5 trillion in assets under management, is considering tokenization opportunities.

- Ripple co-founder Chris Larsen said he donated over $10 million in XRP to the Kamala Harris campaign.

- Rune Christensen, the founder of Sky (formerly Maker), teased the potential rebrand back to Maker in an X post on Monday.

- Open interest on CME’s bitcoin futures hit an all-time high of $12.26 billion.

The Riff

Q: Is crypto ‘fintech’ now?

Fintech is so broad that I think this could be an argument some make. I don’t know if I wholly agree with it, but I’m not the judge or jury for these types of things.

What I can say is that crypto and fintech have a lot of overlap and that could make for a very interesting relationship between the two going forward.

Stablecoins are an obvious example, but there’s also the fact that crypto can benefit payment processing. Not to mention that if the retail appetite for crypto really makes a comeback then the lines between the two are ever more blurry.

I’m not sure I’m behind it enough to say the two are intertwined at this stage but check back in a few years. Maybe I’ll be ready then.

— Katherine Ross

This debate is what urges the pedantic diehard purist in me to reject stablecoins as crypto’s “killer app.”

Setting aside the treasury management that comes with issuing stablecoins — which has more in common with traditional finance — the major stablecoins like USDT, Circle and PayPal USD, are all essentially fintech products, in that they enable digital dollars to be sent back and forth.

Those digital dollars can be seized or otherwise hijacked upon request from authorities, just like dollars in neobank accounts. Stablecoins are then only really interesting because they exist on blockchain rails, and because they’re ultimately accepted by the “real” crypto apps, like wallets and DEXs.

The purist’s logic would go something like this: Stablecoins are arguably one of blockchain’s killer apps — alongside Bitcoin and smart contracts — but they’re not really a “crypto app” in and of themselves, because they don’t share all the properties of cryptocurrencies like bitcoin, ether or sol.

Luckily, nobody really pays attention to purists anymore.

— David Canellis

blockworks.co

blockworks.co