Stellar Lumens token drifted upwards, reaching its highest level since Oct. 1, as the Meridian Conference continued.

Stellar (XLM), one of the biggest cryptocurrencies, rose to $0.096, pushing its market capitalization to over $2.8 billion. The main catalyst for the token’s rise was the announcement of a new partnership between the Stellar Foundation and Mastercard, the fintech giant valued at over $474 billion.

This partnership will see Mastercard integrate its Crypto Credential solution on the Stellar network. The solution, which helps verify interactions between consumers and businesses using blockchain, will be embedded within the Stellar network.

Today at #Meridian2024 in London, we announced a new partnership with @Mastercard to integrate the company’s Crypto Credential solution with the Stellar network. https://t.co/twivBHsrpt

— Stellar (@StellarOrg) October 15, 2024

Mastercard becomes Stellar’s second major partner after MoneyGram. Stellar’s partnership with MoneyGram enables users to send and receive the USDC stablecoin in thousands of retail outlets globally.

Stellar is one of the top blockchains on the USDC network. According to Circle’s website, over $176 million USDC coins circulate on the network.

Stellar has also partnered with Franklin Templeton, an asset manager with over $1.5 trillion in assets under management. Through this partnership, the company launched the Franklin OnChain U.S. Government Money Fund, which has accumulated over $435 million in assets.

Stellar token also rose after the developers partnered with Dune Analytics, one of the biggest data networks in the crypto industry. Data on the network shows that Stellar’s network has completed over 4.12 billion transactions, while the number of users in the ecosystem has jumped to over 26 million.

A key challenge for Stellar holders, however, is the potential for more dilution in the coming years. XLM has a total circulating supply of nearly 30 billion tokens compared to the maximum supply limit of 50 billion.

Stellar lumens has hit resistance

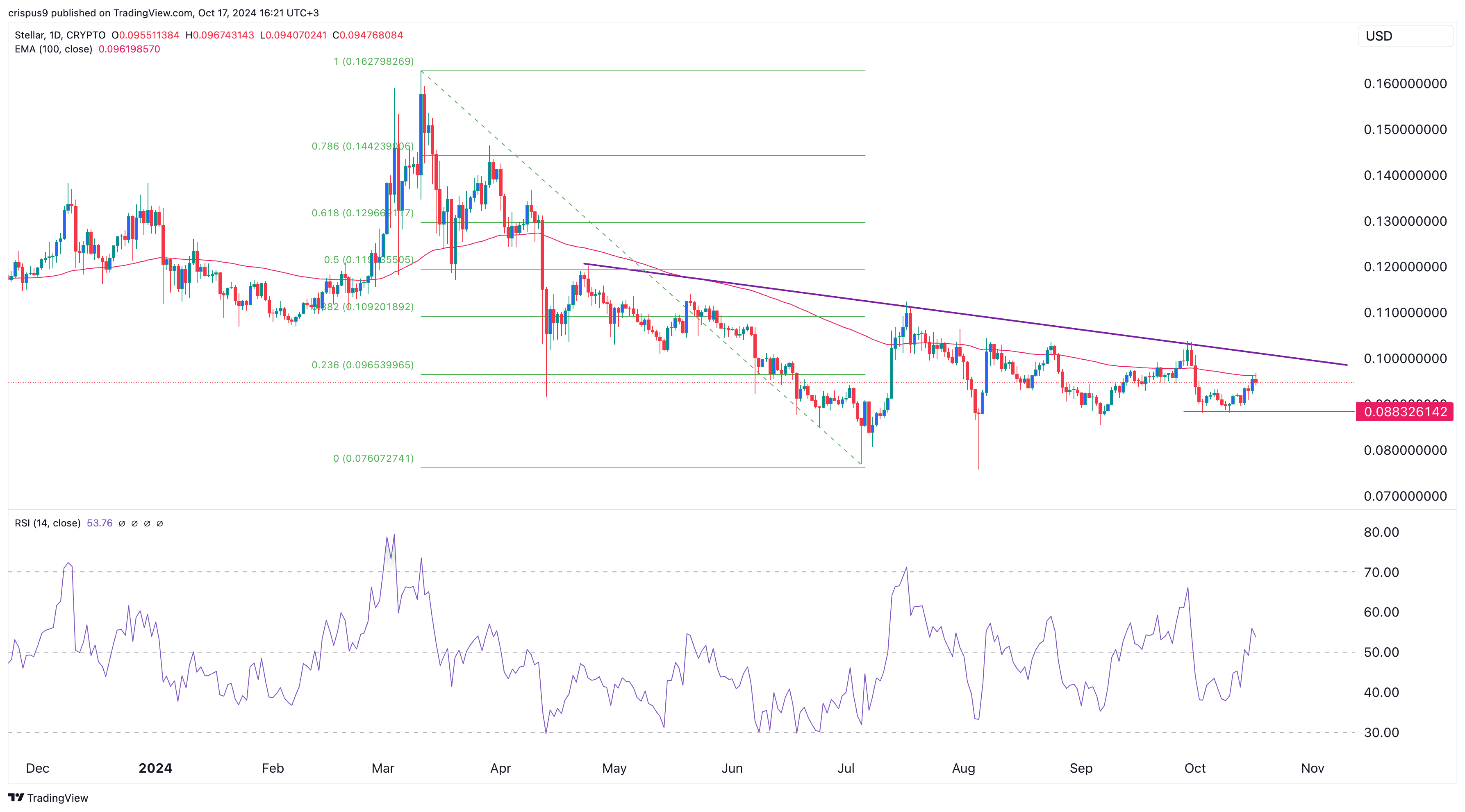

The Stellar XLM token has gradually risen after bottoming at $0.0883 on Oct. 3. Its rebound has faced significant resistance at the 100-day moving average and the 23.6% Fibonacci retracement level at $0.096.

On the positive side, the Relative Strength Index has crossed the neutral level of 50, indicating some momentum. The token has also formed an inverse head-and-shoulders pattern, a popular bullish indicator.

Therefore, Stellar’s gains will be confirmed if it moves above the psychological level of $0.10, which coincides with the descending trendline connecting the highest swings since April.