In this article, we explore the latest report by CoinGecko that analyzes the evolutionary changes in the crypto sector in Q3 2024.

The topics covered are different and range from the overall market capitalization to the dominance of Bitcoin and the outlook of Ethereum’s L2.

Let’s see everything in detail below.

Summary

CoinGecko report: crypto market capitalization slightly down in Q3 2024

The first topic discussed by CoinGecko in its Q3 2024 report concerns the change in the total market capitalization of the crypto market.

From July 1st to September 30th, the value of all crypto assets decreased by 1% going from approximately 2.35 to 2.33 trillion dollars.

This is a drop of 95.8 billion dollars, relatively negligible if we consider the results of the first two quarters of the year.

In particular, in Q1 the capitalization of the crypto industry increased by about 1.05 trillion dollars, while in Q2 it decreased by 420 billion dollars.

The CoinGecko report clearly states that in Q3 there were no significant movements (inflows or outflows).

The global market cap briefly fell to 2.02 trillion dollars in August before recovering in the following weeks, always fluctuating between 2 and 2.2 trillion dollars.

The only days of intense activity were July 22 and August 6: on the first, the market rose sharply, while on the second, it recorded a drop in conjunction with the global economic weakness.

Contributing to this “flat” scenario is the role of the United States Federal Reserve, which in Q3 kept interest rates unchanged on government bonds.

Only at the end of September did we witness a first cut after 2 years of tightening easing, enough to support a positive recovery of the crypto sector.

According to CoinGecko, in parallel there was the release of some economic stimuli by China, which helped speculative markets like that of Bitcoin.

Trading volumes also declined in Q3, with a slight reduction of 3.6%, settling at 88 billion dollars as the average daily value.

Bitcoin grows in dominance in Q3: new opportunities emerge in the altcoin sector according to CoinGecko

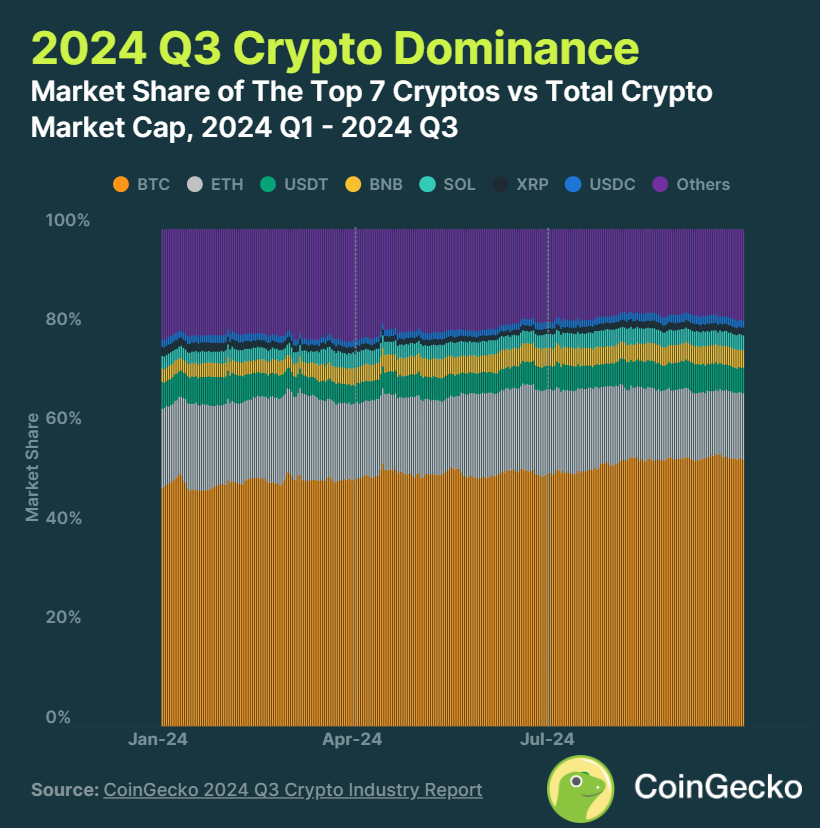

While the crypto market capitalization records a slight decline in Q3, the CoinGecko report shows an opposite trend for the dominance of Bitcoin.

The main currency of the sector has seen its position increase compared to the rest of the existing cryptocurrencies.

This means that investors in Q3 were more inclined to accumulate Bitcoin rather than altcoin or stablecoin.

In particular, according to CoinGecko, Bitcoin’s dominance increased by 2.7% in the quarter, reaching 53.6%.

At the same time, however, there have also been some isolated cases where the altcoins have performed positively. SOL, BNB, and USDC are, in this regard, the coins that have recorded the largest gains.

The dominance of ETH decreased by 3.6% in Q3, highlighting the largest loss among the top 7 crypto assets.

CoinGecko suggests, however, that from here on there could be a recovery in the altcoin world, given the dominance so high of the king of the market.

The last time Bitcoin had reached such an undisputed dominance was in April 2021, before the great summer altseason.

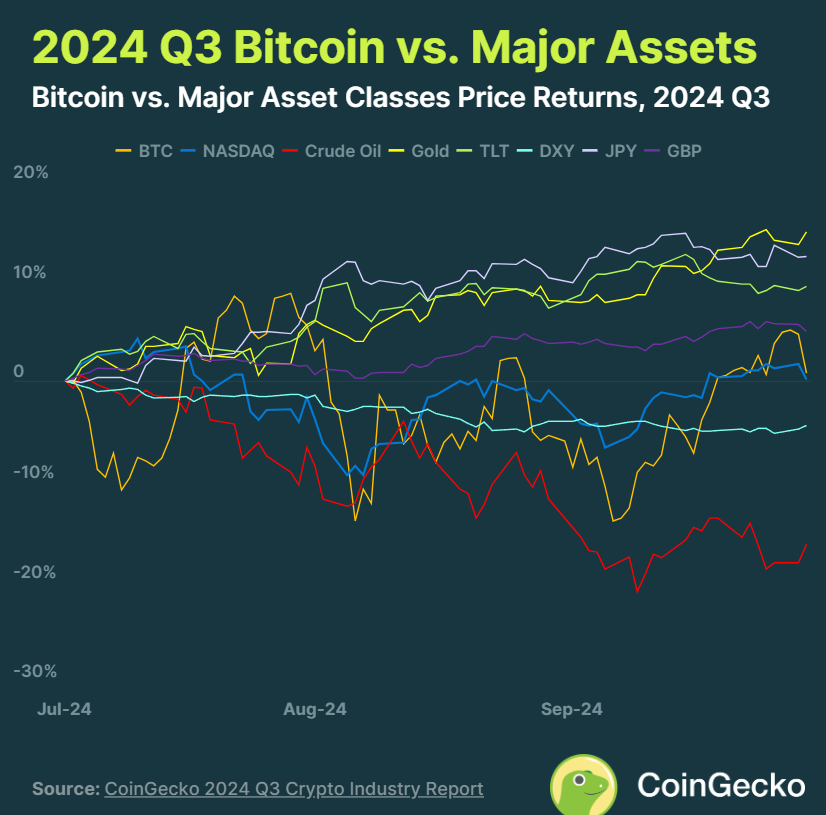

Despite Bitcoin having gained market share against other cryptos, it is noteworthy how it has underperformed other asset classes.

Despite Bitcoin having gained market share against other cryptos, it is noteworthy how it has underperformed other asset classes.

In Q3 the currency has indeed increased in price by only 0.8% against decidedly more enticing performances from other speculative instruments.

The report highlights how gold (GOLD) and the Japanese yen (JPY) have significantly recorded more substantial price increases.

Even the British pound (GBP) and the 20-year yields of the US Treasury Bonds (TLT) performed better than crypto in Q3.

As highlighted by CoinGecko, the only asset classes that have underperformed Bitcoin are oil and the dollar index (DXY).

All this happened amid fears of an economic slowdown in the United States and the growing tension in the Middle East.

On-chain activity of Ethereum layer-2 grows: Base is the most used chain

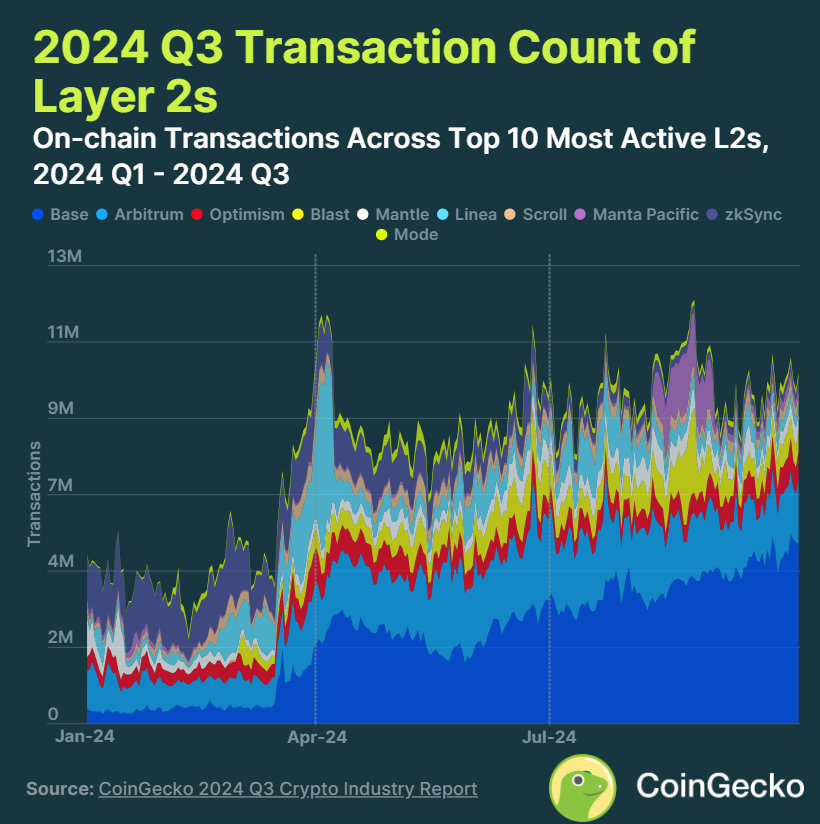

In its report, CoinGecko also focuses on the Ethereum layer-2 landscape during Q3, showing an increase in on-chain activities.

During the quarter, the 10 best blockchain scalability solutions saw a significant increase in the number of daily transactions.

This trend actually started in January 2024, but in September the record of 10 million daily tx was reached. For comparison, the L1 Ethereum processes 1 million.

Base has recorded a strong increase in network activity since the beginning of the year and is by far the most active L2, accounting for 42.5% of all transactions in Q3.

In second place is Arbitrum with 18.9%, while Blast closes the podium with 8.1% in the same period.

Manta Pacific experienced a peak in transactions in August, but then scaled down in the following weeks as shown in the CoinGecko metric.

It is expected that in the coming months the crypto participation on Ethereum layer-2 will continue to increase.

Very important to emphasize how in Q3 Ethereum established itself as the dominant network for trading on DEX, despite its declining share.

The trading volume on Ethereum decreased by 130 billion dollars between July and September 2024, while much of the activity shifted to Solana.

Numbers on the rise for Tron as well after the launch of SunPump and Blast up to the TGE of its own token.

In the meantime, Base has continued to shine, pushing its market share to new highs.

CoinGecko notes that in the third quarter, Coinbase’s layer-2 briefly surpassed Arbitrum, becoming the largest Ethereum secondary network for TVL.

en.cryptonomist.ch

en.cryptonomist.ch