Ethena token price rose for three consecutive days as sentiment in the crypto industry improved.

Ethena ($ENA), best known for the $USDe stablecoin, rose to $0.4676, its highest level since July 24. It has jumped by over 130% from its lowest level this year.

Its rally occurred as the crypto fear and greed index continued rising, moving from last week’s fear zone of 38 to the neutral point of 50.

Bitcoin (BTC) has soared to $67,000, while Ethereum (ETH) and Solana (SOL) rose to $2,650 and $160, respectively. In most cases, altcoins perform well when Bitcoin and the crypto fear and greed index are rising.

Ethena’s rally also coincided with the falling odds that the $USDe stablecoin will de-peg this year. The odds of the stablecoin losing its peg dropped to 4%, down from 16% a few months ago.

$USDe, like Terra USD, is not pegged to the U.S. dollar. Instead, it maintains its $1 peg by executing automated and programmatic delta-neutral hedges on its backing assets. Data shows that $USDe in circulation is valued at over $2.4 billion.

Unlike other popular stablecoins like Tether and USD Coin, $USDe provides yields to its holders. According to its website, it has an APY of 8%, higher than what U.S. government bonds are paying.

Ethena’s rebound occurred even as data shows that the total value locked in its ecosystem continued to fall. The TVL decreased from the year-to-date high of $3.6 billion to $2.4 billion.

Still, the developers have made several important moves in recent months. Last week, they announced plans to invest $46 million of the reserve fund in tokenized assets. Ethena also received backing from BlackRock and Securitize for its new stablecoin, UStb

Ethena price flips key resistance

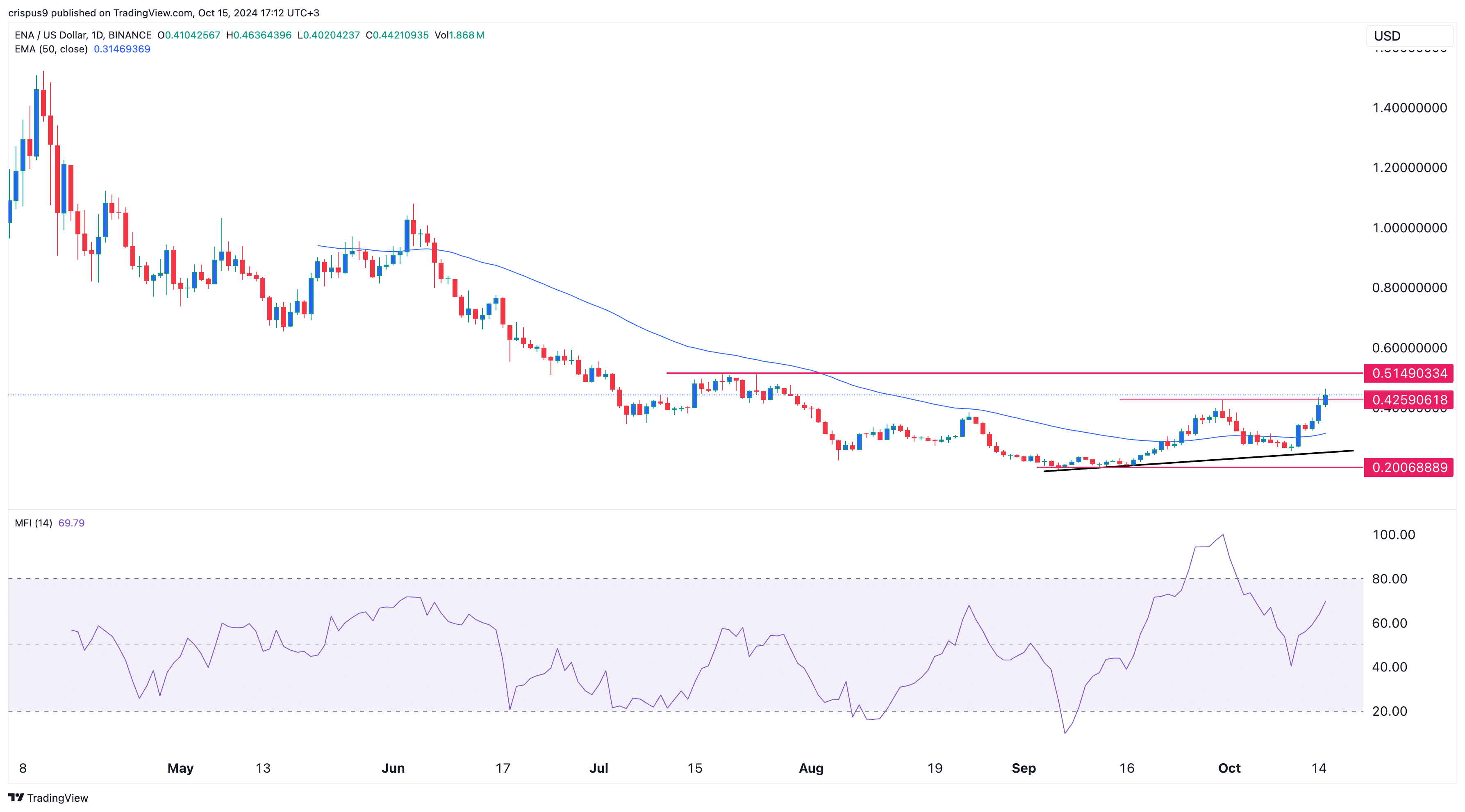

The daily chart shows that the $ENA price bottomed at $0.20 in September and has rebounded by over 125% to $0.462. It flipped the important resistance point at $0.4260, its highest swing on Sept. 30 and the neckline of the double-bottom pattern.

$ENA has also rallied above the 50-day moving average, while the Money Flow Index indicator has tilted upward. Therefore, the token will likely continue rising as bulls target the key resistance level at $0.5150, its highest swing on July 24.