Cardano (ADA) has been in a downtrend since March, forming lower highs and lower lows. Amidst broader market corrections in August, it also lost its position in the top 10 cryptocurrencies by market cap.

At press time, ADA was trading at $0.361 — the last 30 days have seen prices increase by 2.55%, bringing year-to-date (YTD) losses down to 39.09%.

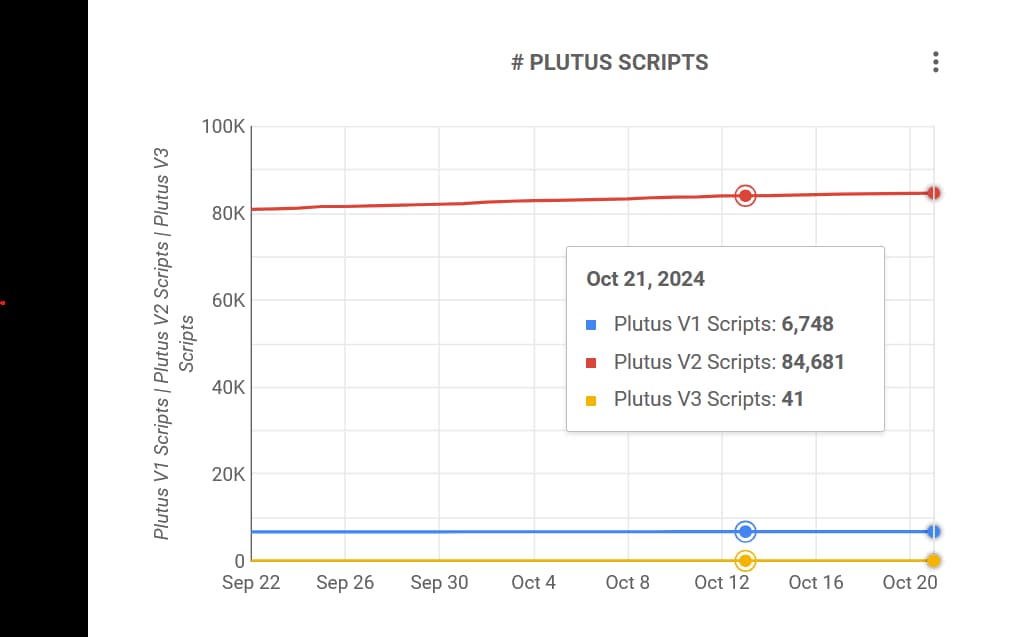

While it hasn’t been a good year for the token thus far, there are some promising developments — Cardano’s smart contract capabilities have skyrocketed this year — going from just 8,083 Plutus scripts to 91,470 at the time of writing.

Sure, that is a good sign — but it’s unlikely to have an effect on price action in the near term. But recently published technical analysis points to the possibility that ADA could in fact see a swing to the upside soon.

Does this ADA Cup and Handle mark the beginning of a rally?

Starting on October 15, Cardano entered a cup and handle chart pattern, as noted in a TradingView post by popular trader Willmangalus.

At first glance, everything seems in order — a relatively even cup, volume slowing down as the bottom of the cup is reached, and a retracement in the handle that has not gone down enough to invalidate the pattern.

On top of that, volume is rising as we enter the ‘handle’ portion of the pattern — another sign of legitimacy.

However, the basic premise might be a bit faulty — this entire chart pattern has formed over the course of a week. As a rule of thumb, legitimate cup and handles take multiple weeks — at least 6 or 7, to form.

That’s not to say that willmangalus’ prediction won’t necessarily come true — chart patterns are not foolproof, and when we discuss these factors for confirmation, we’re talking about probabilities.

The trader set a stop loss at $0.338 — while his take profit target is $0.394. If ADA price levels reach that mark, he will have made a tidy 9.14% gain — while triggering the stop loss would equate to a 6.37% loss.

While the price target is relatively conservative, other analysts, such as TradingShot, point to a recent bullish cross as a strong buy signal — one that could see ADA price reach as high as $5 in the longer term.

It remains to be seen if the chart pattern will play out — although it hasn’t been invalidated at the time of publication, the last couple of hourly candles on the chart are decidedly bearish.

finbold.com

finbold.com