Since the start of 2024, gold has been the commodity in investor focus thanks to the relentless rise that enabled the precious metal to hit multiple new all-time highs (ATH) and even outperform the benchmark S&P 500 index year-to-date (YTD).

On October 22, Robert Kiyosaki, a prominent investor and the author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ took to X to remind his followers that gold is not all that glitters.

Indeed, Kiyosaki urged his readers to turn to the other major precious metal, silver, before it rises too much. To be specific, the author simultaneously predicted silver will continue its rally – which has, in fact, been greater than gold’s YTD – and, at the very least, reach $50 per ounce.

Still, despite climbing approximately $11 from its January prices, it is worth remembering that the precious metal struggled to decisively break above $30 for months – between May and September, it traded between roughly $27 and $31 – and has only recently rallied higher.

Such a trend equally signals the strength of the ongoing uptrend and its potential instability.

For the time being, however, recent developments in the commodity’s price action indicate the ongoing uptrend will persist. On October 17, technical analysis demonstrated that silver is set for a major rally as it was, once inflation is factored in, already at an ATH.

Just two days later – and even without factoring in the dollar’s devaluation – the precious metal broke above its 12-year high, signaling the expected – and current – rally is well underway.

How have Kiyosaki’s recommended assets performed in 2024?

Finally, despite the ambitious implied price target, Kiyosaki’s recommendation for silver is backed by the historical example of assets he had been bullish about.

The famous author did not turn optimistic about silver during the recent upward surge but has been promoting the precious metal as a savvy investment for years. The same can be said for his other two favored assets, gold and Bitcoin (BTC).

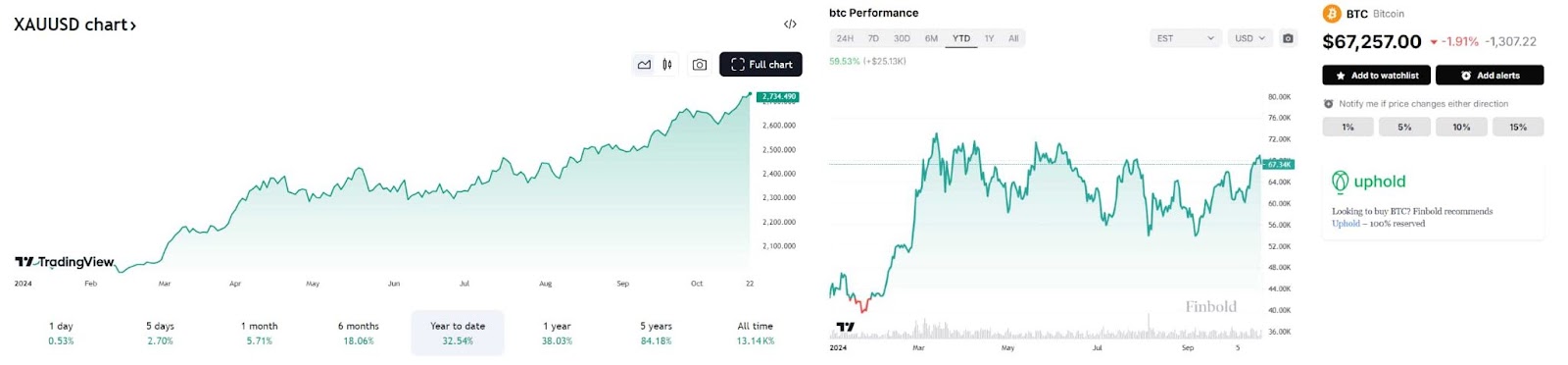

Both of these assets experienced major price jumps just in 2024 and have found new ATH prices – gold above $2,730 and BTC above $73,000 – during the year

Still, at press time, the cryptocurrency is trading below the said high and has only recently reignited the hopes it would again breach it, while gold has been on a record-breaking run in recent weeks.

In total, gold has rallied 32.54% YTD and BTC is up 59.53% within the same time frame to its press time price of $67,257.

finbold.com

finbold.com