Celestia (TIA) exhibited a bullish stance on Monday, up 4% over the past day as Bitcoin flirts with the $70,000 mark, currently changing hands at $69,020.

Meanwhile, ecosystem developments show TIA could fail to capitalize on the much-awaited “Uptober” rally.

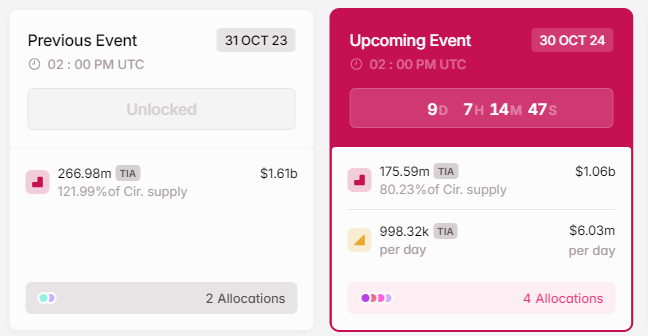

The crypto project will unlock 80.23% of Celestia’s circulating supply (valued at approximately $1.06 billion at the token’s current price) on 30 October.

The enormous release has triggered worries of magnified selling momentum, which would translate to declined TIA prices.

Celestia uptrend threatened as massive token release nears

The blockchain project is preparing to unlock over 175 million tokens in less than ten days.

That has shifted attention to its native coin, TIA, which remains poised for notable volatility in the upcoming sessions.

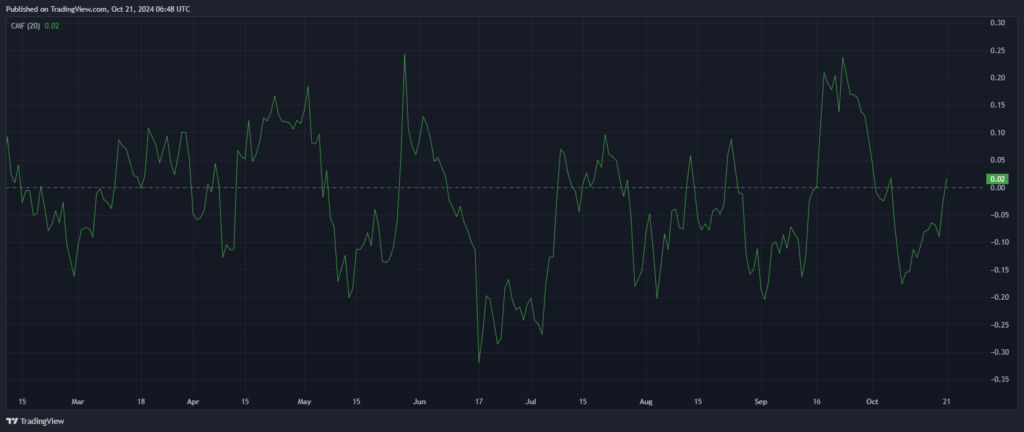

The Chaikin Money Flow Indicator supports the potential price dip, signaling a drop below the $5 mark.

The CMF tracks cash flow in and out of a crypto asset. A positive figure suggests an upside stance, whereas negative values indicate bear dominance.

TIA’s CMF has declined in the past month, down from 0.23 on 23 September to -0.18 on 9 October before reversing to press time levels of 0.01.

That underscores reduced cash flowing into the Celestia ecosystem.

Meanwhile, the upcoming token unlock could trigger downward resumptions as more players pull out to escape magnified selling pressure.

Further, the altcoin printed a head-shoulder formation – a pattern that signals potential trend reversals.

Significant declines often emerge when the token’s price dips beneath the setup’s neckline. Such a move would plummet TIA beneath the $4.73 neckline.

The altcoin could endure a 56% plunge from its current price of $6.04, taking TIA toward the $3.87 low.

Celestia’s current price outlook

TIA trades at $6.04 after gaining 4% on its daily chart. While the 80% uptick in 24-hour trading volume indicates bullish dominance and upside continuation, the upcoming $1.04 billion token unlock could postpone the upward party.

Bears will likely emerge days leading to the massive token unlock event as magnified supply inspires selling activities.

Enthusiasts should watch the pattern’s neckline at around the $4.73 mark. Continued weakness at this barrier will call for the $3.87 price tag, plummeting Celestia’s current value by 56%.

However, stability above $4.73 could encourage bullish activity. That could see TIA climbing to $7.30 before a potential buying pressure propels it to $10.40.

Enthusiasts will likely watch how the upcoming token release will impact TIA’s performance during and after the much-awaited October rallies.

The post Celestia to release over 80% of circulating supply in ten days: what’s next for TIA price? appeared first on Invezz

invezz.com

invezz.com