The crypto market continues to show volatility, with some tokens experiencing sharp price fluctuations and shifts in trading activity. FTX ($FTT), Worldcoin (WLD), Ethena (ENA), Render (RNDR), and Fetch.ai ($FET) made notable movements recently.

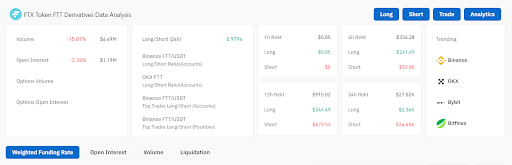

The FTX token has surged 10.48% over the past 24 hours, reaching $2.60. It recorded a trading volume of $135.57M and a market cap of $854.28M. Despite these gains, $FTT’s derivatives data suggests caution. A 15.07% drop in volume and a 2.34% decline in open interest point to reduced market activity.

Besides, the 24-hour long/short ratio of 0.9794 suggests a balanced sentiment between bulls and bears. Additionally, shorts have been hit harder, with $673.53 liquidated compared to $241.49 for longs. Major exchanges like Binance, OKX, and Bybit continue to dominate $FTT trading. Traders are closely watching for shifts in sentiment as the market calms.

Worldcoin Trading Activity Surges

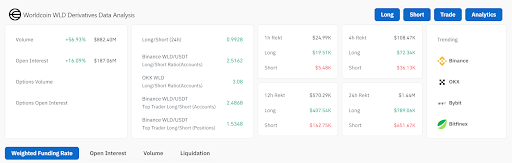

Worldcoin rose 5.16% in the last 24 hours, with a price of $1.83 and a market cap of $923.17M. The token saw a 56.93% increase in trading volume, reaching $882.40M. This surge reflects growing interest in Worldcoin trading on major platforms.

Binance and OKX traders favor long positions, with long/short ratios of 2.5162 and 3.08, respectively. This signals strong bullish sentiment. However, recent liquidation data shows $570.29K in long positions liquidated, hinting at potential volatility. Traders are bracing for possible price fluctuations as trading intensifies.

Ethena Declines With Reduced Activity

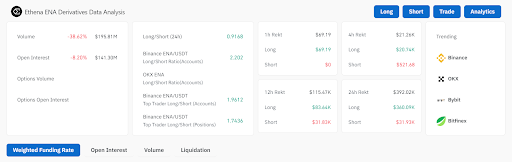

Ethena has dropped by 6.14% in the last 24 hours, with a price of $0.286621. Its market cap is $787.31M, while trading volume decreased by 38.62%. Open interest also dropped by 8.20%, signaling reduced trader commitment.

Despite the decline, Binance’s long/short ratio remains bullish at 2.202, indicating that traders still anticipate upward price movement. However, $360K in recent long position liquidations suggest increased market volatility. Traders are monitoring the market cautiously, anticipating further fluctuations.

Render Faces Bearish Pressure

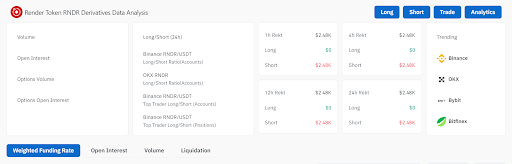

Render token dropped 4.94% in the past 24 hours to $5.42. It has a market cap of $2.80B. Trading volume remains high at $172.11M, but short positions experienced notable liquidations, totaling $2.48K.

Read also: Altcoin Price Watch: $FET, NEAR, ICP, RNDR Outlook for October 2024

This highlights bearish sentiment among some traders, though long positions remain unaffected, signaling continued support from bulls. Binance remains the most active platform for RNDR derivatives trading. As bearish pressures increase, traders are watching for future market developments.

$FET Sees Heavy Liquidations

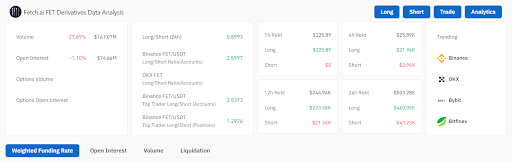

$FET has fallen 4.42% in the last 24 hours, with a price of $1.39 and a market cap of $3.49B. $FET’s trading volume dropped by 27.69%, while open interest also declined by 1.10%. These shifts reflect decreased market participation.

Long positions suffered the most, with $460.05K liquidated in the past 24 hours. However, Binance’s long/short ratio of 2.5997 indicates optimism among long traders. Despite the reduced activity, traders should expect increased volatility as market dynamics evolve.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com