The number of large transactions around some of the leading cryptocurrencies significantly increased as the market witnessed a notable correction.

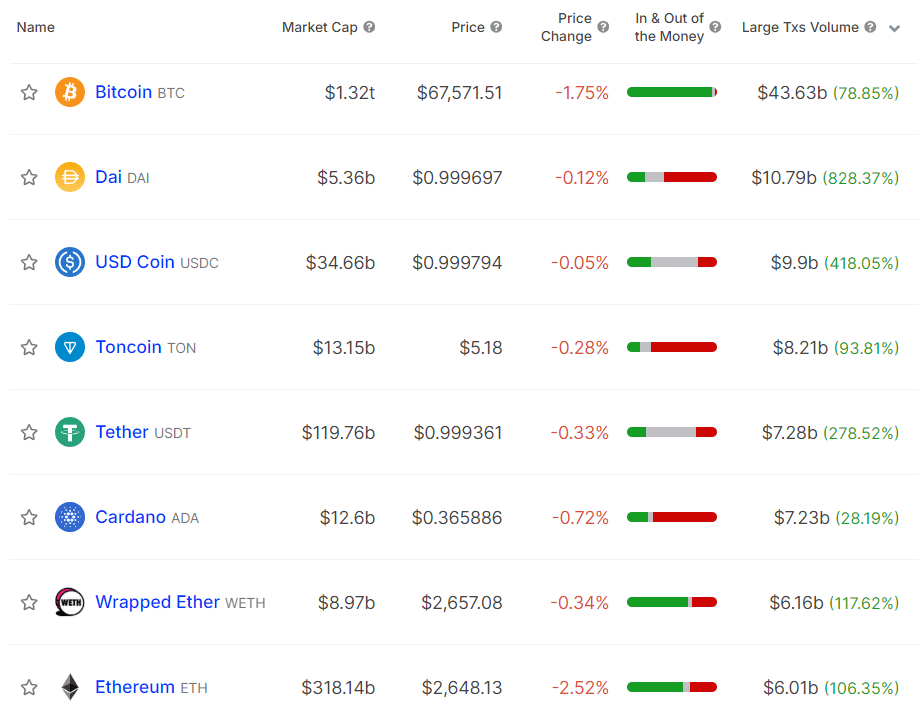

According to data provided by IntoTheBlock, Bitcoin (BTC) leads the chart with a large transaction volume of $43.63 billion on Oct. 21. The leading crypto asset declined 2.2% and is trading at $67,500 at the time of writing.

However, addresses holding Bitcoin for over a year increased their balance by 0.05%, reaching $856.23 billion, despite the price drop.

Toncoin (TON) saw a 93% surge in its whale transactions yesterday, reaching $8.21 billion. Considering TON’s $13 billion market cap, this amount of whale activity could hint at panic and uncertainty among investors.

Cardano (ADA) whale transactions increased by 28%, reaching $7.23 billion. Wrapped Ether (WETH) recorded a 117% rally in its whale transactions, reaching $6.16 billion. ADA and WETH holders are also wandering in uncertainty amid the market-wide selloff.

The whale activity around Ethereum (ETH) also doubled to $6 billion. ETH, quite similar to BTC, witnessed a 0.04% hike in its long-term holder balance—currently at $288 billion.

There has also been a significant increase in stablecoin whale activity, according to data from ITB. Data shows that USDC and DAI are seeing increased exchange outflows as well. This momentum usually hints at an overheated market and whales take a step back to look for buying opportunities.

According to data provided by CoinGecko, the global crypto market capitalization declined by 3.1% in the past 24 hours, currently at $2.44 trillion. The daily trading volume, however, surged from $90 billion to $118 billion in the same timeframe.

The recent market-wide correction would be considered natural since the bullish momentum was majorly triggered by the “Uptober” trend and greedy traders.