In October, the $HNT price experienced a significant drop of nearly 30% from its supply zone. This strong selling momentum easily broke through the 20-day and 50-day EMA bands. It reached the 200-day EMA level by mid-month.

In the past two days, the Helium crypto price has demonstrated a recovery, surging by 12%. The 200-day EMA on the daily chart supports this rebound.

What Influenced the Optimism in $HNT Price?

This $HNT price surge was driven by multiple factors, including Helium’s strategic partnerships aimed at enhancing its ecosystem.

On October 9th, Helium announced a strategic partnership with Ameriband to deploy over 100,000>

“Through this partnership, the Helium Network is expanding by adding Ameriband’s 100,000+>

gm, @Grayscale https://t.co/kbBSOywe9o pic.twitter.com/0av7X9ZNBs

— abhay 🎈 (@abhay) October 11, 2024

Additionally, on October 17th, per the 2024’s, a16z crypto’s State of Crypto report highlighted Helium’s prominence, featuring 4 out of 6 major DePINs.

These positive developments within the Helium ecosystem have boosted the Helium crypto price, indicating strong potential for future growth.

How is the $HNT Price Performing on the Daily Chart?

The $HNT price has started recovering over the past two days. It found support from the 200-day EMA on the daily chart.

Despite this rebound, the Helium Network Token’s price remains 42.50% below its all-time high (ATH). Although there are indications of a possible breakout rally, the market remains wary, especially around the $8 mark. That’s a significant resistance level for the $HNT crypto to overcome.

In the past week, the Helium crypto price has seen a 14% correction and has declined by 30% since September. The 50-day EMA indicates a bearish trend, while the 200-day EMA remains a support level, underscoring a period of uncertainty for Helium.

Additionally, the RSI is nearly neutral at 45, suggesting a balance between buying and selling pressure.

This crypto could retest the $6.525 resistance level in the short term if the bullish momentum returns. If it manages to hold above this threshold, it could pave the way for $HNT price to target its upper resistance range of $8 to $9 in the coming weeks.

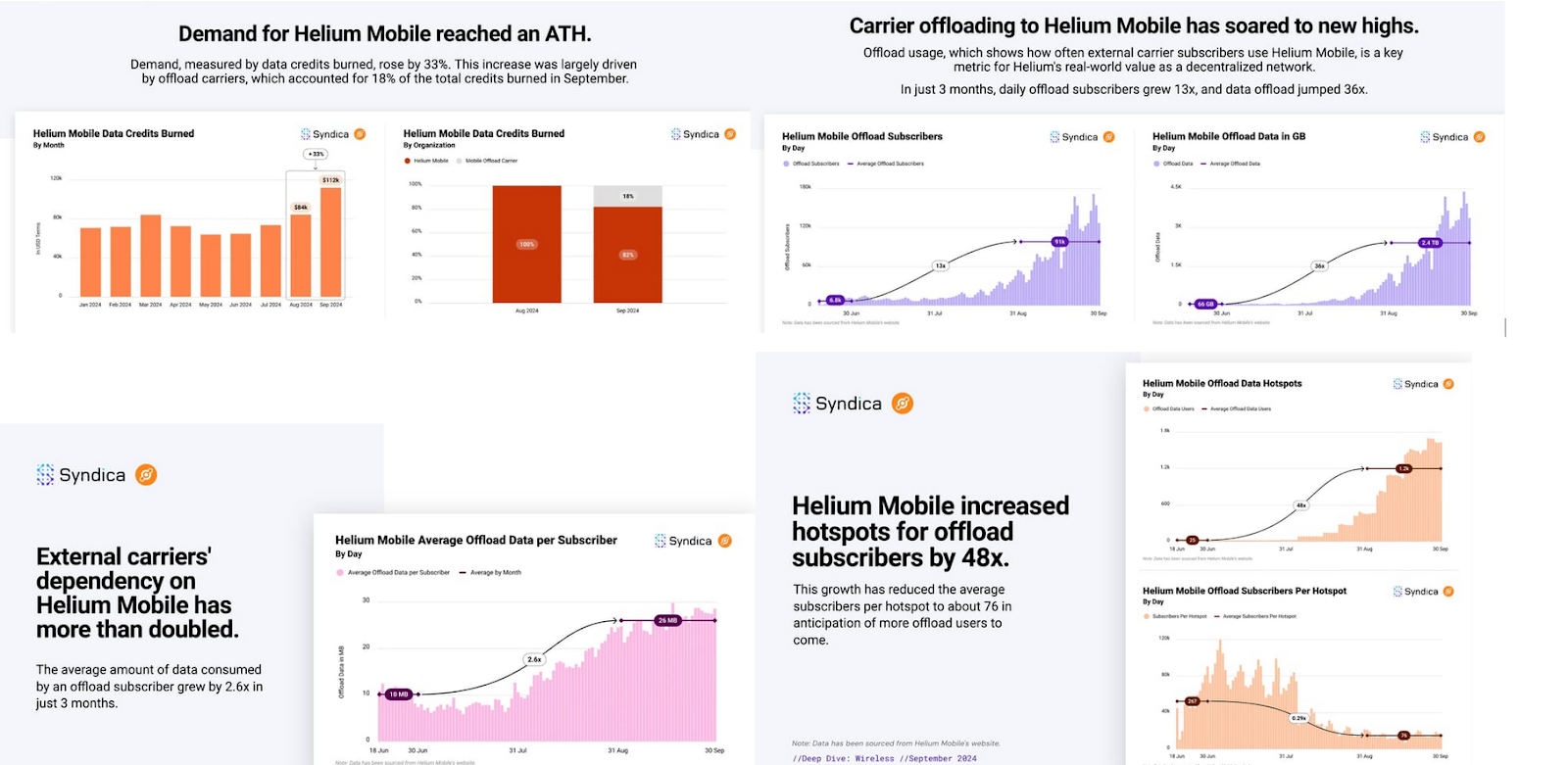

Syndica Report Highlights Helium as a Top Tier DePIN Leader

According to their report, Data Credits burn rose by 33%, daily Helium Network subscribers increased 13-fold in three months, and data transferred on the Helium Network surged 36-fold. These figures reflect growing optimism in the Helium ecosystem.

The report underscores the increasing demand and practical application of the Helium Network as it expands swiftly. It also demonstrates that community-driven infrastructure can grow more rapidly than centralized systems.

How Efficiently the Helium Ecosystem is Expanding?

Helium Mobile has solidified its standing and made notable progress in the telecommunications industry. $HNT price has exhibited a positive trend, driven by Helium’s compelling DePIN narrative.

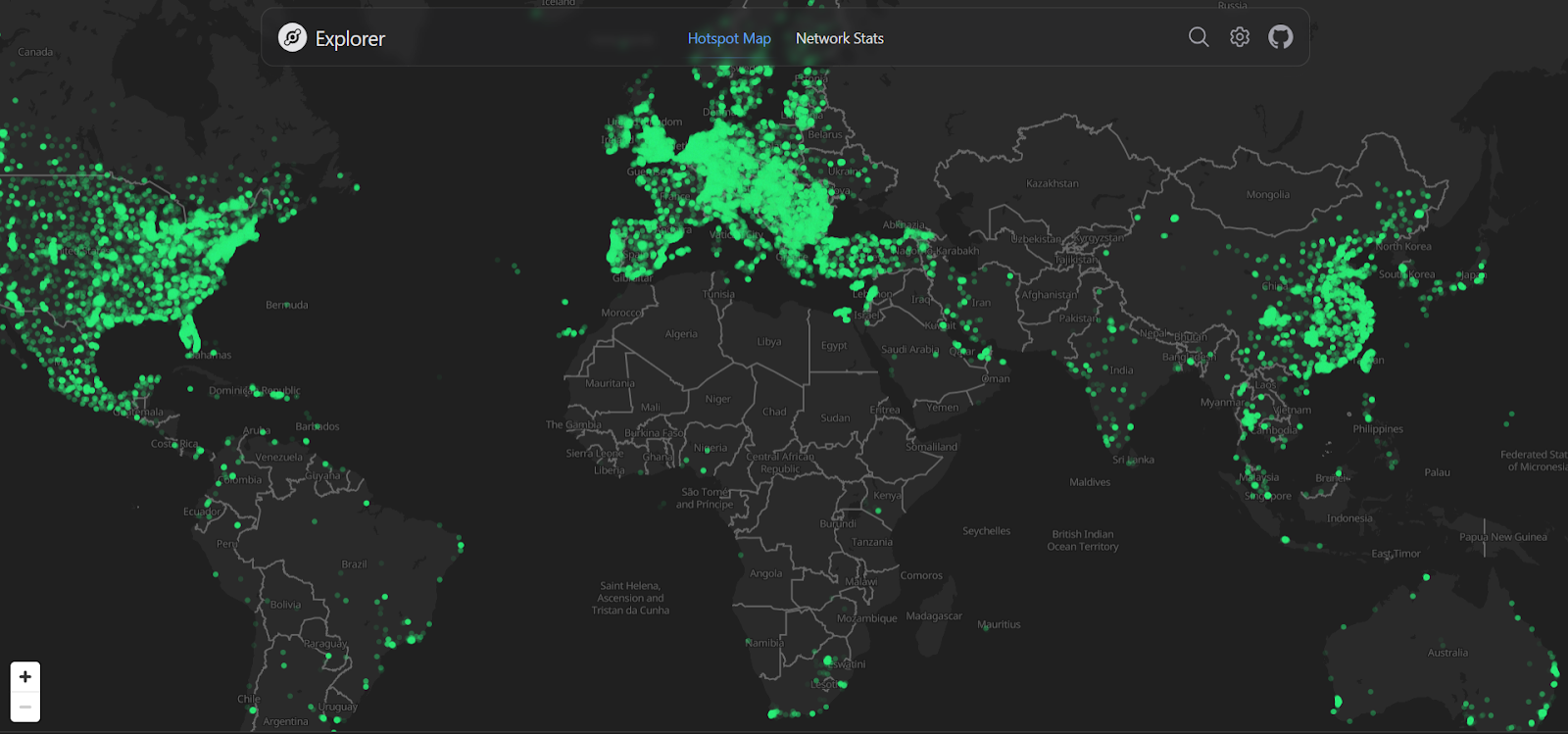

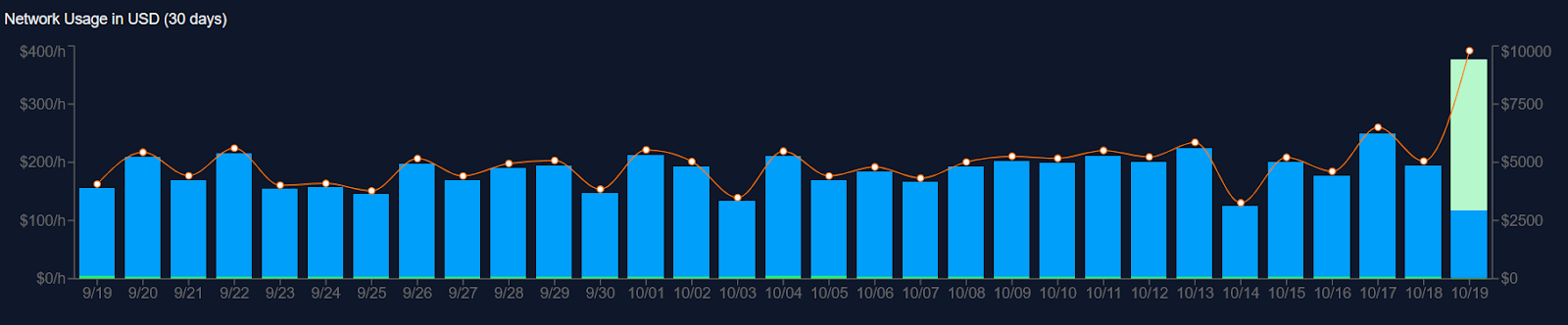

According to the Helium website, the Hotspot map indicates significant network growth with promising potential. Over the past 30 days, Helium Mobile network usage has advanced. The estimated daily total usage of the network has reached approximately $9403.72 as of October 19th.

Network statistics indicate that there were 354,483 active Helium IoT Hotspots at the time of writing. Additionally, the Helium Mobile network had 18,135 active hotspots.

thecoinrepublic.com

thecoinrepublic.com