Just in time for the second half of ‘Uptober’, the month that historically sees the best performance of the cryptocurrency market, professional crypto analyst Michaël van de Poppe has readjusted his holdings. The expert, who believes that the bull market still has a ways to go, has been investing in altcoins after divesting from Bitcoin (BTC) back in May.

In a YouTube video posted on October 17, van de Poppe shared his latest portfolio changes — focusing on newer altcoins that he sees as having a stronger growth potential compared to older, more established coins and tokens.

Coins that Michaël van de Poppe is holding

The expert continues to hold 4 altcoins from his previous portfolio recommendation — Optimism (OP), Celestia (TIA), Bittensor (TAO), and Ethereum Name Service (ENS).

van de Poppe’s approach hinges on these coins — his thesis is that the gains accrued from newer, more volatile altcoins should be used to increase positions in either these four coins, Sui (SUI) in the case of traders with higher risk tolerance, or even BTC and Ethereum (ETH).

While he is generally optimistic regarding this ‘old batch’ of coins, he has doubled the number of holdings in his portfolio in search of outsized returns.

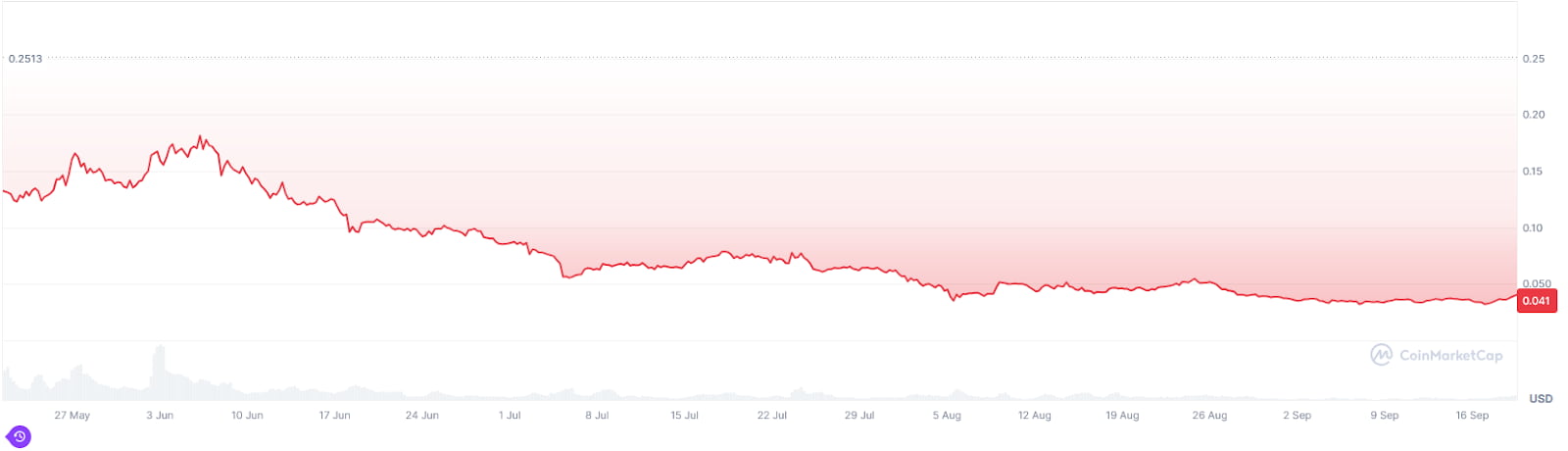

#1 Renzo (REZ)

Renzo is a lesser-known asset — at a total market cap of $67 million, it has not yet reached broader recognition, although it has started to trade on major exchanges.

The analyst noted the cryptocurrency’s 18 cent high on June 6, which occurred after listing — and recommended that traders should start exiting their positions once that price point is reached again.

At press time, REZ is trading at $0.04135 — having rallied by 15% over the course of the last 30 days.

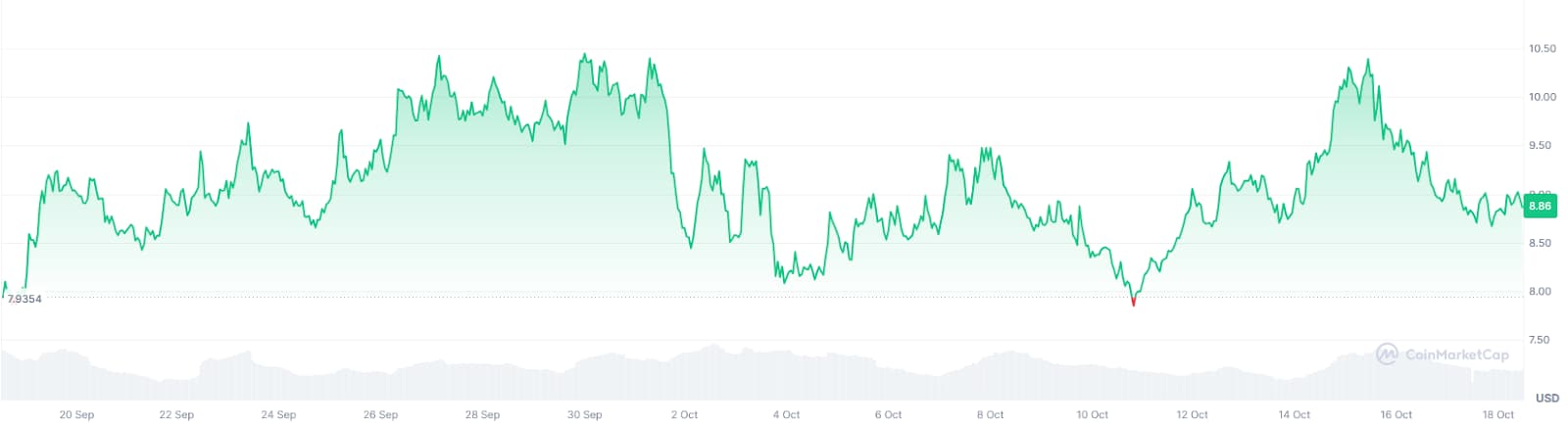

#2 Omni Network (OMNI)

Designed with the goal of making seamless cross-chain communication and transfers possible by connecting all Ethereum rollups, the Omni Network (OMNI) token was launched on April 17. At press time, it has a market cap of $81 million.

Since then, it has exhibited a lot of volatility — although it is currently trading at $8.87, up 10.74% on a monthly basis, the token has hit four $10.40 peaks within that time frame. As of yet, van de Poppe has not shared a profit-taking target for OMNI, although we expect he will do so in a future update.

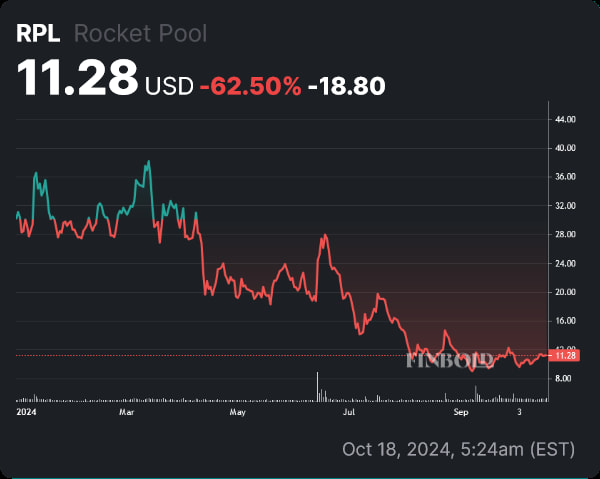

#3 Rocket Pool (RPL)

Rocket Pool (RPL) is an outlier in this list — the proof-of-stake token has been around for some time, and it remains a strong contender in the decentralized staking ecosystem. Accordingly, it has a higher market cap — currently around $234 million.

At press time, RPL is trading at $11.28 — the token is down 72.08% year-to-date (YTD). It’s in the middle of a significant rally — prices have gone up 20.82% over the last 30 days, but it hasn’t been a smooth ride —with a noted 25% plummet from September 28 to October 3.

In terms of price targets, the crypto expert focused on price action from March to June as a reference point. That period saw two pronounced peaks — with prices reaching $38 and $27, respectively, on temporary surges.

van de Poppe took the average of these two points as a price target — and is recommending selling once prices reach approximately 33% — which would represent a 300% increase from current prices.

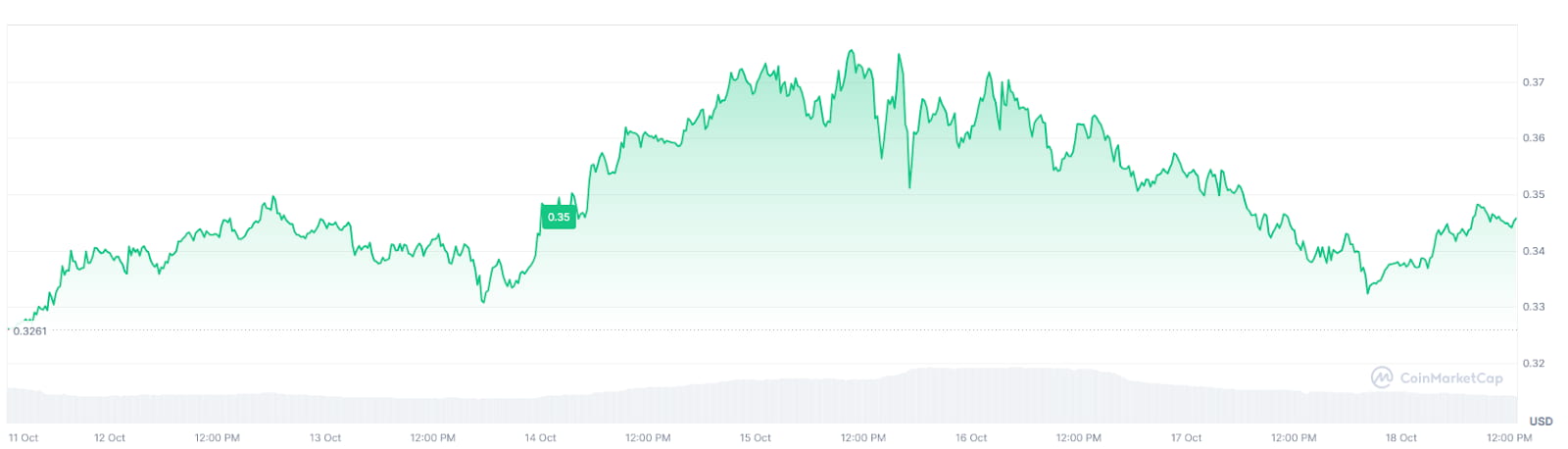

#4 Aevo (AEVO)

A relative newcomer, Aevo (AEVO) was first listed on major exchanges in March. The token is tied to a trading platform that deals in decentralized derivatives and currently maintains an impressive $304.5 million market cap.

Since listing, AEVO prices have dropped by 87.69% — back in August, the crypto analyst pointed to technical analysis which indicated a potential reversal in the making. At the time, AEVO was trading at $0.3731 — at press time, it was trading at $0.3455, having rallied by 5.89% over the last seven days.

Conclusion

van de Poppe’s thesis is simple — older, more established altcoins are less likely to see outsized gains again — newer altcoins have a much better chance, and those gains should be secured at previous highs and transferred to more stable assets.

However, the analyst did caution that when these new altcoins see a 30% to 50% correction after once again reaching recent highs, traders would be wise to take advantage and enter new long positions.

finbold.com

finbold.com